The holy grail for lowering electric rates in Maine is to increase winter supplies of natural gas, the fuel used to generate half the region’s power. For years, proponents sought to do it with new and expanded pipelines.

That effort isn’t dead, but most major pipeline proposals are stagnating or have been defeated by environmental and community opposition. Now there’s a alternative solution: Build a big tank in Maine, along existing pipelines in either Rumford or Brewer. Store natural gas in its liquid form during the summer, when prices are low. Draw it off on cold winter days, when prices are high.

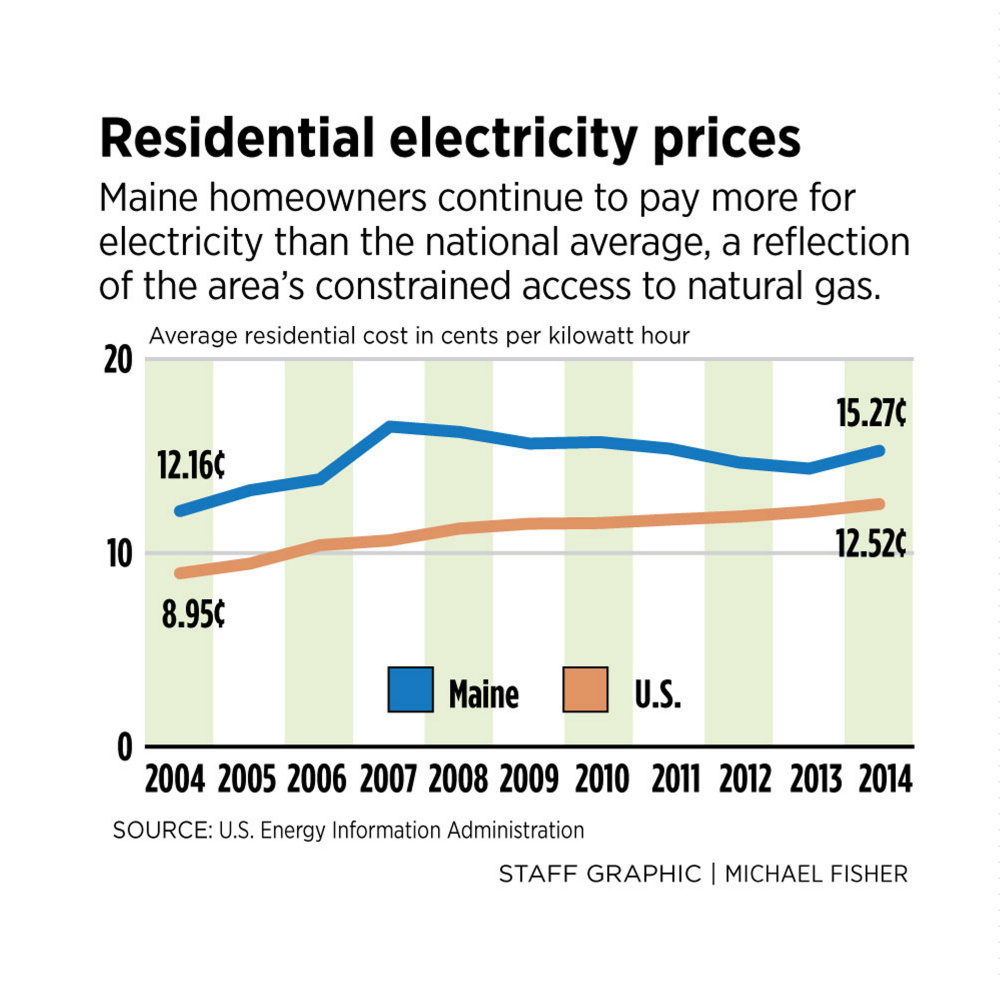

This storage tank could cost $250 million, so the developer is asking the Maine Public Utilities Commission to make electric and gas customers help pay for it over 20 years. Industry officials say LNG storage has a good safety record, and the promise is that if Mainers chip in $25 million annually to contract for storage, a cap set by the Legislature, they’ll save even more on their electric bills. Maine homeowners typically pay between 20 and 24 percent more for electricity than the national average.

But this big tank isn’t the only idea for the PUC to consider.

One company is telling regulators that it’s cheaper to store gas in existing tanks in New Brunswick, Canada, and send it to New England when needed via a pipeline that runs through Maine.

Another company says it’s better to store gas in small, mobile tanks during the winter, close to factories and other big power users.

Other companies are weighing in with their proposals. Some have been so heavily redacted for confidentiality reasons that it’s impossible, so far, for the public to determine what they want to build and where.

Would any of these plans increase gas supply by meaningful amounts?

Would ratepayers really save money and how much?

Will local opposition form to hosting an LNG storage tank?

These are among the issues the PUC is trying to decide, in the latest effort to bring down Maine’s power rates.

A consultant for the PUC will present its opinion Wednesday. Following public hearings and other procedures, the commission will decide the case in April.

Meanwhile, environmental lawyers participating in the case are expressing doubt that any new gas storage is needed. They have been instrumental in killing pipeline expansion projects elsewhere. To fight climate change, they want New England to run on greater amounts of renewable energy, and less on natural gas.

Even so, the notion that Maine can store its way out of higher electric bills is getting a full examination.

“Whether something happens or not with pipelines, storage is interesting,” said James Cote, a spokesman for Maine Energy Storage, the tank project developer. “We can build out at least some of that capacity.”

Maine Energy Storage is a partnership between a Boston-based company that helped develop a gas-fired power plant in Rumford and a Japanese firm that builds gas storage around the world. Their proposal supplements an ongoing case at the PUC in which lawmakers asked the agency to see if Maine electric customers could benefit by underwriting capacity on new gas pipelines.

Recent legal action and opposition in other states have dampened hopes for a pipeline solution. That has focused more attention on a bill passed during the last legislative session asking the PUC to examine the merits of LNG storage.

A POSSIBLE HEDGE

Because natural gas has become such a dominant fuel, its wholesale price at different times of the day and year sets the pace for electric rates. New England lacks enough pipeline capacity on the coldest days, so gas prices surge when demand for heat and power is high. Maine Energy Storage says that having gas stored at those peak times can act as a hedge against price spikes.

The company’s tank would be similar in size to the oil tanks in Portland Harbor, Cote said. It would hold up to 1.3 billion cubic feet of liquid gas, enough to last 10 consecutive days, based on projected demand. When needed, it would be vaporized and delivered to customers, through the existing pipeline system and by trucks. The target operation date is 2021.

The project also could bring some welcome economic development to rural Maine. The host community would receive the benefits tied to the $250 million investment, plus up to 20 full-time jobs. Roughly 200 workers would be needed to build the facility, Cote said.

A key question for regulators is whether 1.3 billion cubic feet of gas in storage is enough to influence prices, in a market that burns several times that much on one cold winter day.

Maine Energy Storage estimates the project will save Maine customers between $9.9 million and $40.6 million a year, compared to new pipeline proposals, and up to $2.1 million if no new lines are built.

Cote said the project won’t be built unless customers help finance it.

“If ratepayers don’t have some sort of skin in the game, I think we’re unlikely to attract capital investment,” he said.

STORAGE ALTERNATIVES

But skeptics of the plan point out that Maine is being asked to bear 100 percent of the subsidy for a project that could benefit all of New England, even though the state uses only a tenth of the region’s power. A “go-it-alone” approach for Maine already has been rejected by the PUC in the pipeline case.

The storage idea seems to suffer from the same problem, said Drew Landry, a lawyer who has been representing large industrial customers in the case. Landry’s firm recently withdrew from that position to represent a company that’s proposing an alternative storage facility. But Landry said he personally questions how Maine Energy’s tank is big enough to result in the savings the company is projecting.

“In the best-case scenario, the savings would be modest,” he said. “I’m willing to be wrong on this, if someone can demonstrate there is more substantial savings than we understand at this time.”

The size of Maine Energy’s proposal also is being questioned by a competitor, Repsol Energy North America Corp. It operates the Canaport LNG terminal at Saint John, New Brunswick, which receives shipments from overseas.

The Canaport terminal can store 10 times as much gas as Maine Energy Storage, Repsol says, and deliver it in larger volumes. It would be more economical, Repsol says, to use an existing facility that doesn’t require costly new construction.

Another competitor, Prometheus Energy, is offering a less-expensive, interim solution that involves trailer-mounted LNG storage tanks located where they’re needed in the winter for gas utilities and industrial large power users. The company is using this approach to successfully meet peak demand in other states.

SECURITY ISSUES

Any new LNG storage in Maine is bound to raise safety issues.

LNG is produced by cooling natural gas at atmospheric pressure to minus 260 degrees. If exposed to air, it vaporizes back to a gas.

The industry has a good safety record, according to the Department of Energy. But accidents do happens. A 2014 explosion and fire at an LNG facility in Plymouth, Washington, caused injuries and millions of dollars in damage.

Maine Energy Storage says it will have redundant layers of protection to meet or exceed industry standards. Both sites in Rumford and Brewer are in industrial zones, far from most homes. Cote said it’s too early to seek public input, until the PUC acts and a location is chosen.

Storage also is likely to get pushback from the Conservation Law Foundation. The group hasn’t taken a position yet in the case, but in general, says existing pipelines and storage are sufficient to meet peak demand.

“We don’t think that a need for additional infrastructure has been demonstrated,” said Emily Green, a staff attorney.

Green also said that with the drop in wholesale gas prices, there’s no reason consumers should be saddled with paying for new gas projects.

But Landry, who has long represented industrial customers, said last year’s mild winter and the current lower gas prices have created a false sense of security.

“A lot of the urgency was lost last winter,” Landry said. “If we have a cold winter and we see prices spike again, you could see more urgency in New England to find a solution.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.