WROCLAW, Poland – The European Union’s 27 countries overcame a year of infighting to agree Friday to tougher budget rules that make it easier to punish overspending governments, but they failed to produce any new measures that might contain the debt market turmoil threatening them.

Polish Finance Minister Jacek Rostowski said his EU counterparts approved the measures at their meeting in Wroclaw, Poland, where the officials were under international pressure to show some progress in their fight to contain the debt crisis.

Although the new rules will not ease immediate market concerns about debt, they are a first indication that Europe’s states are willing to give up some sovereign powers to bolster longer-term confidence in the region.

The yearlong delay and the complicated voting procedures that define the final deal, however, suggest more progress will be hard to come by.

“I don’t say that it is perfect,” European Central Bank President Jean-Claude Trichet said of the compromise deal. “But it is a very significant improvement.”

Under the new rules, it will be easier to put sanctions on governments that breach the EU’s limits on debts and deficits, because in most cases a state would have to rally a majority of governments to stop the punishment. That is a reversal of powers, since until now, a majority was necessary to impose sanctions. Governments that are found to ignore warnings can also be punished.

In the years before the current crisis, many European states — including Germany and France — had broken the EU rule requiring deficits to be kept below 3 percent of gross domestic product. Experts say that the lack of accountability has helped cause the rise in government debt that is currently afflicting the region.

The eurozone ministers are under intense pressure to find solutions to the debt crisis that has hobbled their 17-nation currency union for almost two years.

U.S. Treasury Secretary Timothy Geithner’s presence at Friday’s informal meeting — the first time for an American Treasury chief — was an indication of the fears that Europe’s turmoil will hurt the global economic recovery.

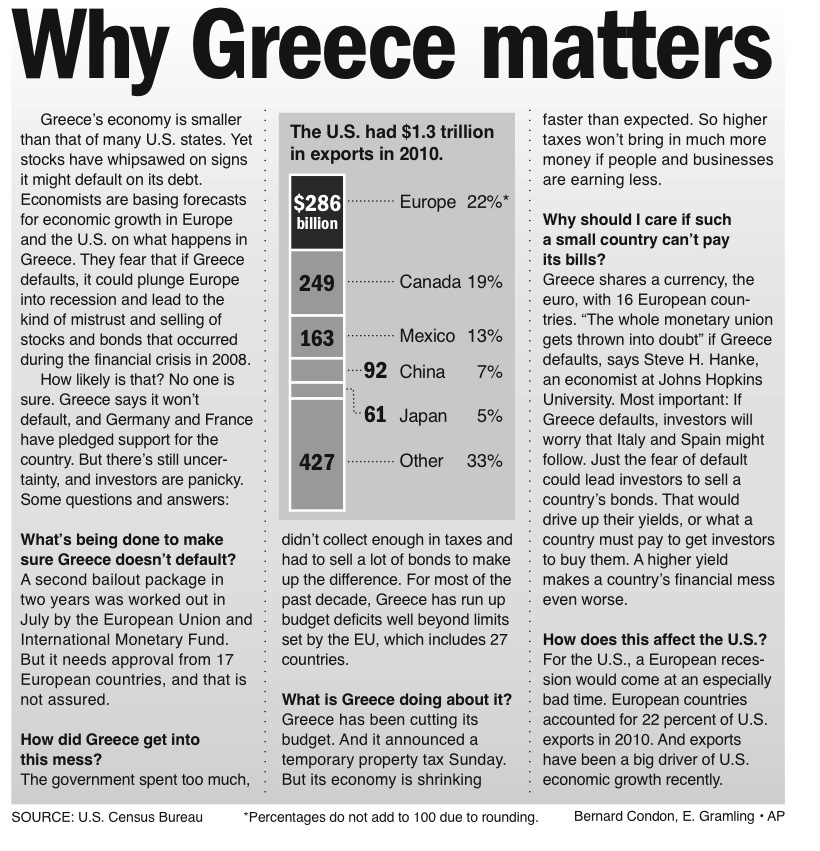

Yet Friday’s meeting produced little concrete progress toward snuffing out the more immediate crisis, in which high interest rates threaten to cut off indebted countries from bond market financing. Greece, Ireland and Portugal have needed international bailout loans to avoid defaulting on their debts, and eurozone officials are trying to keep default fears from pushing Spain or Italy, regarded as too big to bail out, into default.

Eurozone officials said they would not decide until October on whether Greece had met conditions to receive the next installment from its original $151 billion bailout, required to keep it from a default that could trigger wider financial havoc among Europe’s shaky banks.

They also could not agree to resolve a dispute over Finland’s demand for collateral to cover its contribution to a second, $150 billion bailout, which was agreed to when the first did not put Greece back on its feet.

Other calls, such as increasing the size of the eurozone bailout fund or providing more government stimulus to fight a growth slowdown that could make the debt crisis worse, were rejected.

For the longer term, calls have been growing louder for the 17 eurozone countries to coordinate their fiscal and economic policies much more closely to avoid similar crises in the future, and more importantly to assure financial markets of the endurance and unity of the currency union.

However, the struggle over the new budget rules, which dragged on after the European Commission proposed the new legislation in September 2010, has raised doubts that eurozone states would be willing to give up more decision-making power to central authorities such as the commission, the EU’s executive body.

The European Central Bank had been particularly critical of states’ attempts to preserve powers to stop sanctions, saying initially that even the original proposals from the commission were not tough enough.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.