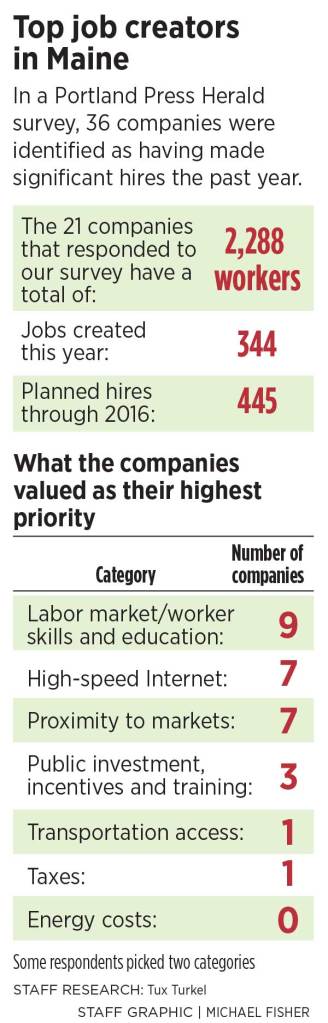

The presence of a healthy labor market made up of skilled and educated workers was the most important consideration of 21 employers who created jobs in Maine during the past year, according to companies that participated in a Portland Press Herald job-creation survey.

Next to finding the right workers, access to high-speed Internet service and being close to customers were tied for second in a ranking of concerns and values for these job creators.

None of the survey respondents identified energy costs as their top concern in deciding whether to hire new workers or locate in Maine. Only one flagged taxes as the most important value in the decision-making process, and the owner indicated that a dedicated workforce and government grants have helped offset high taxes.

The other two choices in the survey were access to transportation and an availability of public investments, such as job training programs and financial incentives.

Taken together, the survey findings run counter to the economic development priorities of Gov. Paul LePage, who has made tax relief and lower energy costs the cornerstones of his efforts to lure “job creators” to Maine.

Job creation is a hot topic in Maine.

Politicians frequently lament the state’s business climate and argue over what economic conditions can best retain existing jobs and create new ones. LePage and some Republican leaders identify above-average heat and electricity costs, as well as the combined tax burden, as primary reasons why companies don’t come to Maine or expand here.

Democratic leaders, meanwhile, have been publicizing a statewide “jobs tour” this year and a “Put ME to work” bill that emphasizes public-private partnerships and training for growth sectors, such as health care and information technology.

The practice of offering state-sponsored tax incentives recently came under scrutiny after a Maine Sunday Telegram investigation into how some apparent job creators took advantage of complex financial loopholes in a new program and collected millions of dollars from taxpayers, without producing new jobs.

While business leaders and employers may lend their voices to one viewpoint or the other, often missing from the political discourse are the opinions of owners and managers who actually have hired people over the past year. The Press Herald’s survey and follow-up reporting were done to examine the topic of job creation by hearing directly from some of Maine’s true job creators.

These companies employ a total of 2,288 people and are located from Biddeford to Bangor. Together they created 344 new jobs last year and say they plan to hire another 445 people through 2016. They represent a broad spectrum of enterprises, including manufacturing, biotechnology, financial services and retail. They also range in size: One was a biotech startup with three workers, another an insurance firm with 700 employees.

The newspaper scoured media reports and contacted chambers of commerce and other business sources to identify roughly three dozen companies that had hired new workers or expanded into Maine within the past 12 months. It then reached out to those companies by email with a survey, which was returned by 21 of them.

On a scale of 1 to 10, the survey asked owners and executives to rank from among seven topics the most important considerations in their job-creation decisions. It also sought comments about Maine’s business climate and the single most important thing Maine politicians could do to help create jobs. Finally, it asked for a tally of recent and planned hiring numbers.

One key finding is that although the price of energy does matter to many of these job creators, it’s not a deciding factor in whether they expand. That’s true even for manufacturers such as Jotul North America in Gorham, which assembles Norwegian wood stoves, or Auburn Manufacturing, which makes high-temperature fabrics for industry. Both factories are served by natural gas, and have endured winter price spikes. But in both instances, these businesses identified skilled labor as their top consideration for hiring new workers.

The newspaper shared a summary of its conclusions with the LePage administration. It sought a reaction to the findings and asked if the state was doing enough to help train and educate workers.

The governor’s office didn’t answer the questions directly, but Peter Steele, the communications director, replied with a statement.

“We are pleased these companies have created jobs and are committed to Maine, but this ‘survey’ is not statistically relevant. It does not take into account businesses that chose not to come to Maine – or ones that are struggling to stay afloat – because of the factors listed. The number of jobs that have not been created is much more difficult to quantify. If Maine becomes known as a low-tax state with affordable energy costs and right-to-work laws that protect employee paychecks from forced unionism, we could add many more jobs to those listed in the impromptu ‘survey.’ ”

FACTORS AFFECT LABOR RANKING

In total, nine of the 21 respondents – nearly half – picked labor market/worker education as their primary value.

The focus on labor market isn’t surprising, said Glenn Mills, chief economist at the Maine Department of Labor’s Center for Workforce Research and Innovation. By definition, any survey aimed at companies looking to hire has a built-in bias to labor-market concerns, he said.

“It’s a small sample and it’s skewed toward companies that are adding staff,” Mills said. “So the ability to find people is a more-present issue for them than companies that are stable or declining.”

Another finding is that many of the employers who are hiring are newly formed or recently growing. That’s also in line with who’s creating jobs in the overall economy, Mills said. New businesses are responsible for virtually all of the net job growth in Maine, Mills said.

“Mature companies, on average, are declining over time,” he said. “It’s the new starts, the new companies, that sustain us.”

The Labor Department’s research on job creation in Maine also has found that six industries account for two-thirds of new jobs. The largest sector was professional, scientific and technical services. That was followed by wholesale trade, retail trade, administrative support and waste management, lodging and food, and health care and social assistance.

These growth sectors, Mills said, tend to be more “human capital intensive” than energy intensive, which is why energy is less of a factor in today’s employment trends.

Energy costs are deal-breakers for some of Maine’s legacy employers, especially in the forest-products and paper industries. Those sectors have been shrinking for decades, but did create some new jobs over the past year. Among the most notable was the purchase of the bankrupt Old Town Fuel & Fiber pulp mill by Expera Specialty Solutions of Wisconsin, which hired back 180 workers, as well as the new $30 million Ashland Sawmill, which created 60 jobs in Aroostook County.

The newspaper sent surveys to both companies. Expera declined to participate. J.D. Irving, the Canadian owner of the sawmill, didn’t respond to the email or a follow-up contact.

LURE OF MAINE, SKILLED WORKERS

For some new companies, high energy costs are a good thing.

Take ReVision Energy of Portland. The solar and alternative fuels company grew from two men in a garage 11 years ago to 80 full-time employees in two states today. It added 20 jobs in the past year and is benefiting from public worries over volatile oil prices. The company picked proximity to customers as its top consideration in hiring, along with a value not included in the survey – quality of place.

“Why is there a steady migration of workers from Atlanta, Washington, D.C., Philadelphia, New Jersey, NYC and Boston to Maine?” said ReVision’s co-founder, Phil Coupe. “It’s because people don’t want to stay in those rat-race cities for a second longer than they have to.”

Another example is SaviLinx in Brunswick, a two-year-old call center for government contracts and services. It has ramped up fast with 130 employees. Those jobs can’t exist without high-speed Internet, making broadband service the top value for the company’s president.

“Although we are hampered by high energy costs in Maine, the primary driver for job creation at SaviLinx is the availability of a skilled and loyal workforce,” said Heather Blease. “Excellent and redundant Internet connections (also) are essential for our operation.”

SaviLinx benefits from its location at Brunswick Landing, the business campus at the former Brunswick Naval Air Station. The campus and its new TechPlace incubator space and Topsham Commerce Park has a total of 570 employees at more than 50 work sites.

The former military base’s grid connection allowed Brunswick Landing to negotiate a discount, bulk electricity supply contract. But Steve Levesque, executive director of the Midcoast Regional Redevelopment Authority, said that’s not the prime reason the campus is growing so fast.

“A company can have the best incentives, free rent and cheap energy,” he said. “But if they don’t have the people to make their business successful, they won’t be here.”

FINDING THE RIGHT COMBINATION

Maine’s aging population puts a finer point on available workforce, but finding workers is a national problem, said Peter DelGreco, president of Maine & Company, the private, nonprofit consulting firm that helps companies relocate to Maine.

“There is a fundamental misalignment between who employers are looking to hire and the skills of the workforce,” he said.

Businesses looking to relocate or expand evaluate costs and risks, DelGreco said. The Internet has made it easy to compare energy prices or tax burdens. Any company considering Maine already has factored those known costs into its site-selection criteria, he said.

Finding enough of the right workers is harder to assess, and represents a risk. Maine has one advantage in attracting companies from the Boston area, because many job creators are familiar with the state.

One example is Sun Life Financial, the Canadian disability insurance company that DelGreco helped bring to Scarborough. The company has a U.S. subsidiary outside Boston with a top executive who once worked in Portland and knew of the city’s cluster of disability insurers, anchored by Unum. It plans to create 200 jobs over the next two years. In its survey response, Sun Life ranked labor market skills and proximity to customers as its top reasons for expanding here.

“Our most important rankings have to do with the industry climate in the Portland area, particularly in disability benefits expertise,” said Devon Portney Fernald, a company publicist. “We want to draw from the great pool of talent Portland has to offer. … And because this area is such a hub for disability benefits, it is also a destination for customers.”

LINK BETWEEN LOW TAXES, NEW JOBS

SunLife has 27,000 employees worldwide, so Maine is a small player. But the sense that Maine could attract large companies and thousands of workers – if only it had a lower tax burden – is a mantra for LePage. Legislation proposed by the governor would lower required salaries and benefits for companies in a program that offers tax breaks for promising to make major investments and create jobs.

The link between lower taxes and new jobs provides a powerful narrative for the Maine Heritage Policy Center, a free-market advocacy group.

“Taxes are a major deterrent in terms of cost, compared to other states,” said Matt Gagnon, the group’s CEO. “It’s something that differentiates us. Even in the Northeast, it puts us at a competitive disadvantage.”

Gagnon’s group recently hosted a presentation of the 2015 “Rich States, Poor States” report by the American Legislative Exchange Council, which advocates for limited government and free-market policies. The report rankings are heavily weighted toward low overall tax burden. It ranked Maine 44th in past economic performance (Texas was first and Michigan was 50th). Maine was ranked 42nd for economic outlook (Utah was first and New York was 50th).

But for companies that have operations in other states and expand in Maine, the calculus is more complicated.

C&L Aerospace has offices in Australia, Romania and California, but is headquartered at the Bangor International Airport. The company maintains, leases and services aircraft. It came here by purchasing Telford Aviation in 2010.

Chris Kilgour, a New Zealand native and the CEO, said many states have contacted him about relocating. They offer him financial incentives and tax relief.

“Ultimately,” Kilgour said, “the higher the percentage of money the government wants to take from our bottom line, the less attractive it is to build my business in this particular area of the country.”

In the survey, Kilgour ranked taxes as his chief concern. Despite that, he has decided to grow in Bangor, and completed a $5 million expansion last year. Employment has grown from 20 people five years ago to 130 today, with more jobs planned.

“It’s interesting how many people have told me how surprised they are that I have chosen to locate my business in Maine,” he said.

But Kilgour said he was surprised by the government assistance he found here, including $576,000 in federal and city matching grants.

“Once I moved here,” he said, “and started looking at what opportunities there were for support in growing my business, the more I came to realize there is good support for business growth when creating jobs. … I think Maine needs to somehow market itself better and concentrate on its strengths to attract business to the area, rather than negatives, such as the cost of heat and electricity.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.