Chesapeake Energy Corp. shareholders should have a lot to say at today’s annual meeting.

Their shares are worth about 40 percent less than a year ago. The nation’s second-largest natural gas producer still has big spending plans even though it’s taking in less cash because of a plunge in natural gas prices. And it needs to sell off billions of dollars in assets to service a huge debt load.

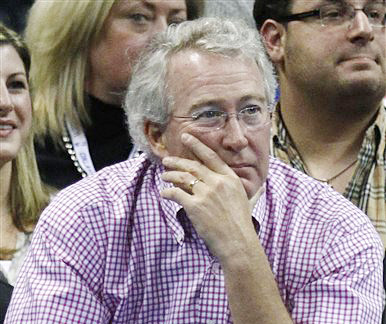

There’s also the controversy surrounding Chief Executive Aubrey McClendon. Reports about his personal business dealings sparked a drop in the company’s shares in April and led to charges of insufficient oversight by the board of directors.

The share sell-off followed disclosure that McClendon was allowed to borrow money from a company that Chesapeake was doing business with. Shareholders began calling for a shake-up of the board after Chesapeake acknowledged that directors hadn’t fully scrutinized the loans’ details.

Chesapeake has agreed with Carl Icahn and Southeastern Asset Management, its largest shareholder, to replace four of nine board members with directors they choose. The company also stripped McClendon of the chairman title. It plans to name a new independent board chairman by June 22.

Shares have rallied 14 percent this week, easing some but not all of shareholders’ pain. At Thursday’s close of $17.85, the shares are still down 20 percent for the year. A number of analysts have welcomed the board shake-up and boosted their rating of the stock. A few, however, are calling for McClendon to be ousted.

Chesapeake is making progress on asset sales. Earlier Friday, it announced the sale of its pipeline assets in three deals that will bring it $4 billion. Half of that amount will be in its coffers before the end of the month. These deals would bring asset sales so far this year to $6.6 billion. Biju Perincheril, an analyst at Jeffries & Company, has estimated the company needs to sell at least $7 billion worth of assets this year or risk violating the terms of some of its loans.

Chesapeake has outlined plans to sell as much as $14 billion of assets in 2012.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.