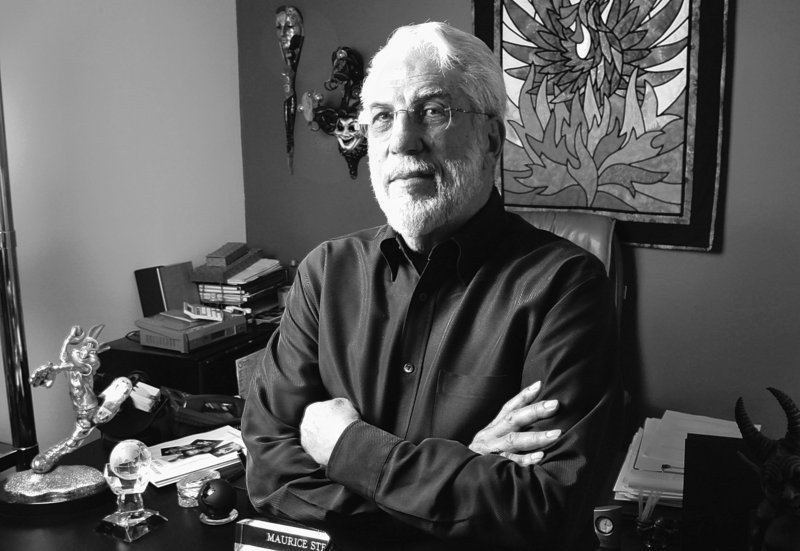

LOS ANGELES – Maurice Stein sells face paint that can make you look like a bronze statue or an alien. Or a vampire. For those in need of facial hair, he’s got a big glass case full of glue-on sideburns, moustaches and mutton chops.

But there’s little this expert makeup man can do to mask the worry he feels about his business.

The economic downturn has ravaged Cinema Secrets, the cosmetics retail and manufacturing firm that Stein runs with his wife and three adult children in Burbank, Calif. He’s lost half of his clientele, pink-slipped two-thirds of his employees and mortgaged his paid-off house to pay the bills.

Through it all, Stein, 76, has continued to pay for his employees’ health insurance. He spends $11,000 a month to cover just half of the cost of premiums on the Anthem Blue Cross PPO and HMO policies that he provides the 40 people who still work for him.

He’s hoping for some relief from the recently enacted health overhaul. But he’s not likely to get much.

Stein’s company is small but still too big to qualify for the tax credits that are meant to help small businesses provide health insurance to their employees. Under the Patient Protection and Affordable Care Act signed into law in March, companies with 10 employees or fewer will get rebates from the federal government for up to 50 percent of what they spend on their employees’ care.

Without the boost from the tax credit, Stein will face a difficult choice. Should he cancel the insurance if his fortunes don’t improve?

There’s nothing in the new law that requires him to continue providing it. That requirement kicks in for companies with 50 or more full-time employees, or enough part-timers to add up to the equivalent of 50 full-time jobs.

But making sure his workers get medical care is important to Stein. He has diabetes. His wife is a breast cancer survivor, as is his daughter. And he believes that providing coverage makes his company more stable by helping him attract and retain good people.

“I have provided it from the day I started this company,” Stein said. After 25 years as a Hollywood makeup man, Stein started Cinema Secrets in 1984, the year he turned 50.

The company started out selling mostly cosmetics, but it quickly added a Halloween line that included costumes, makeup and fake scars. The company had 120 employees at its peak a few years ago, but the combined effect of outsourcing, a Hollywood writers strike and the poor economy has winnowed its ranks.

Lucien Wulsin, director of the Insure the Uninsured Project and a faculty associate at the UCLA Center for Health Policy Research, said Stein’s premiums might get a little cheaper in 2014, when purchasing groups will be set up to help small businesses buy insurance. When the groups — known as insurance exchanges — are in place, small businesses will be able to join together to purchase plans for their employees.

That’s a significant step, because large groups are much cheaper to insure than small groups.

The reason is that a big pool of employees and their families spreads the cost of medical care for the few group members likely to become severely ill. That makes it less risky for insurance companies — and less expensive for consumers.

The policies would also be cheaper than they are now because, under the new law, insurers will no longer be able to charge extra for people with pre-existing conditions.

The amount they can charge for older people will also be limited.

Still, Stein might not be able to afford the premiums for his employees (he and his wife are on Medicare). If he cancels his plan, the law would require his employees to buy insurance for themselves.

But that doesn’t mean he can’t help them. New laws meant to control the cost of premiums could eventually bring down the cost of the employees’ new plans, Wulsin said, while also allowing Stein to contribute as much as he can toward helping them.

“Once it hits 2014 … premiums should be lower for both the employer and the employee,” Wulsin said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.