WASHINGTON — World markets plunged Monday in the worst trading day since the financial crisis, eradicating hundreds of billions of dollars of wealth in a setback to the struggling U.S. economic recovery.

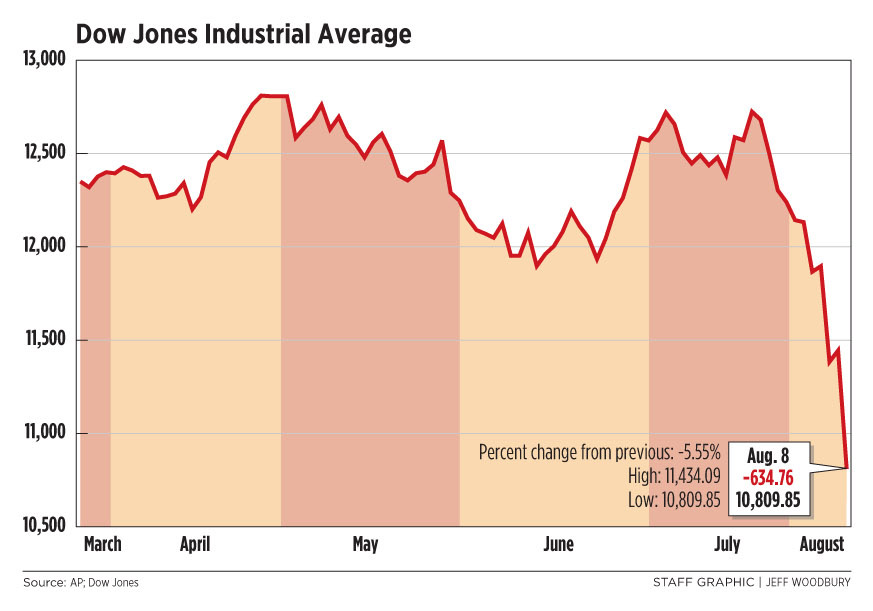

Despite efforts by world leaders to reassure markets, investors remained alarmed over the mounting economic woes in the United States and a spreading debt crisis in Europe. The Dow Jones industrial average fell 634.76 points, or 5.55 percent, to 10,809.85.

Asian equity markets were down sharply early today as investors fearing a possible global economic slowdown continued to flee stocks.

Japan’s Nikkei 225 index plunged 4.8 percent in the morning session, while Hong Kong’s Hang Seng index fell 3.8 percent. Australia’s benchmark S&P/ASX-200 index lost 4.9 percent, Taiwan’s TAIEX dropped 4.9 percent and New Zealand’s benchmark NZX 50 index shed 3.7 percent.

On Monday, the first trading day since the United States was downgraded Friday by Standard & Poor’s, which said U.S. Treasury bonds have become a riskier bet because of the government’s failure to tackle its debt burden, investors actually poured money into U.S. bonds.

With concerns spiking about a global economic slowdown, investors were treating the Treasury bond as the safest haven in a time of turmoil.

In Washington, President Obama went on television in a bid to reassure the markets, declaring that the nation would always meet its obligations. “We’ve always been and always will be a triple-A country,” he said.

On Monday, S&P followed its downgrade of the government by cutting the ratings of mortgage giants Fannie Mae and Freddie Mac and other institutions that depend on federal guarantees, saying their credit is only as good as that of the government.

U.S. economic policymakers were growing increasingly worried about the market volatility. The Federal Reserve is likely to consider new measures to boost economic growth at its regularly scheduled meeting today.

The Treasury Department has intensified its discussions with domestic and foreign investors over what they’re seeing in the markets and stepped up its work with other countries to muster an international response to the crisis. Officials have also been encouraging European policymakers to do more to contain the growing debt crisis on the continent, according to people familiar with the matter.

U.S. policymakers are also paying close attention to new signs of trouble among major banks. The Financial Stability Oversight Council, which was established under the financial reform legislation adopted last year, held an emergency conference call Monday to discuss risks to the financial system posed by market volatility but did not take specific action.

Bank stocks were among the biggest losers on Monday. Bank of America and Citigroup both lost more than 15 percent of their value.

Spokesmen for the banks said they were well fortified against the decline in their stock.

The violent market reaction was reminiscent of the 2008 financial crisis.

While an economic recovery had seemed to be gaining steam early in the year, U.S. and European economies have shown signs in recent months that they are losing momentum and that it could take much longer than anticipated to bounce back from the 2008 crisis. Investors, who had sent stock markets soaring, have been having second thoughts.

The panic in the markets threatens to undercut the recovery even more. Not only has the sell-off eliminated billions of dollars of wealth, it is also unnerving consumers and businesses. The economy needs both consumers and businesses to have the confidence to spend and hire.

“The truth of the matter is, (investors) are waking up and saying, ‘The U.S. and the world economy is headed for at least a soggy recovery for quite a while,’ ” said Edward Truman, a senior fellow at the Peterson Institute for International Economics and a former assistant Treasury secretary for international affairs.

The drop in the markets was the worst since December 2008. The Standard & Poor’s 500 index fell 79.92 points, or 6.66 percent, to 1,119.46. European and Asian markets declined, all more than 2 percent. Emerging markets such as Brazil and Turkey suffered even harder hits. Oil prices swooned, with investors concluding that an economic slowdown would mean less demand for energy. And gold soared as investors sought a safe place to park their money.

But the standout of the day was the Treasury bond, gobbled up by investors even after S&P lowered the U.S. credit rating Friday for the first time in history. The credit-rating company said that the U.S. political system was having difficulty reaching agreement on how to control the national debt and that creditors could no longer assume with complete certainty that the U.S. government would pay them back.

The Obama administration criticized the decision, saying it was based on flawed logic and flawed math.

Strong demand for Treasurys on Monday led to lower borrowing costs for the government. It had to pay only 2.34 percent to borrow for 10 years, a near-historic low and down from 2.55 percent Friday. The resiliency of the Treasury bond made clear that investors remain confident that the United States is the best place to put money during volatile markets.

“It’s either that or the mattress,” said Karen Shaw Petrou, managing partner at Federal Financial Analytics.

S&P downgraded Fannie and Freddie because the U.S. government promised to cover their losses when it seized the firms three years ago. The companies own or insure half of all U.S. home loans.

S&P also downgraded some of the debt of 10 of the nation’s federal home loan banks and of the Farm Credit System. The rating company downgraded bank and credit union debt that is guaranteed by the Federal Deposit Insurance Corp. and the National Credit Union Station as well as several insurance companies.

The immediate impact of these downgrades was not clear. In Fannie and Freddie’s case, for example, the companies could be forced to pay more to borrow money from the capital markets. If that’s the case, the interest rate on home loans would probably increase too.

S&P officials said they may announce downgrades of states and localities that rely on the federal government in coming days as well.

Fed and Treasury officials have been meeting with their European counterparts to brief them on the investor concerns and to urge them to take aggressive action to contain financial disruptions from the debt crises facing Italy and Spain. The crises threaten to undermine Europe’s fourth- and fifth-largest economies. U.S. officials have recommended their own response in addressing the 2008 financial crisis as a model.

Some stronger European countries, such as Germany, have resisted taking on new risks to help their struggling neighbors. But Sunday night, the European Central Bank acted, announcing that it would invest in European bond markets in a bid to prop up Italy and Spain by reducing the rates they must pay to borrow money. The actions soothed investors in the countries’ debt Monday.

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.