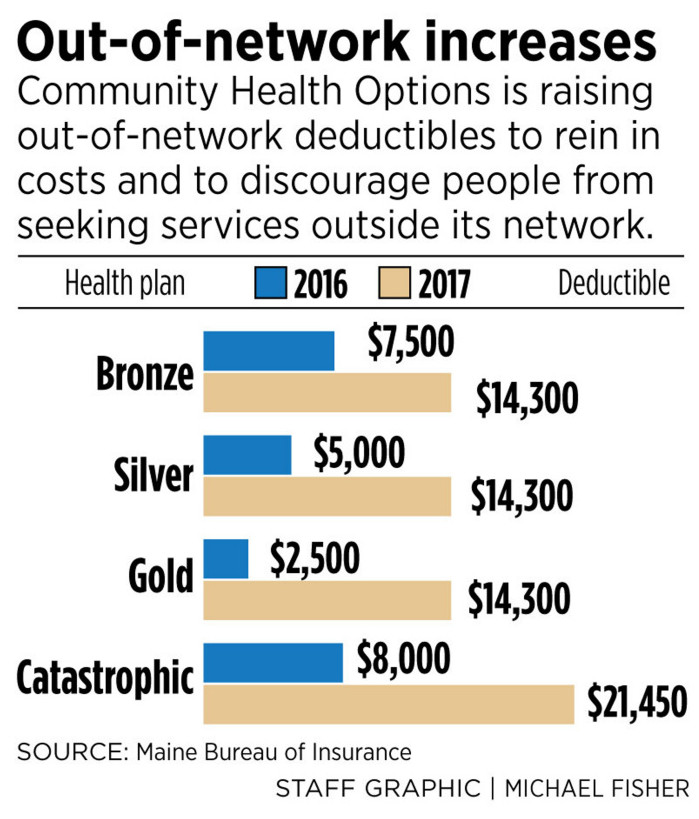

Lewiston-based health insurance co-op Community Health Options will increase its deductibles for out-of-network medical care by as much as 472 percent in 2017, hoping to curb its members’ use of the expensive option.

The lowest out-of-network deductible, for CHO’s “gold” plan in the Affordable Care Act marketplace, will increase by 472 percent, from $2,500 to $14,300, according to the Maine Bureau of Insurance. At the opposite end of the spectrum, the out-of-network deductible for CHO’s “catastrophic” plan will increase by 168 percent, from $8,000 to $21,450. Deductibles for its four most popular “silver” plans will increase by 186 percent, from $5,000 to $14,300.

Meanwhile, premiums for CHO individual insurance plans in 2017 are increasing by an average of 25.5 percent, although subsidies will offset most of those increases. Deductibles for in-network care also are increasing for many CHO plans but will remain far lower than out-of-network deductibles. They will range from $1,200 to $7,150 in 2017, compared with $750 to $6,850 in 2016.

The dramatic increase in out-of-network deductibles is intended to tamp down an ongoing problem of too many CHO policyholders seeking medical services outside of Maine, said Kevin Lewis, the co-op’s chief executive. Such services are more expensive for CHO, which has been operating at a net loss since 2015.

“We’ve gone to great lengths to provide a solid and respectable array of in-network providers,” Lewis said. “This encourages people to stay in the network.”

Insurance companies sign contracts with a wide range of medical care providers, under which the providers agree to charge contractually agreed-upon rates for their services. Those providers are considered “in network.” All others are “out of network” and do not have to charge specific rates, so their fees are usually higher.

Lewis said CHO’s network is extensive in Maine, covering nearly all medical providers. Still, he said it appears that some CHO policyholders have moved out of state and are receiving the more expensive out-of-network treatment on an ongoing basis. He said those policyholders should switch to another insurer in their new state.

“It makes sense to have a different carrier” under those circumstances, said Lewis, who did not provide specific data on out-of-network costs.

But Emily Brostek, executive director of the Augusta-based nonprofit Consumers for Affordable Health Care, said the out-of-network deductible increase may make CHO a less appealing choice for part-year residents, seasonal workers and college students who split their time between Maine and elsewhere.

“We have seen a lot of people gravitate toward (CHO’s) products because they did spend a large part of the year outside the state,” Brostek said. “If they get a Community Health Options plan (for 2017), then they might not have access to a primary care provider during the times of the year that they’re not in Maine.”

SERIES OF COST-SAVING MEASURES

CHO is one of about two dozen insurance cooperatives to start under ACA, the federal health insurance law. They were intended to take a slice of the insurance markets created by the act and provide competition to for-profit insurers. About half those cooperatives had folded by the end of 2015, and CHO was the only cooperative in the nation to make money during 2014, its first year of operation.

It has been a popular choice for Mainers looking for health insurance. CHO signed up about 40,000 policyholders in its first year, posted a slight increase in enrollments in 2015, and has about 77,000 policyholders now. About 11,000 of those policyholders are in New Hampshire, where CHO plans to discontinue coverage in 2017 and move customers to other providers.

Lewis has said CHO’s customers accessed significantly more health care in 2015 than during the cooperative’s first year, driving up costs. As with most U.S. insurers, soaring drug costs contributed to the increased claims that the co-op handled.

In 2015, CHO reported a $31 million loss and was forced to set aside an additional $43 million in reserves to cover potential losses this year.

In addition to deductible and premium increases, CHO has implemented other cost-saving measures for 2017, including the elimination of coverage for elective abortions and adult vision care.

It also is raising its out-of-pocket maximum for all policyholders to $21,450 for out-of-network care in 2017, said Eric Cioppa, Maine’s superintendent of insurance. The maximum currently ranges from $8,250 to $19,000, depending on the plan, he said.

State-approved rate increases for the coming year average in the double digits for all carriers’ individual health plans and about half of all small-group plans in Maine, according to the Bureau of Insurance. Maine’s health insurance rates already rank among the highest in the nation, in part because of the state’s relatively sparse population and high percentage of elderly residents. They also are affected by national trends, including rising prescription prices and treatment costs.

CONSUMER ALERT: POLICIES CHANGING

All three of Maine’s remaining ACA marketplace insurance providers – CHO, Anthem and Harvard Pilgrim Health Care – are raising premiums and making changes to their various individual and small-group insurance plans for 2017, the bureau has said. It has recommended that consumers shop around for the best deals when ACA enrollment for 2017 opens Tuesday.

But the issue of skyrocketing out-of-network deductibles is specific to CHO, because Maine’s other individual insurance providers – with the exception of Anthem in parts of northern Maine – don’t offer coverage for out-of-network care, the bureau said.

While CHO’s network in Maine is extensive, insurance policyholders occasionally may find that a specialist or hospital worker involved in their care requires an out-of-network fee. Still, Cioppa suggested that the massive deductible increases probably will have little effect on the typical CHO policyholder, because most patients tend to stay in network.

“Our empirical analysis of the claims database, and other analyses by the American Academy of Actuaries, indicate that relatively little utilization actually occurs out of network in terms of total dollars,” he said.

Brostek, the consumer advocate, said insurance plans are so complex that many policyholders might not notice significant changes such as big increases in their out-of-network deductibles until it’s too late. She recommended that Maine consumers with questions about which 2017 plan is best for them take advantage of free help that’s available by visiting enroll207.com or calling Consumers for Affordable Health Care’s hotline at (800) 965-7476.

“People really need to be conscious of these other changes that are happening in plans,” Brostek said. “It’s not like you can change midyear if you find out the plan isn’t what you thought it was.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.