WASHINGTON — Problems in the housing market and high unemployment are the biggest economic challenges the nation faces, Federal Reserve Chairman Ben Bernanke said Wednesday.

After suffering through the worst recession since the 1930s, the economy seems to have stabilized and is growing again, he said. But he warned: “We are far from being out of the woods. Many Americans are still grappling with unemployment or foreclosure or both.”

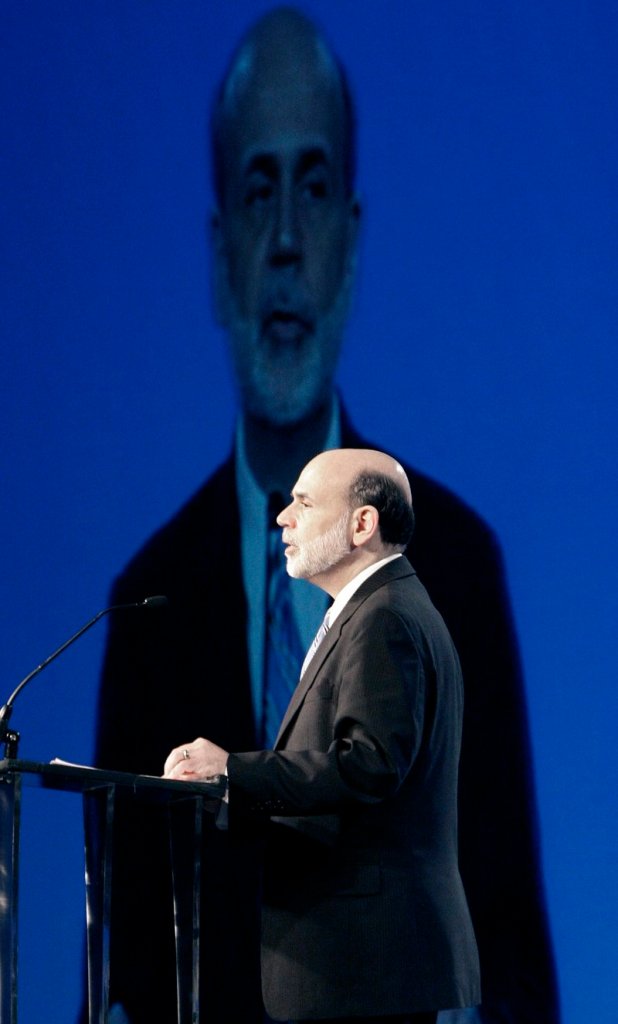

In remarks to business people in Dallas, Bernanke said he saw no evidence of a “sustained recovery” in the housing market, noting that foreclosures keep rising. Commercial real estate remains a trouble spot, too.

The toughest problems are in the job market. Even though layoffs have slowed, hiring is “very weak,” Bernanke said. He noted that unemployment, now at 9.7 percent, is still close to its highest levels since the early 1980s.

Record-low interest rates should help, the Fed chief said. But economic growth won’t be robust enough to quickly drive down the jobless rate, he indicated.

The Fed is expected to keep its key interest rate near zero at its next meeting on April 27-28 and for most of this year. The Fed has held rates at such rock-bottom levels since December 2008.

Deciding when to start boosting rates will be among the most important decisions Bernanke will make in his second term, which started in February. Doing so too soon could endanger the recovery. But waiting too long could spur inflation or feed some new speculative bubble in the prices of stocks, bonds, commodities or other assets.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.