WASHINGTON – Since taking office at the height of the financial crisis, President Obama has promised to hold Wall Street accountable for the meltdown.

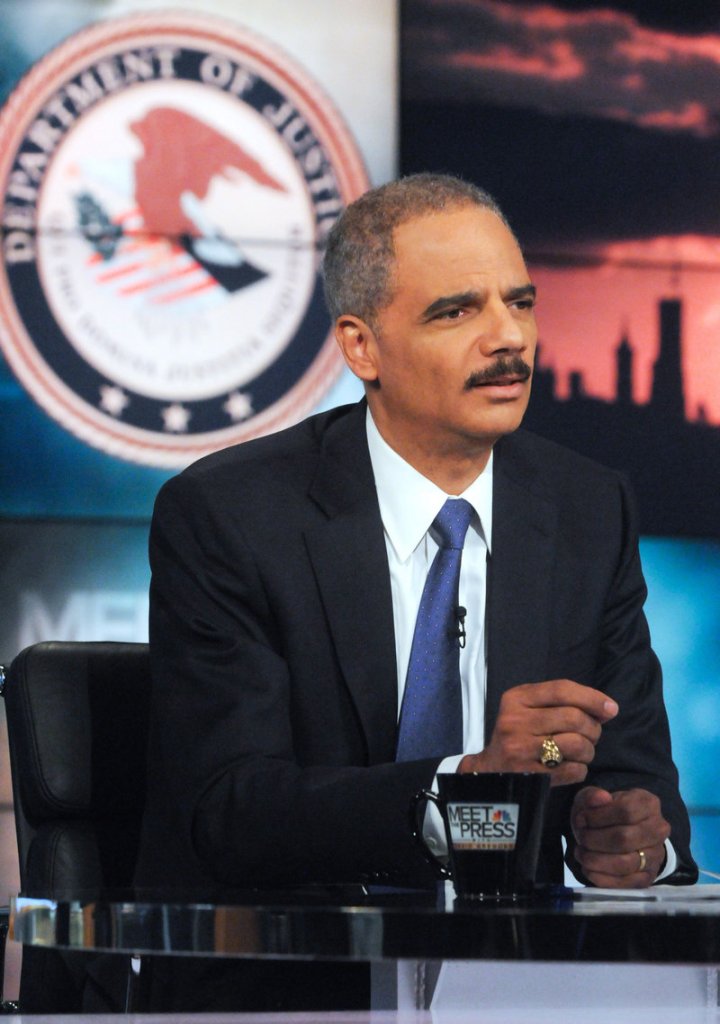

Attorney General Eric Holder reinforced that message in November when he vowed to prosecute Wall Street executives and others responsible for the crisis.

“We will be relentless in our investigation of corporate and financial wrongdoing and we will not hesitate to bring charges,” Holder said as he launched a financial fraud task force.

His Justice Department took steps to fulfill that promise last week when it arrested the former chairman of one of the nation’s biggest mortgage firms — the largest crisis-related criminal case — and announced that 1,215 people have been charged with mortgage fraud since March 1. But that success masks the government’s difficulties in the highest-profile investigations: those of Wall Street banks.

Nearly 1½ years into Obama’s tenure, despite several cases against mortgage companies whose lending practices contributed to the crisis, the administration has not brought any charges against the big Wall Street banks that took those loans, converted them into toxic securities and pumped them into the world’s financial markets. And law enforcement sources say no such charges are imminent.

The blunt words of administration officials have triggered debate over whether they have gone too far in appearing to promise difficult cases that critics say might never be filed, in part because they would essentially criminalize an entire business model in the financial industry.

“The attorney general got out ahead of the facts and the evidence in saying ‘we’re going to go down to Wall Street with a pitchfork and roust those fat cats out of their offices and put them in jail,’ ” said Tim Coleman, who prosecuted major fraud cases before leaving the Justice Department five years ago. “This was a case, in general, of people making business judgments and taking risks and having them go badly. That’s not criminal misconduct.”

A current law enforcement official agreed. “I’m not big on using such strong language before your cases are ready,” said the official, who spoke on the condition of anonymity to discuss internal deliberations. Referring to a key Wall Street case filed in the Bush administration against two former Bear Stearns executives — a case lost last year — the official added: “Look what happened with Bear Stearns.”

Justice officials say Holder did not over-promise and that the task force is targeting all financial fraud, not just on Wall Street. At a news conference Thursday, Holder said the administration’s efforts should not be evaluated only in terms of Wall Street cases: “You have to look at the totality of what this task force was supposed to do.”

In April, Holder noted to the Senate Judiciary Committee that meltdown-related cases “are complex by their nature. They are not easy to put together.”

James Cole, Obama’s nominee for deputy attorney general, reinforced the tough message during his Senate confirmation hearing last week. “We need to hold people accountable” for the financial crisis, he told the committee. “One of the main ways to do this is to go after the individual executives who are responsible. It is they who will go to jail, they who will suffer the consequences.”

The shortage of Wall Street prosecutions is not for lack of effort. The Justice Department is pouring resources into financial fraud, including 48 FBI investigations of businesses and financial institutions involved in the crisis. Justice officials vow that more indictments will come and point to other major fraud cases in recent months, including massive Ponzi schemes, mortgage frauds and the largest insider-trading case in a generation.

“We are zealously investigating an array of criminal activity on Wall Street and Main Street,” said Assistant Attorney General Lanny Breuer, who heads the Criminal Division and says Holder “is committed to this at his core.”

But investigators are encountering obstacles in what they call their top-priority cases, which sources said include probes of J.P. Morgan Chase, Citigroup and other household names.

“Not every case can be brought, and it’s very easy for people to want to see heads roll and sometimes understandable when they do. But it’s not possible to roll the head if you don’t have the evidence,” said Preet Bharara, the U.S. attorney in Manhattan, who sources said is overseeing some of the highest-priority investigations. He added: “We have never been working harder, have never put so many resources into investigating and prosecuting corporate fraud in this office. If there is anything to get to the bottom of, we will.”

Kevin L. Perkins, assistant director for the FBI’s Criminal Investigative Division, said Wall Street and other corporate investigations involve “very highly paid, educated and sophisticated” targets who argue that they warned investors of potential risks. Prosecutors must prove a deliberate intent to defraud.

“Is that a valid defense that makes it hard? From a criminal standpoint, it is, yes,” Perkins said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.