AUGUSTA — The LePage administration is proposing to lower the bar for employers participating in an economic development program that already has its share of critics for its questionable returns to taxpayers and effectiveness in job creation.

The proposal, L.D. 1364, would make significant changes to the Pine Tree Development Zone program, which provides tax breaks to companies that promise to make major investments and create jobs. To participate, employers are required to pay workers competitive salaries and offer health benefits.

The proposal, submitted by the Department of Economic and Community Development, would significantly lower the minimum threshold for salaries that businesses must pay to be certified for the program in most counties. It also would remove the requirement that certified employers provide group health insurance.

Administration officials said Monday that the proposal is intended to make the program attractive to new employers.

“Certainly the intent here is to bring more new investment into the state of Maine, in particular in the areas with higher unemployment,” said Doug Ray, a spokesman for the economic development department.

The bill was presented amid new scrutiny of Maine’s economic development programs. The Legislature’s watchdog agency, the Office of Program Evaluation and Government Accountability, is trying to provide greater oversight and accountability for the state’s tax break initiatives. That includes the Pine Tree Development Zone program, an initiative of Democratic Gov. John Baldacci in 2004 to jump-start business development, particularly in economically distressed areas.

Its success has been questioned often. In 2006, OPEGA found that the program failed a number of accountability benchmarks and presented a high risk to the state. In 2014, a state-commissioned report by Investment Consulting Associates found that the program’s costs exceeded its benefits.

According to the report, the state received total direct benefits of $358 million in 2012, in terms of people employed, salaries and total sales in the state. However, the program had $457 million in total direct costs related to lost taxes, administrative costs, overhead and other expenses.

Those findings loom as lawmakers gear up to review L.D. 1364, a proposal that essentially retains the same benefits for businesses while potentially cutting the benefits to workers.

“This bill is about reducing wages and cutting benefits for workers,” said Joel Johnson, an economic policy analyst for the Maine Center for Economic Policy, a progressive advocacy group. “In this case it does it by weakening accountability in an economic development program which already lacks accountability.”

REFLECTING LOCAL MARKETS

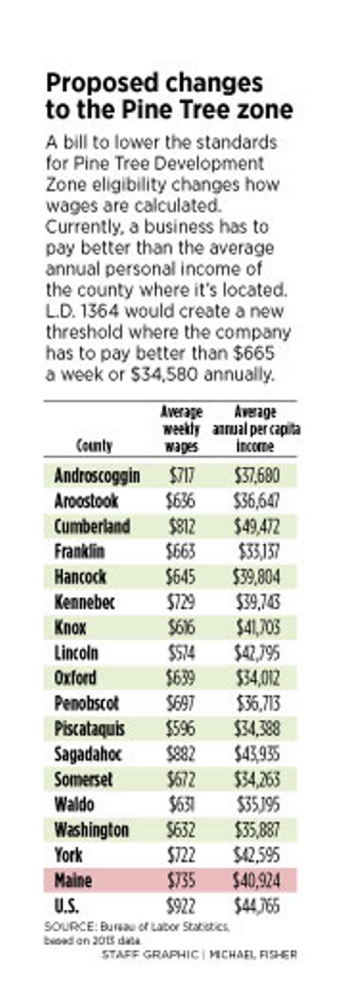

LePage administration officials counter that the new wage requirements are a truer reflection of the employment market. Currently, the Pine Tree program requires that employers pay workers based on the average per-capita earnings of the county in which the business is located. For example, under the current rules of the program, T-Mobile, located in Oakland, is required to pay its employees a minimum of $39,743 in wages and benefits, the average per-capita income in Kennebec County based on 2013 data from the U.S. Bureau of Labor Statistics. The 2013 per-capita income for other counties included $36,647 in Aroostook, $34,388 in Piscataquis, $49,472 in Cumberland and $37,680 in Androscoggin.

The proposed bill would set a new wage-and-benefits requirement statewide of $34,580, or about $665 per week. All told, the change would result in a wage decrease in most counties where certified Pine Tree employers pay the minimum salary and benefits.

That’s because the minimum wage requirement would no longer be based on regional wage data, but on the average wages of 14 of Maine’s 16 counties. The bill excludes Cumberland and York – the first- and third-highest average-wage counties in the state – from its calculation.

Ray said the calculation excluded Cumberland and York because the Pine Tree program only offers limited participation for employers in those counties.

According to state data, however, there were 1,180 employees working for certified Pine Tree employers last year in Cumberland County, the second-highest number in the state. Androscoggin was first with 1,273 employees. York had 406.

STANDARDS FOR WAGES, BENEFITS

Glen Mills, an economist for the Maine Department of Labor, said the change from per-capita income to the new calculation makes sense. That’s because the per-capita calculation includes other income besides wages, he said, including Social Security and retirement payments or public assistance and welfare payments. Overall, Mills said, only 62 percent of the per-capita calculation is determined by wages.

“These programs are designed to promote job creation,” he said. “You want your standard of comparison to be what the wages are paid in those jobs … not something else.”

He added, “You don’t want to require an employer in Washington County or Piscataquis County to have to pay the wages that are getting paid when that’s not the market there. It’s designed to reflect the local market.”

Johnson, the economic policy analyst, countered that the taxpayer-subsidized programs should provide better benefits.

“I think the main point here is that our economic development incentives should have high standards for wages and benefits,” he said. “This bill is clearly an attempt to weaken wage and benefit standards in a program that already is not accountable enough. The reality is this bill is going in the wrong direction. We need more accountability so that taxpayers aren’t left holding the bag.”

CONTROVERSIAL FROM THE START

The Pine Tree Zone Program gives qualifying companies a 100 percent corporate income tax break for five years and a 50 percent break for another five years. Other incentives include reduced employment taxes, and the elimination of personal property, sales and use tax for qualifying businesses. Pine Tree businesses also qualify for discounted utility rates.

Eligible businesses include firms from industries such as biotechnology, finance, aquaculture, composite manufacturing and information technology.

Ray acknowledged that companies in those fields would have to offer competitive wages to lure a qualified workforce. He said the new wage requirements wouldn’t impede them from doing so.

“We have heard that there are businesses that want access to the program and want to move here, and this would make the wages more competitive,” he said. “This would make us more competitive in that realm.”

According to the economic development department’s biennial report to the Legislature, the program has 287 current participants statewide, including 214 manufacturing companies.

In 2014, there were 7,952 people working for certified Pine Tree employers. The state estimated that the program had generated $361 million in investment last year.

LEPAGE TRIED TO BEEF UP PROGRAM

Some Republicans criticized Baldacci when he first unveiled the Pine Tree Development Zone program in 2004, calling it corporate welfare.

Gov. Paul LePage, however, has taken a different view of Pine Tree and made a number of attempts to beef up the program. Last year his administration touted a plan described as Pine Tree Zone “on steroids.” In the plan, companies that invest at least $50 million and promise to create 1,500 jobs in the designated areas would be eligible for discounted electricity rates, employment tax benefits, job training, increased access to capital and exemption from collective bargaining laws. The proposal failed in the Democrat-controlled Legislature.

The latest proposal is likely to generate opposition in the Legislature, where Democrats control the House of Representatives. Republicans have the majority in the Senate.

However, the bill has two Democratic co-sponsors, Rep. John Martin, D-Eagle Lake, and Rep. Robert Saucier, D-Presque Isle. Both represent rural districts that LePage officials say would benefit from the proposal.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.