The hot rental housing market in Portland – one that has driven up prices and made vacant apartments scarce – could be cooling off.

Landlords already are reporting fewer responses to ads and a lower quality of applications this winter, a typically slower time, said Brit Vitalius, president of the Southern Maine Landlord Association and owner of Vitalius Real Estate Group, who presented at the Maine Real Estate & Development Association’s annual conference Thursday.

But even in the spring when there’s more movement, he doesn’t expect the demand to reach the same level as last year, especially as the hundreds of units in development start coming onto the market.

“We’re nervous that someone is going to turn off the spigot here,” he said.

In the residential housing sector, single-family home sales are up and are expected to continue climbing steadily, said David Marsden of Bean Group, although he believes the luxury home market – for properties over $700,000 – could start to struggle.

Portland’s rental housing market was the subject of a recent Maine Sunday Telegram/Portland Press Herald special report, “No Vacancy,” which found that rents in the city had risen 40 percent in the past five years.

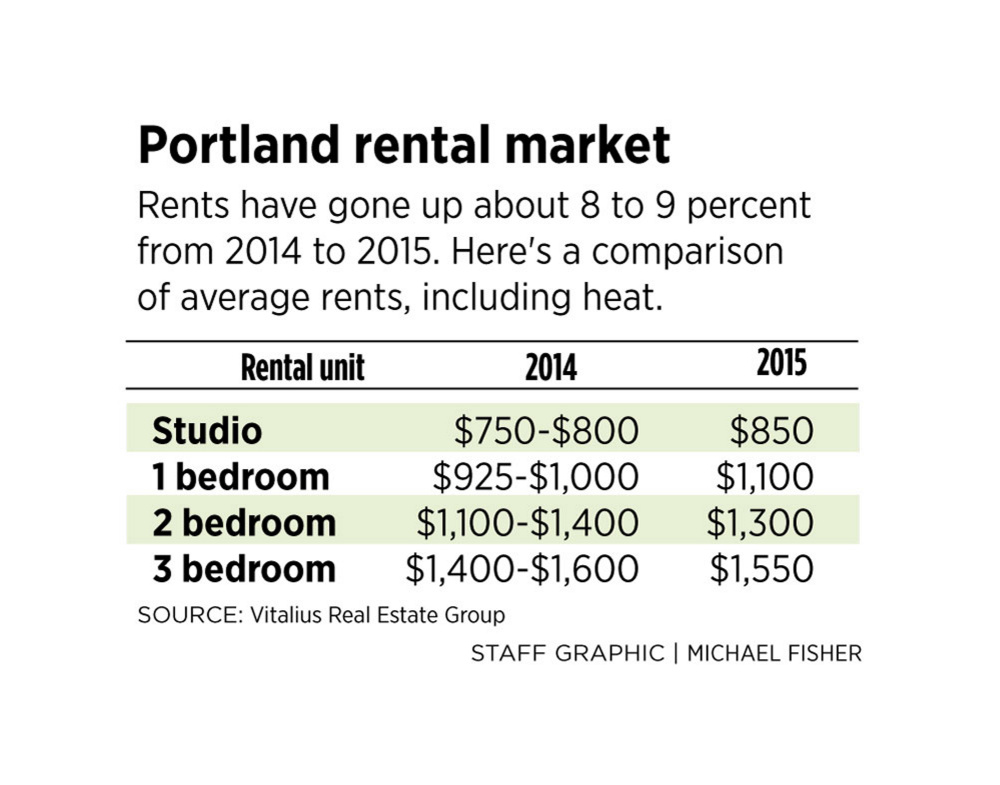

In his talk, Vitalius disputed a statistic cited in the report – that rents in May 2015 were up 17.4 percent from the year before, according to the online real estate firm Zillow. He believed they rose 8 percent or 9 percent last year – to about $1,300 for a two-bedroom apartment – and would rise about 5 percent this year.

Still, he described it as “an incredible year in the multifamily sector.”

The high demand for apartments was a boon for property sales, as buyers believed they could get higher rents without having to worry about filling their units, he said.

About 150 properties were sold in Portland in 2015, the most since 2005, according to his presentation.

At over $60 million, the sales volume also was the highest in 10 years, as was the median sale price of $350,000.

Other metro areas, including Westbrook, South Portland, Biddeford-Saco and Lewiston-Auburn, have yet to see prices rebound to 2005 levels. However, he said, “basically all the regions were up, and up substantially.”

Multifamily properties were on the market an average of 16 days in Portland, second to South Portland, where it was 13 days.

Buildings in Westbrook and Biddeford-Saco are typically sold in about a month and a half, and in Lewiston in more than two months.

At the same conference in past years, Vitalius has insisted that Westbrook would emerge as the next hip rental market. This year was no different, except that there’s more of an indication that it has started to happen.

Although the median sale price of multifamily buildings in Westbrook fell by $2,000, to $220,000, from 2014 to 2015, 10 more buildings were sold and there was nearly a 30 percent increase in sales volume.

The average number of days on the market dropped from 72 to 43.

“We don’t all need to live on the peninsula,” he said, pointing out the proximity of Westbrook, which has a downtown that sits on a river.

As for the future of the rental market as a whole, Vitalius said the question is whether Portland is going through a “fundamental change” or is simply at the peak of a natural cycle.

“I have no idea,” he said. “There’s arguments for both.”

But eventually, he said, rents will flatten out and “everyone’s going to sober up.”

In the single-family home sector, it’s luxury homeowners who have reason to worry, said Marsden, of the Bean Group.

As baby boomers downsize and want to sell their four-bedroom, three-bathroom homes, they’re going to find that there aren’t enough people to buy them, he predicted.

Generation X is half the size, and millennials, loaded down by student debt and late to start their careers, don’t have the money, he said. Plus tastes have shifted toward smaller, more environmentally and financially sustainable homes.

But overall, the market for single-family homes and condos has been on the upswing, and Marsden expects it to continue on a “slow and steady rise.”

Houses spent an average of 33 days on the market in 2015, down from 76 in 2011, he said.

The median price for the 5,786 homes sold in Cumberland County last year was $238,000 – up from $215,000 in 2011, when there were 3,496 sales, according to his presentation.

September had the highest prices, and the most houses were sold in June, it said.

The median price of homes sold in Falmouth was the highest in Greater Portland, at $468,500.

Marsden predicted that the median home price would continue to rise this year, with the greatest buyer demand for urban homes and sustainable buildings.

For more on Portland’s volatile rental market, read “No Vacancy,” a Maine Sunday Telegram/Portland Press Herald special report.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.