WASHINGTON – Slumping job growth has alarmed some economists who fear the U.S. economy is in trouble.

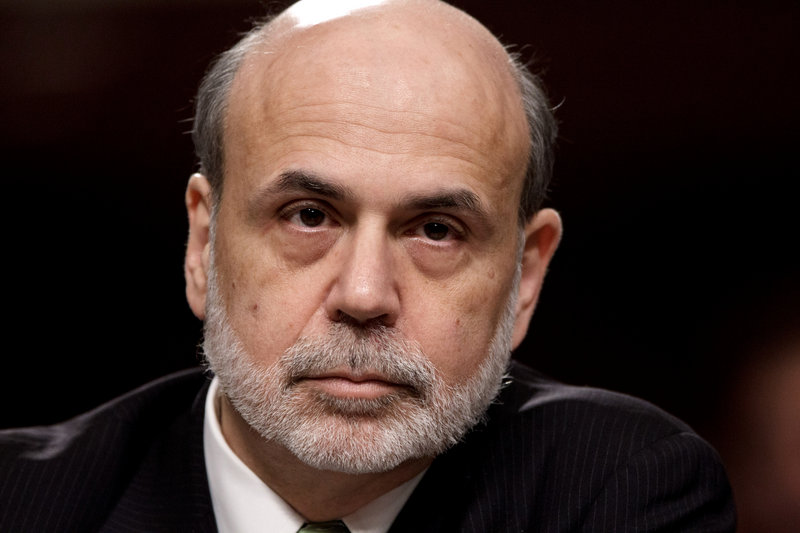

Ben Bernanke doesn’t appear to be one of them.

The Federal Reserve chairman sketched a hopeful outlook in testimony to a congressional panel Thursday and sent no signals that the Fed will take further steps soon to aid the economy.

Bernanke acknowledged that Europe’s debt crisis poses risks to the U.S. financial markets. He also noted that U.S. unemployment remains high at 8.2 percent. And he said the Fed is prepared to take steps to boost the U.S. economy if it weakens.

But he said Fed officials still need to study the most recent economic trends, including job growth. For now, Bernanke said he foresees moderate growth this year.

He said he’s mindful that all that could change, if Europe’s crisis quickly worsened or U.S. job growth stalled.

“As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate,” he told the Joint Economic Committee.

The Fed could buy more bonds to try to further reduce long-term interest rates, which might encourage more borrowing and spending. Or it could extend its plan to keep short-term rates near zero beyond late 2014 until an even later date.

But most economists don’t expect a major announcement at the Fed’s next policy meeting June 19-20, despite signals this week from some other Fed members in favor of considering further action.

For one thing, long-term U.S. interest rates have already touched record lows. Even if rates dropped further, analysts say they might provide little benefit for the economy. They say it’s unlikely that many businesses and consumers who aren’t borrowing now at super-low rates would do so if rates declined a bit more.

And Bernanke could face pressure not to pursue further stimulus before the November election because such steps could be perceived as helping President Obama win re-election.

“The Fed stimulative effects have really run their course,” Obama’s Republican opponent, Mitt Romney, argued in a television interview last week.

John Ryding and Conrad DeQuadros, economists at RDQ Economics, said there was nothing in the testimony to “tip Bernanke’s hand” before the June meeting of the Fed’s policy committee.

“Yes, the Fed chairman said the Fed stands ready to act if Europe poses a threat to the U.S. financial system or the economy,” they wrote in a note to clients. “However, he gave no specifics.”

Many analysts are worried that the U.S. economy is suffering a midyear slump just as in 2010 and 2011. They’re concerned in particular about the job market. From December through February, the economy added an average 252,000 jobs a month. But since then, job growth has slowed to a lackluster 96,000 a month. In May, U.S. employers added just 69,000 jobs, the fewest in a year.

Paul Edelstein, an economist at IHS Global Insight, said he thought Bernanke didn’t seem alarmed by the weak hiring in May. “His view is that it isn’t a sign that the economy is falling apart,” he said.

Bernanke’s message to financial markets, Edelstein said, was, “Don’t expect anything drastic from the Fed at the June meeting.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.