WASHINGTON – Defending his company under blistering criticism, the CEO of Goldman Sachs testily told skeptical senators Tuesday that customers who bought securities from the Wall Street giant in the run-up to a national financial crisis came looking for risk “and that’s what they got.”

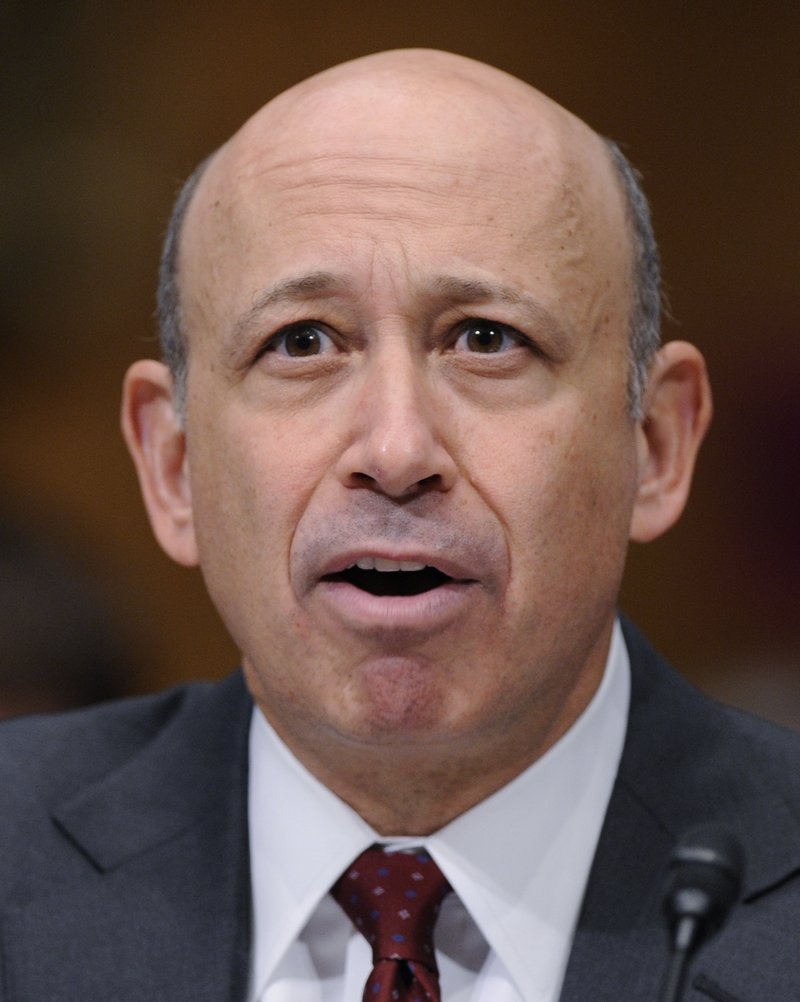

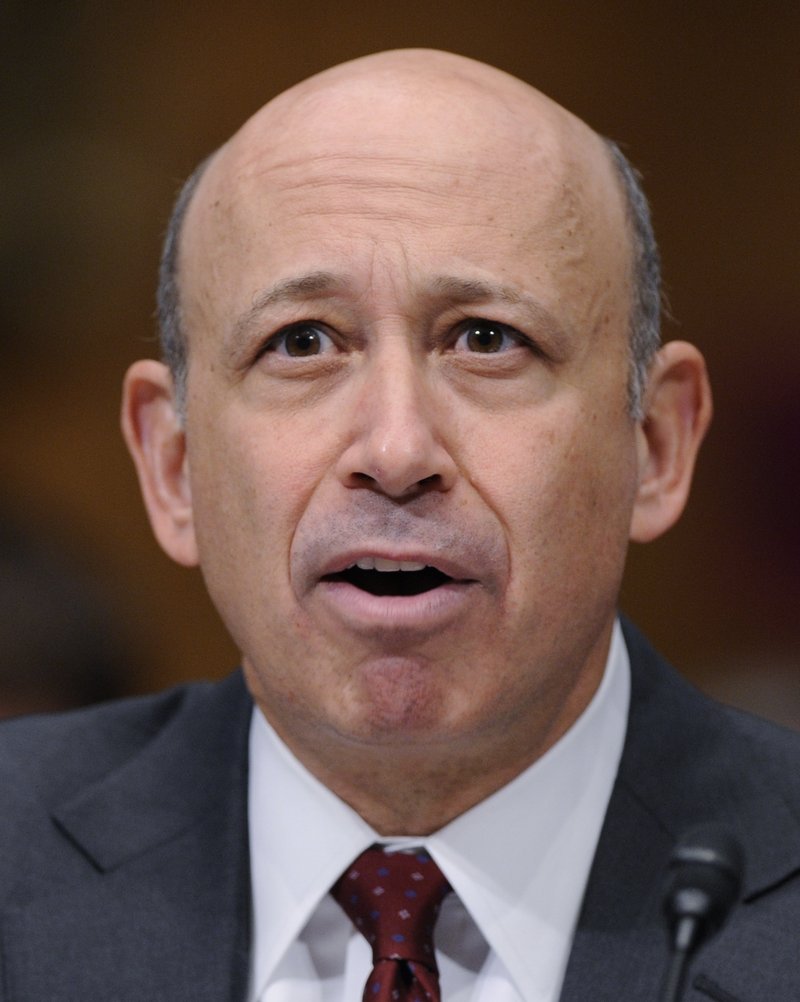

Lloyd Blankfein and other Goldman executives were lambasted by lawmakers for “unbridled greed” in an often-electric daylong showdown between Wall Street and Congress — with expletives frequently undeleted. Unrepentant, five present and two past Goldman officials unflinchingly stood by their conduct before a Senate investigatory panel and denied helping to cause the financial near-meltdown that turned into the worst recession since the Great Depression.

“Unfortunately, the housing market went south very quickly,” Blankfein told skeptical senators. “So people lost money in it.”

Democrats hoped the hearing would build momentum for legislation, now before the Senate, to increase regulation of the nation’s financial system. That legislation would crack down on the kind of lightly regulated housing market investments that helped set off the crisis in 2007.

Elsewhere at the Capitol, Republicans succeeded for a second day in blocking efforts to move toward debate and a vote on that bill. At the same time, they floated a partial alternative that they said could lead to election-year compromise on an issue that commands strong public support.

Both sides are trying to harness voter anger toward Wall Street. Unlike with the health care debate, both Democrats and Republicans say they want tighter regulations passed, but they disagree on timing and significant details.

At the hearing, there was hour upon hour — nearly 11 hours in all, winding up just before 9 p.m. — of combative exchanges, occasional humor and long stretches of senators and Wall Street insiders speaking past each other. There was talk of ethical obligations vs. financial transactions so complex they all but defy explanation. And there were a half-dozen protesters dressed in prison stripes with Goldman officials’ names around their necks.

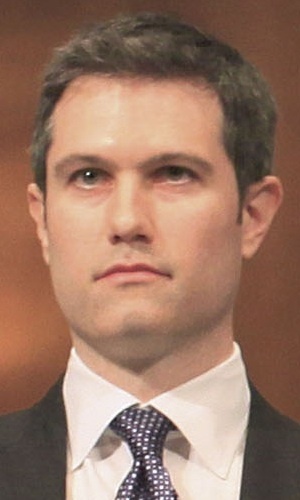

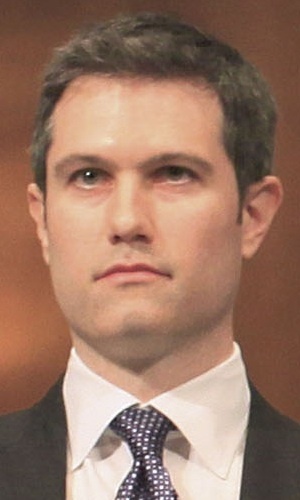

First to testify were four current and former mortgage executives — Fabrice Tourre, Daniel Sparks, Michael Swenson and Joshua Birnbaum — who all had worked extensively to prepare for questions the committee might ask.

The Washington Post reported Tuesday that Goldman hired lawyers who formerly worked on the committee to prepare the executives, and one of those lawyers once told a trade journal that the best strategy is “long, thoughtful pauses followed by rambling nonresponsive answers.” The executives practiced the technique.

At one point, Sen. Susan Collins, R-Maine, asked Tourre — the subject of a fraud lawsuit by the Securities and Exchange Commission — about an e-mail he wrote that suggested he was looking to sell mortgage-backed investments only to unsophisticated investors. But, taking his time, Tourre asked Collins three times to identify which e-mail she meant and to repeat her question.

“I cannot help but get the feeling that a strategy of the witnesses is to try to burn through the time of each questioner,” Collins responded in an exasperated tone.

Senators from both parties verbally pounded the Goldman executives, accusing them of a financial version of rigged casino gambling that they said endangered the entire U.S. economy.

That drew a protest from Sen. John Ensign, a Nevada Republican. In Las Vegas, he said, “people know the odds are against them. They play anyway. On Wall Street, they manipulate the odds while you’re playing the game.”

Outside the hearing room, analysts and investors suggested the firm was surviving the hearing with its reputation intact, something its stock performance for the day may have underscored. Goldman’s stock rose $1.01 per share, to $153.04, on Tuesday, a day in which the Dow Jones industrials had their worst drop in nearly three months, down 213 points.

Blankfein, the public face of Goldman, was the final witness in the daylong hearing on Goldman conduct that resulted in a SEC civil fraud charge earlier this month against the firm and against Tourre specifically.

Sen. Carl Levin, D-Mich., the panel’s chairman, cited a “fundamental conflict” in Goldman’s selling to clients the home-loan securities that company e-mails showed its own employees had derided as “junk” and “crap” — and then betting the same securities would lose money and not telling the buyers.

“They’re buying something from you, and you are betting against it. And you want people to trust you. I wouldn’t trust you,” Levin told Blankfein.

Blankfein denied such a conflict in a combative exchange. “We do hundreds of thousands, if not millions of transactions a day, as a market maker,” he said, noting that behind every transaction there was a buyer and a seller, creating both winners and losers.

Levin vigorously pressed about an e-mail between Goldman executives describing one product called Timberwolf using a descriptive term for excrement.

“Your top priority is to sell that (expletive) deal,” Levin said. “Should Goldman Sachs be trying to sell a (expletive) deal?”

I didn’t use that term, the executive responded.

Other senators repeated the language in their questioning.

Goldman’s chief said the company didn’t bet against its clients — and can’t survive without their trust. He repeated the company’s assertion that it lost $1.2 billion in the residential mortgage meltdown in 2007 and 2008 that touched off the financial crisis and a severe recession. He also argued that Goldman wasn’t making an aggressive negative bet — or short — on the mortgage market’s slide.

He and other officials described their use of complex trading tools as a way to reduce risks for the company and its clients.

Collins described as “unseemly” Goldman’s bets against the market while it was selling mortgage-backed securities, and said it was “unsettling” to read internal e-mails released by the committee of Goldman Sachs celebrating the collapse of the market.

Earlier, Levin said that financial industry lobbyists “fill the halls of Congress, hoping to weaken or kill legislation” to increase regulation. He accused Wall Street firms of selling securities they wouldn’t invest in themselves. That’s “unbridled greed in the absence of the cop on the beat to control it,” he said.

Whether Tuesday’s hearing would help Democrats win Republican converts on the legislation remained an open question. “It’s too soon to tell,” Levin said in a brief interview outside the hearing. “We’ll have to wait until the dust settles.”

The Goldman witnesses strongly denied that the firm intentionally cashed in on the housing crash by crafting a strategy to bet against home loan securities while misleading its own investors.

“I will defend myself in court against this false claim,” said Tourre, a French-born 31-year-old trader who was the only individual named in the SEC suit. “I deny — categorically — the SEC’s allegation.”

The SEC says Tourre marketed securities without telling buyers they had been chosen with help from a Goldman hedge fund client that was betting the investments would fail. The commission alleged that Tourre told investors that the hedge fund, Paulson & Co., actually bought into the investments. Tourre said he didn’t recall telling investors that.

Tourre said: “I am saddened and humbled by what happened in the market in 2007 and 2008. But I believe my conduct was proper.”

Was Goldman harmed by the hearing?

“Despite the interrogation, the Goldman team hasn’t really provided any new information,” said market analyst Edward Yardeni. “And the (senators) aren’t creating a more damaging view than already existed.

“Right now, it looks like the PR battle has been fought to a draw,” he said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.