WASHINGTON – Fewer U.S. banks are failing than at any time since the financial crisis erupted in 2008. The healthier banking industry is helping sustain an economy slowed by lackluster hiring, weak manufacturing and Europe’s debt crisis.

Banks have benefited from low interest rates, higher account fees and more mergers. The recovery from the financial crisis has helped, too. It means more people and businesses can take out and repay loans.

Banks remain generally cautious about lending. And their rebound has yet to drive a robust economic recovery from the recession that officially ended three years ago. But the banks’ gains have allowed them to gradually make more loans and keep the economy from slowing further.

Bank loans rose at a 2.1 percent annual rate in the first three months of 2012 and at a 4.6 percent rate since then, according to the latest Federal Reserve data.

Signs of the industry’s improvement:

• Banks are making more money. In the first three months of 2012, the industry’s earnings reached $35 billion, up from $29 billion in the first quarter of 2011. It was the best showing since 2007. At the depth of the recession in the fourth quarter of 2008, the industry lost $32 billion.

• Fewer banks are considered at risk of failure. In January through March this year, the number of banks on the Federal Deposit Insurance Corp.’s confidential “problem” list fell for a fourth straight quarter. The list numbers 772 as of March 31 — about 9.5 percent of U.S. banks. At its peak in the first quarter of last year, the number was 888.

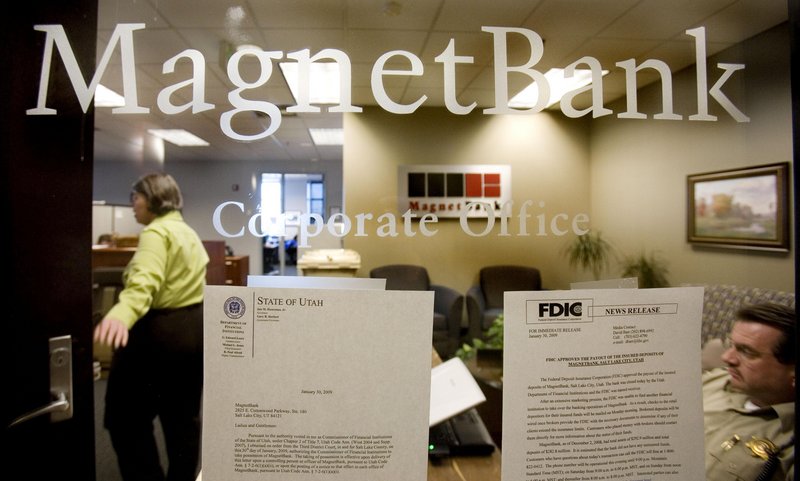

• Bank failures are down. In 2009, 140 banks failed. In 2010, more banks failed — 157 — than in any year since the savings and loan crisis of the early 1990s. In 2011, 92 failed. This year, regulators closed 31 in the first half of the year. In a good economy, only about four or five banks close each year. But the pace shows sustained improvement.

• Less fear of loan losses. The money banks must set aside for possible loan losses declined by nearly a third in the January-March quarter compared with a year earlier. Their loan portfolios have grown safer as more customers have repaid on time.

“The worst is over,” says Bert Ely, a banking consultant.

The main reason for the sharp drop in bank closings has been a stronger economy. Employers have added nearly 1.8 million jobs over the past year, which means more people and businesses have money to repay loans.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.