NEW YORK – Many of Bernard Madoff’s victims who thought they lost everything could get at least half their money back after the widow of a Florida philanthropist agreed Friday to return a staggering $7.2 billion that her husband reaped from the giant Ponzi scheme.

Federal prosecutors reached the settlement with the estate of Jeffry Picower, a businessman who drowned after suffering a heart attack in the swimming pool of his Palm Beach, Fla., mansion in October 2009. Picower was the single biggest beneficiary of Madoff’s fraud.

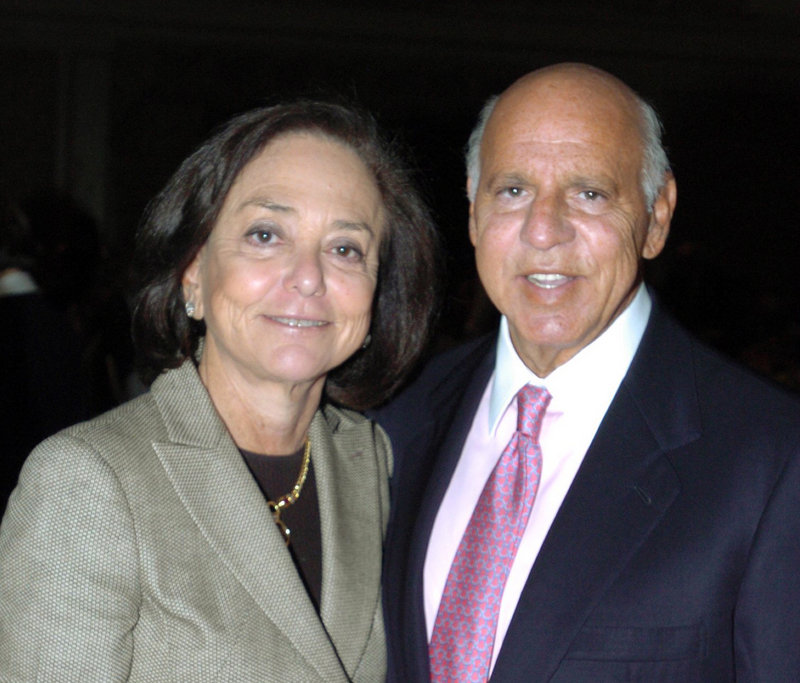

U.S. Attorney Preet Bharara called the forfeiture the largest in Justice Department history and a “game changer” for those swindled by Madoff. He commended Picower’s widow, Barbara, “for agreeing to turn over this truly staggering sum, which really was always other people’s money.”

“We will return every penny received from almost 35 years of investing with Bernard Madoff,” Barbara Picower said in a statement. “I believe the Madoff Ponzi scheme was deplorable, and I am deeply saddened by the tragic impact it continues to have on the lives of its victims. It is my hope that this settlement will ease that suffering.”

The settlement means roughly half of the $20 billion that investors entrusted to Madoff has now been recovered, authorities said.

The $7.2 billion eclipses by far the deals reached with other defendants sued by Irving Picard, the court-appointed trustee who is recovering victims’ money.

The next largest — $625 million — was announced earlier this month in a settlement with Massachusetts businessman and philanthropist Carl Shapiro.

Madoff’s burned clients greeted the news warily.

Willard Foxton, a British journalist whose father committed suicide after losing his life savings, said he was stunned that a major investor decided to return so much money.

“I don’t think he would have killed himself if he thought a few years down the line that he was going to be getting a good amount of his money back,” he said. He added: “I thought we had zero chance of getting any money back, and I still am very, very skeptical. If I see a penny before 2015 I’d be amazed.”

Lawrence Velvel, a law school dean who lost money he had invested with Madoff for decades, said Picower’s widow “did the right thing.”

But he was wary about who, in the end, would benefit more — the multitude of small and midsized investors who had been counting on their investments for their retirement, or the big hedge funds that did business with Madoff.

“It’s going to go to the hedge funds,” he said.

Madoff, 72, is serving a 150-year prison sentence.

Jeffry Picower, who was 67 when he died, was one of Madoff’s oldest clients. Over the decades, he withdrew about $7 billion in bogus profits, or more than a third of the sum that disappeared in the scandal. The money paid out to Picower was supposedly made on stock trades, but authorities said it was simply stolen from other investors.

Picower’s lawyers claimed he knew nothing about the scheme, but Picard had argued in court papers that the businessman must have known the returns were “implausibly high” and based on fraud.

Barbara Picower said she was “absolutely confident that my husband, Jeffry, was in no way complicit in Madoff’s fraud and want to underscore the fact that neither the trustee, nor the U.S. attorney, has charged him with any illegal act.”

In his will, Picower had earmarked most of his fortune for charity.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.