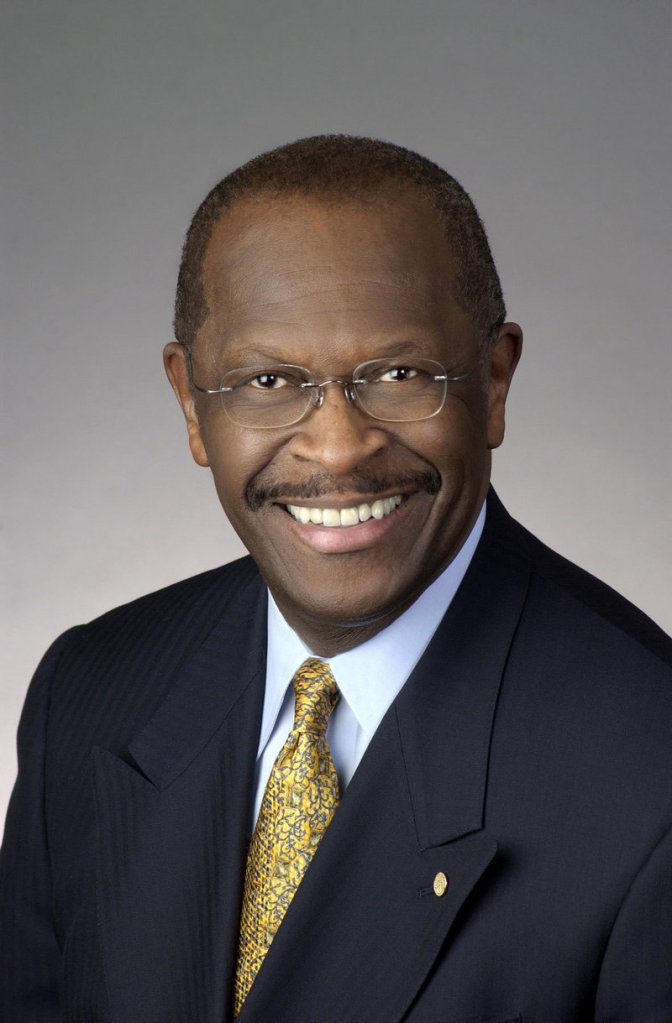

Does Herman Cain understand his 9-9-9 tax plan? Evidence suggests the answer is “no-no-no.”

At the Bloomberg-Washington Post debate, Cain argued that economic growth spurred by the reduced rates would more than make up for any lost revenue.

“We have had an outside firm, independent firm dynamically score it,” he said. “And so our numbers will make it revenue-neutral.”

Beware when you hear the phrase “dynamic scoring.” It translates to: “This tax cut might bust the budget, but let’s cross our fingers and hope for growth.”

And it turns out — at least according to his chief economic adviser — that Cain didn’t mean to be relying on dynamic scoring at all.

Cain adviser Richard Lowrie said the candidate mistakenly invoked dynamic scoring. But even under a more traditional analysis, Lowrie said, the plan would be revenue-neutral, meaning it would not lose money.

“On occasion he might transpose the terms,” Lowrie told me. “When asked if it is revenue-neutral, he might say it’s dynamically scored. He might misspeak.”

This is not reassuring. Sure, anyone can jumble up terminology, especially in the unaccustomed glare of a presidential debate. But a few days earlier, Cain said the same thing.

“The people who are saying it will not be revenue-neutral? They are absolutely wrong because they did a static analysis,” Cain told CNN’s Candy Crowley. “We had this done with the dynamic analysis with an outside independent firm so they are making an erroneous assumption.”

The 9-9-9 plan is the main plank — the only plank — of Cain’s campaign.

As it turns out, according to new calculations by the non-partisan Tax Policy Center, his plan would probably raise more revenue in 2013 than would the current tax code. But his muffed explanation is pretty unsettling.

Cain is even more muddled on the undeniably regressive impact of his plan. “Some people will pay more, but most people would pay less,” Cain told NBC’s David Gregory.

The Tax Policy Center analysis shows that Cain has it exactly backward.

Compared with current tax rates, 84 percent of taxpayers would pay more under 9-9-9 if it were fully implemented in 2013. Just 14 percent — the wealthiest — would see their tax bills drop.

By a lot. The top 1 percent, earning $600,000 and up, would pay almost 20 percent less, for an average tax break of $238,000.

The middle 20 percent, those with incomes between $37,000 and $65,000, would see their taxes rise 10 percent — an average increase of $4,330.

Why? As University of Southern California law professor Edward Kleinbard, former chief of staff to the congressional Joint Committee on Taxation, has shown, the 9 percent business tax, 9 percent retail sales tax and 9 percent wage tax is effectively a 27 percent tax on wages.

Cain’s business tax is not like the existing corporate income tax, which applies to profits. Instead, it’s basically a value-added tax in which businesses do not deduct the cost of wages.

That means, in effect, another 9 percent tax on income — just as standard economic theory now treats the employer’s share of payroll taxes as reducing workers’ wages.

Cain ignores any impact of the business tax on wages. Meanwhile, he asserts that the 9 percent retail sales tax would not raise the final cost of goods; rather, it would replace existing taxes “embedded” in the current price. If anything, he asserts, prices will drop.

Simultaneously, however, Cain claims the tax isn’t a problem for lower-income people because they can simply buy used goods, on which the tax would not apply. Slight problem: There’s no such thing as used milk.

Assume Cain is right. Prices won’t go up. Wages won’t fall. Cain simplistically argues that the existing payroll tax adds up to 15 percent and asserts that people will be six percentage points better off under his 9 percent plan.

This is wrong, as explained above. But consider the impact of only the personal income tax on two taxpayers earning $25,000 and $250,000, both married with two children.

According to the Tax Foundation’s nifty calculator, the $25,000 earner owes $1,413 in payroll taxes.

Thanks to the Earned Income Tax Credit and the Child Tax Credit, his income tax liability is negative. He receives a $5,002 check. Under the Cain plan, he owes $2,250.

Assuming a standard deduction, the $250,000 earner owes combined income and payroll taxes of $60,765. His Cain tax is $22,500.

Explain again, Mr. Cain, who wins under your plan?

Ruth Marcus is a columnist for The Washington Post. She can be contacted at:

ruthmarcus@washpost.com

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.