WASHINGTON – Senate Democrats and Republicans say a deal on legislation to rewrite the rules of U.S. finance may be within reach. If they succeed, they’ll be only halfway home.

Senate and House negotiators would then have to resolve differences between their versions of the overhaul on issues ranging from the power of the Federal Reserve to a new consumer protection agency to derivatives regulation.

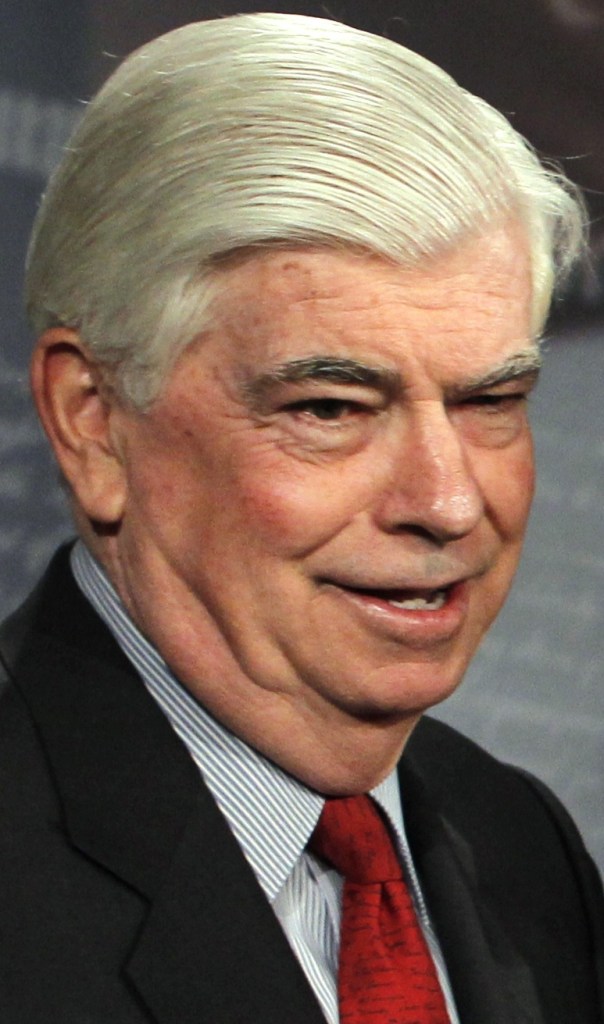

The Senate plans to hold a test vote on Monday, April 26, on a bill offered by Banking Committee Chairman Christopher Dodd, a Connecticut Democrat who said yesterday he will “conceivably” have a deal with Republicans by then. The House bill, written by Financial Services Committee Chairman Barney Frank, a Massachusetts Democrat, was approved in December.

Dodd and Frank “will bridge the gap between whatever comes out of the Senate and the House,” said Gilbert Schwartz, a former attorney for the Fed. “It’s probably less important to one side or the other side to have its way than to have this legislation in place in the near future. Their view is that the country needs it and they want to deliver it.”

The legislation is aimed at adopting President Barack Obama’s proposal to redesign Wall Street regulations following the financial crisis that led to $700 billion in taxpayer-funded aid to banks including Citigroup and Bank of America.

Frank’s bill tracks closer to the Obama proposal because Dodd has had to make more concessions to Republicans in the Senate, where Democrats lack the 60-vote supermajority needed to pass major legislation.

Dodd’s measure incorporates Obama’s proposal to ban proprietary trading at U.S. banks, named the Volcker rule after former Fed Chairman Paul Volcker, who’s advising the president.

The administration didn’t propose the Volcker rule until after the House passed its bill. That bill empowers the Fed to ban proprietary trading at a financial holding company only if the central bank determines the activity poses a threat to the safety and soundness of the company or to U.S. financial stability.

“We’re at about the right spot on the Volcker rule,” Dodd told reporters Thursday. His legislation calls for a study on how the ban should be applied, which will provide “flexibility” in imposing the rule, Dodd said.

The bill offered by Frank also creates a standalone Consumer Financial Protection Agency proposed by Obama. Dodd’s measure would set up a consumer protection bureau at the Fed, in response to Republican opposition to a standalone agency.

Both bills exempt lenders with less than $10 billion in assets from examination by the agency. While the consumer bureau would set rules for smaller banks, their primary regulator would examine them for compliance and cite violations.

The House legislation keeps intact the Fed’s oversight powers.

The Senate legislation would shrink the central bank’s jurisdiction to the 36 banks with more than $50 billion in assets, including Goldman Sachs Group and Morgan Stanley. Oversight of smaller banks now supervised by the Fed would move to the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency.

The Fed has been urging senators to remove that language from the bill, saying the central bank needs an overview of the entire system to set monetary policy.

Sen. Kay Bailey Hutchison, R-Texas, said April 21 that she would offer an amendment to retain the Fed’s power over small banks.

“The reason we have regional Fed banks is so that our whole country and the body of information that we get from our small businesses and our Main Street banks is a part of our monetary policy setting,” Hutchison told reporters.

Dodd and Frank’s staff have met since the Senate Banking Committee approved the Dodd bill in March, and are waiting until the Senate approves its bill to begin working out differences, Frank spokesman Steve Adamske said.

One key difference is over derivatives. The Senate Agriculture Committee on April 21 approved legislation by Sen. Blanche Lincoln, the committee chairman and an Arkansas Democrat, that would require lenders such as JPMorgan Chase to spin off swaps-trading desks.

The main gaps between the Lincoln and Frank plans are a mandatory clearing requirement and the ability of regulators to impose capital requirements on end-users. The Lincoln bill also requires that cleared derivatives be executed on an exchange.

Another difference is the size of an industry fund the government would use to liquidate firms. The House bill creates a $150 billion fund while the Senate bill sets up $50 billion in reserves. Republicans say that would institutionalize bank bailouts. Dodd has said he’s willing to consider alternatives.

The Senate bill’s details are likely to change as Dodd and Alabama Senator Richard Shelby seek a compromise. No Republican has pledged to support the bill.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.