SAN FRANCISCO – Call it the curse of great expectations.

Apple did just about everything right in its latest quarter. The company increased its profit by more than 50 percent and boosted revenue by nearly 40 percent over the same quarter last year.

It was the second-best three-month period ever posted by the revered maker of the iPhone, iPad and iPod. Even more impressively, Apple pulled it off against a backdrop of economic uncertainty and fears of another recession. But by the sometimes absurd logic of Wall Street, it was a disaster.

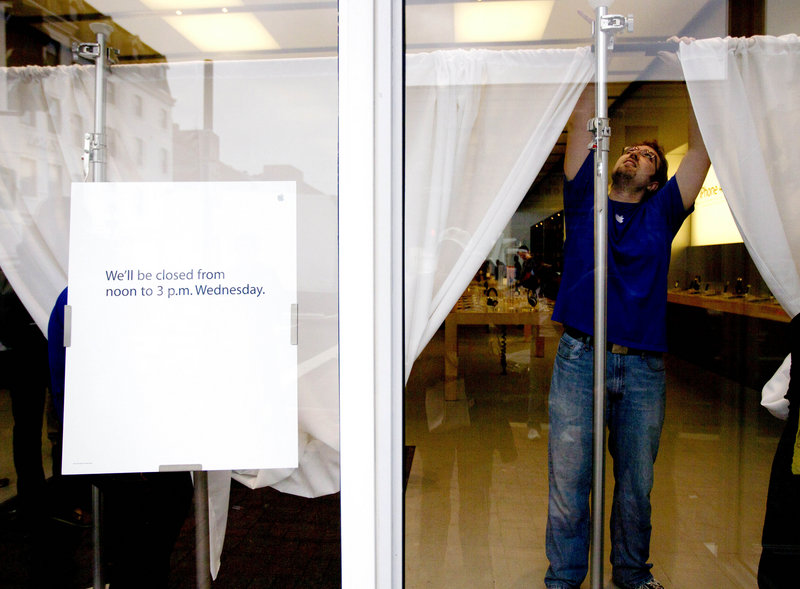

Apple Inc.’s shareholders awoke on Wednesday morning to headlines like “Apple Loses Some of Its Shine,” and then proceeded to lose about $22 billion on paper, as their stock dropped by more than 5 percent — all because Apple failed to manage the analyst expectations that can make or break a stock.

Apple’s numbers didn’t surpass the high bar set by roughly 50 securities analysts who follow the company’s stock. It’s another reminder of how difficult it can be for even the most prosperous companies to please Wall Street quarter after quarter.

“It’s a rough game,” said BGC Financial analyst Colin Gillis. “Apple has (done) so well for so long that it has gotten itself into a position where it has to set a new (earnings) record every quarter. Now, some of the momentum has been broken.”

The backlash to Apple’s fiscal fourth-quarter report, released late Tuesday, could very well turn out to be a gross overreaction. If so, this is a prime buying opportunity for investors willing to go against grain.

Apple suggested as much by issuing a jolly outlook for the current quarter, which includes the holiday shopping season. The projections call for earnings and revenue above analyst estimates, an anomaly for a company that makes a habit of low-balling its quarterly predictions. Analysts have caught on to Apple’s tactics, so they deliberately set their estimates above the company’s forecast. Gillis’ rule of thumb, for instance, is to expect Apple’s quarterly revenue to be about 20 percent above the company’s publicly stated target and for earnings to be about 40 percent higher.

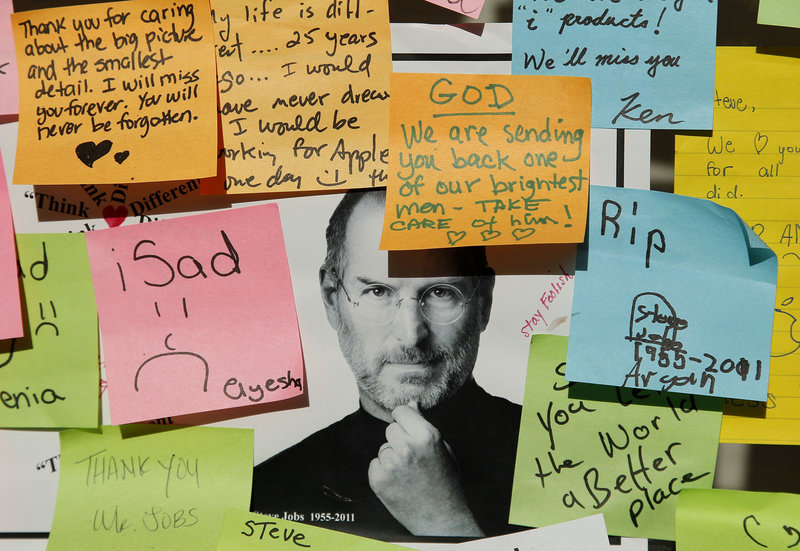

The Oct. 5 death of Apple co-founder and CEO Steve Jobs throws a new twist into the equation.

Now that Tim Cook is chief executive, analysts must figure out whether the rules of Apple’s expectations game have changed. ISI analyst Brian Marshall thinks that’s unlikely because Peter Oppenheimer, Apple’s chief financial officer for the past seven years, remains in charge of the numbers. What’s more, Cook has promised not to mess with the “magic” that has increased Apple’s market value by nearly $300 billion during the past decade and established it as technology’s most valuable company.

Trying to figure out how much money a company is going to make every three months is a little like pulling a rabbit out of a hat. Most major companies provide some guidance to help analysts because it helps keep their stock prices relatively stable. Big drops are unwelcome because they can raise anxiety among customers and business partners. For technology companies that offer employees stock in lieu of lavish salaries, those dips can affect morale.

Apple’s big mistake in its latest quarter centered on the impact the iPhone 4S — already a hit in the current quarter — would have on its revenue in the just-completed quarter. As word got out that the next generation of the iPhone would be hitting the market in the fall, more shoppers decided to hold off on buying the version already in the stores during the summer.

The result: Apple sold 17.1 million iPhones from July through September, below the 20 million units that analysts had factored into their projections. That left the company, which is based in Cupertino, Calif., with earnings per share of $7.07 on revenue of $28.3 billion instead of the earnings per share of $7.28 per share on revenue of $29.4 billion projected by analysts.

Missing the mark inevitably led to some second-guessing, particularly now that Jobs is no longer around. Cook had been running Apple since Jobs went on medical leave in January, but he didn’t take the CEO job until Aug. 24 with about five weeks left in the company’s fiscal fourth quarter.

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.