The number of pending home sales is down in Cumberland County, new figures show, and Greater Portland real estate agents are speculating on whether Maine’s tentative housing recovery will continue or if prices are poised to start falling again.

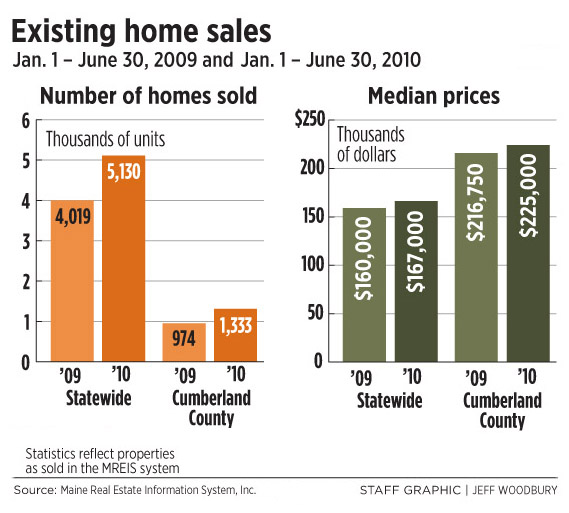

The median sale price of existing homes in the county rose 3.81 percent in the first half of the year, to $225,000, according to the Maine Real Estate Information System. That rate of increase is in line with the statewide average of just over 4 percent. Sales volume also surged in the county during the past six months, up nearly 37 percent over the same period last year.

But past sales don’t say much about the future. A better indicator is the number of homes under contract that have yet to close.

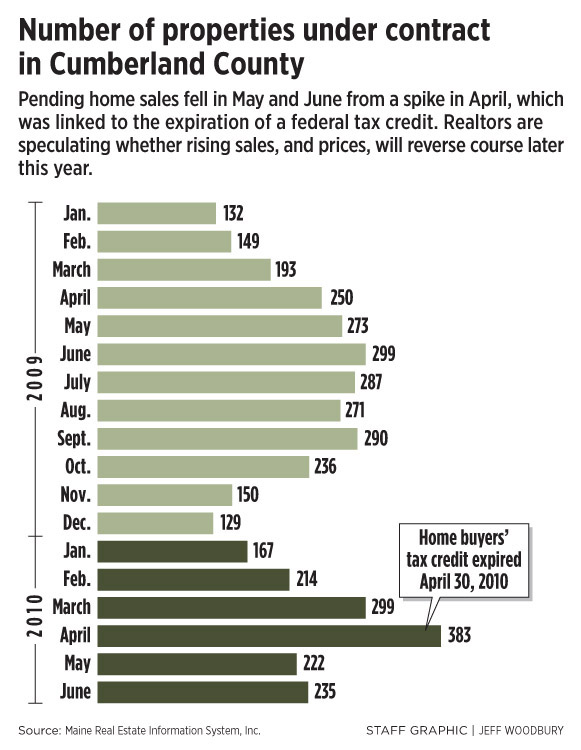

Statistics on pending sales for May and June in the county show a sharp drop in activity compared with April. That’s not a surprise. The $8,000 federal tax credit for home buyers expired April 30, leading to a rush of closings.

In much of the United States, home sales fell sharply in June. Inventories rose, driven in part by foreclosures. The combination may trigger a new round of falling prices, some experts say.

The question is whether the decline will extend to Maine. The trend may not be clear until fall, after all of the tax credit sales clear the pipeline.

“I truly believe we’re going to continue the trend we’re on — slow, steady growth,” said Wayne Syphers, president of the Greater Portland Board of Realtors.

Syphers points out that home prices in Maine and the Northeast didn’t experience the extreme boom and bust seen in states such as Nevada and California. The median price in Cumberland County peaked in early 2007, at $251,000. It fell 6 percent a year during the past two years before starting a gradual rebound.

Greater Portland appears to have escaped the worst of the foreclosure crisis. Although filings in the metro area that includes Biddeford are up over a year ago, Greater Portland ranks 173rd in the country for foreclosures, according to new information from RealtyTrac. Foreclosures and short sales, in which owners sell for less than they owe on a mortgage, lower overall prices in a market.

Jobs are also a critical indicator. Maine’s unemployment rate in June was 8 percent, down slightly from May. That’s on par with the New England average, and below the 9.5 percent national figure.

Last week’s announcement that Kestrel Aircraft Co. will expand to the former Brunswick Naval Air Station and create up to 300 jobs is a hopeful sign of an improving economy, real estate agents say. But that news is tempered by the fact that many residents remain out of work or are underemployed.

“The job market clearly could change the picture,” said Marie Flaherty, an associate broker at Prudential Northeast Properties in Westbrook.

Another unknown, she said, is to what extent people who had credit problems during the recession can get financing under today’s stricter guidelines. But Flaherty, who has studied the pending sales figures, said the drop in May and June isn’t as steep as she had feared. She’s optimistic that home values have stabilized and will grow at a slow pace typical of Maine’s market conditions.

Not everyone agrees with this assessment.

Pending sales no longer provide an accurate picture of homes that are about to close, said Leonard Scott, who owns Assist-2-Sell Buyers & Sellers Realty in Falmouth. Some homes under contract have been on the books for many months, he said, including short sales that can take more than a year to resolve with lenders.

Scott prefers to combine homes that currently are for sale with those under contract. He then calculates how many closings in different price ranges took place in the past six months to get a sense of how long it will take to sell all of the existing inventory. that measure, it will take nearly a year to clear out what’s on the market today, an indication of a sustained buyers’ market.

“To me, there’s no way you’ll have much of an increase in home values, with all the competition,” he said.

Flaherty has more faith in the pending-sales data, but agrees that sellers need to be realistic. She and other brokers work with owners who want to hold out for a higher price. They think their homes are worth it, or they owe a lender more than what an agent recommends for an asking price.

“They need to accept the conditions of today’s market,” she said.

For credit-worthy buyers, though, record-low interest rates and ample inventory make this a good time to move, Flaherty said. Some clients want to wait, hoping that prices will fall again in Maine. Her advice is to be careful — a jump in interest rates could cancel out a modest drop in prices.

“All signs are that there won’t be a significant adjustment downward,” she said.

Staff Writer Tux Turkel can be contacted at 791-6462 or at:

tturkel@pressherald.com

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.