The company that has been planning a proposed liquefied natural gas import terminal in Washington County for nearly a decade has announced a significant reconfiguration of the project that it says will thrust it into global markets while benefiting Maine by increasing the amount of natural gas that gets piped into the state.

Dean Girdis, CEO of Downeast LNG, said Tuesday that the company is now proposing to spend $1.3 billion to build a “bi-directional” facility, which would have the capability to import natural gas from abroad, as originally proposed, or export domestically produced natural gas to global markets, depending on demand. Prime among those markets is Eastern Europe, where countries are trying to loosen ties to Russia and its natural gas supply.

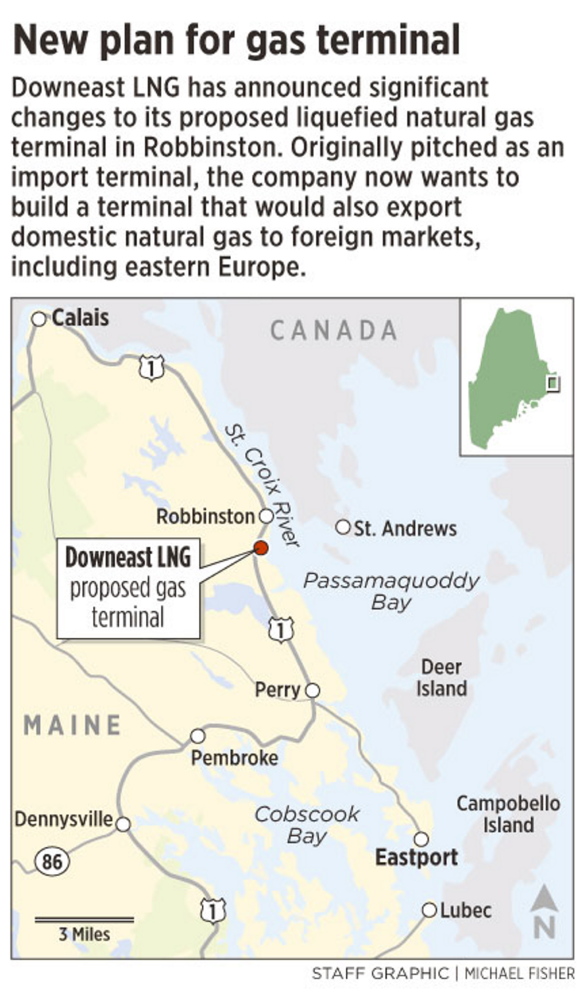

The terminal is still being proposed for Robbinston, where the company bought nearly 80 acres on Passamaquoddy Bay in August for $2.5 million, Girdis said. It would have capacity to liquefy 2 million tons of natural gas per year or “regasify” 100 million cubic feet of liquefied natural gas, depending on market conditions.

The fuel is pumped as a gas through pipelines such as the Maritimes and Northeast Pipeline, which runs from New Brunswick south through Maine. The gas must be turned into liquid before being loaded onto tankers.

The desire to export domestic natural gas arises from significant changes in the global market since Downeast LNG first proposed its project, in 2005. Production in the United States has increased more than 35 percent in that time, from 18.9 trillion cubic feet to 25.6 trillion cubic feet in 2013, according to the U.S. Energy Information Administration.

The federal agency expects domestic production to grow to 33.1 trillion cubic feet by 2040 because of the boom in shale gas production in places including Pennsylvania, West Virginia and portions of southern New York and eastern Ohio.

That kills the business case for importing natural gas into the region, but makes an export terminal attractive, Girdis said.

PIPELINE CAPACITY AND PRICES

Despite the growing supply of domestic natural gas, Maine residents and businesses still pay high prices at times of peak demand because of limited pipeline capacity into New England.

In addition to making more financial sense for the company, the reconfigured project offers a “creative solution” to help reduce prices for Maine residents and businesses.

Federal law requires pipeline operators to have commitments from buyers before building new pipelines. Girdis said Downeast LNG would seek to contract for 300 million cubic feet of natural gas pipeline capacity, thereby supporting construction of new pipelines into the state.

The new project’s cost of $1.3 billion is double the original estimate, but the potential payoff is larger. The new project could generate $300 million in revenue annually, while the import-only project had potential for $130 million, Girdis said.

The original project called for two storage tanks, a pier, regasification equipment and a pipeline to connect the terminal with the Maritimes and Northeast Pipeline. The new project would replace one of the storage tanks with equipment to liquefy the natural gas before it’s loaded onto tankers for export.

The new project would reduce the number of ships passing through Head Harbour Passage to reach the terminal in Robbinston from 60 to 30 a year, Girdis said.

The passage of ships through Head Harbour Passage is a source of controversy. The Canadian government has signaled that it would not allow tankers through the passage, which is north of Campobello Island and provides access to Passamaquoddy Bay.

Girdis said the politics of the issue don’t concern him. The project has received a “letter of recommendation” from the Coast Guard, he said.

“We have definitive right to passage through Head Harbour. Canada cannot block that,” he said. “We’re interested in cooperating and addressing the concerns of both U.S. citizens and Canadian citizens regarding our proposal, but we have right of passage.”

OPPONENTS’ OBJECTIONS

The new project still has opponents who are set on derailing it. Robert Godfrey of Save Passamaquoddy Bay, a group that has opposed the project since the beginning, filed a complaint with the Federal Energy Regulatory Commission on Tuesday, asking it to deny the company’s current application.

Godfrey argues that Downeast LNG has misled FERC and the public for years by not revealing its real purpose until now.

“They had to know the market they intended to meet wasn’t there,” Godfrey said. “They’ve known this for quite a while and should have made their intentions known. So they’ve abused the permitting process and are abusing the intervenors in this case and the public. All parties of this preceding should have been notified long ago.”

Downeast LNG is nearing the end of its permitting process for the original project. In May, FERC’s staff issued a favorable final environmental impact statement for the project.

FERC, the lead federal agency in such matters, gave other federal agencies, such as the Environmental Protection Agency, until the end of August to make a determination on the project. The commissioners have as much time as they need to make their decision, said FERC spokeswoman Tamara Young-Allen.

Girdis is unfazed by starting over in the regulatory process for the new project. The company will file new paperwork within the next two weeks to begin the pre-filing process, he said. He hopes the process will take 18 months, but acknowledges that could easily change.

Young-Allen said Tuesday that the federal agency has not received official paperwork from Downeast LNG concerning its reconfigured proposal. She said the current proceedings will continue unchanged until that happens.

Girdis said he has not approached the state yet about the next steps in obtaining state permits. He would like to see construction begin in 2016 and have the facility begin operating by 2020.

LNG BUYERS AS INVESTORS

Private investors have bankrolled Downeast LNG to this point, but to line up the necessary financing for a $1.3 billion terminal, the company would need long-term energy contracts with buyers, Girdis said.

“We’re speaking with LNG buyers interested in becoming investors in the terminal,” he said. “Given what’s been going on in Europe, we’ve got interest in parties that want to diversify away from European gas to less politically tied gas.”

Most of the natural gas used in Europe comes from Russia, the second-largest producer in the world behind the United States.

Downeast LNG commissioned an economic impact study by Todd Gabe at the University of Maine, who calculated that the new project would create 2,350 jobs and $375 million in labor income during its three-year construction period. Gabe estimates the terminal would support 337 jobs in the state and have an annual economic impact of $68 million.

Patrick Woodcock, director of Gov. Paul LePage’s Energy Office, said Tuesday that the administration is interested in the project.

“We’re very encouraged that this could be a real opportunity to move the project forward, which brings jobs but also addresses these natural gas challenges that have emerged over the last couple years,” Woodcock said. “But, of course, we have to see the actual proposal. It’s counterintuitive that an export project would give pricing benefit to Mainers, but that’s the reality of the seasonality of our gas market in New England.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.