CHICAGO — Starbucks’ CEO proclaimed its once-stumbling brand is back in business after two years of layoffs and store closings, while the coffee giant issued its first-ever dividend for investors on Wednesday.

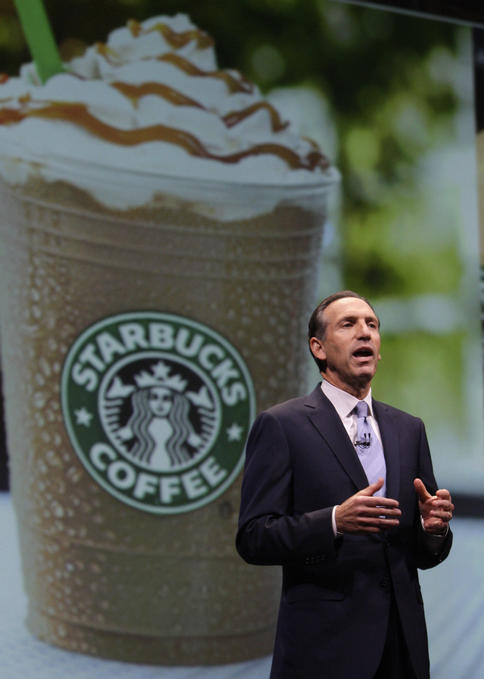

Speaking in front of thousands of shareholders and employees at the company’s annual meeting in Seattle, CEO Howard Schultz said the brand’s ambitious turnaround effort sliced $580 million from its expenses and the turnaround is now taking hold.

“It’s been a long two years,” he said. “But the company is extremely healthy and robust.”

Earlier in the day, Starbucks announced the dividend, pledging to return 10 cents per share to investors and ultimately boosting that payment to as much as 40 percent of its annual profit. It also will expand its effort to buy back its own shares.

Companies pay dividends to share profits directly with shareholders, and are often a sign that a company has matured beyond the fast-growth stage.

Hit by the recession and overwhelmed by its own rapid expansion, Starbucks began a retreat more than two years ago.

It brought back Schultz, who helped build the company, to lead day-to-day operations. And it shut hundreds of locations and laid off thousands of workers to scale back its spending.

“Growth was covering up mistakes,” Schultz said. “But we cleansed ourselves of that and we began to understand that we not only had to fix the mistakes but also start righting the ship.

“We realized we had to fundamentally transform the company by taking out cost.”

At the same time, the company tried to make over its image, emphasizing some of its cheaper drinks and trying to add more local flair to some of its cookie-cutter locations as it also had to fight off increasing competition from independent coffee houses and big chains alike.

That included a faceoff with McDonald’s Corp., which muscled in on Starbucks’ turf with a successful line of coffee drinks.

It also plans to be more careful with its growth, balancing store openings with adding new products that can be bought outside the cafe, such as its Via instant coffee.

The changes seem to be working. In 2009, Starbucks’ profit climbed 24 percent and in the past year its share price has more than doubled.

Morningstar analyst R.J. Hottovy said Wednesday’s announcement shows just how far the company has come.

“They’ve done the cost-containment side,” he said.

Starbucks shares hit $26 per share Wednesday, a level not seen since November 2007.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.