Employees of most Maine companies have seen their health insurance premiums and deductibles continue to rise in recent years, but that’s not the case for workers at two midsize manufacturing businesses in Guilford.

Hardwood Products Co. LLC and Puritan Medical Products Co. LLC, sister companies that produce wooden sticks for consumer and medical uses, aren’t subject to the same market forces as most businesses their size when it comes to employee health insurance. That’s because the companies self-insure their roughly 475 workers rather than relying on a third-party insurance provider.

“We’ve been able to keep our employees’ premiums at the same level and lower their deductibles over the last couple years,” said Scott Wellman, chief financial officer at Hardwood Products and Puritan Medical.

Self-insurance, in which a company underwrites its workers’ health insurance policies and pays claims directly to medical providers as they occur, isn’t a new concept. Most large companies have been self-insuring their workers for decades.

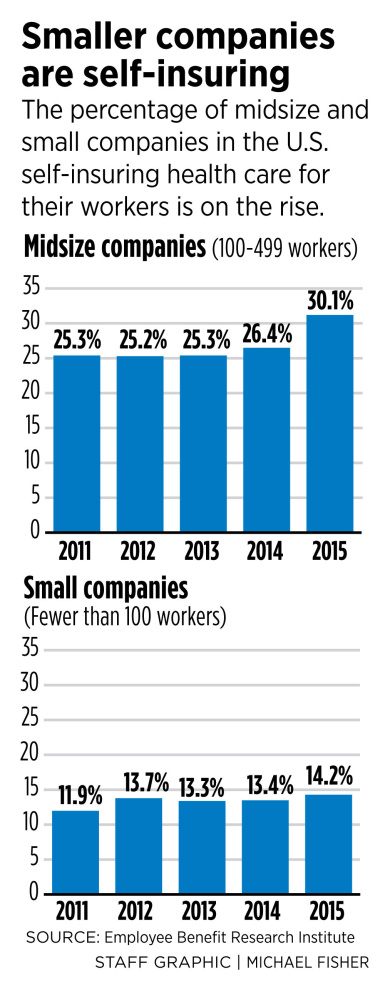

However, self-insurance has become more popular nationally among midsize companies and even some small businesses since the passage of the Affordable Care Act in 2010, according to the most recent data available.

The share of self-insured midsize companies, those with 100 to 499 employees, increased from 25.3 percent of all midsize companies in 2011 to 30.1 percent in 2015, according to the Washington, D.C.-based Employee Benefit Research Institute. The share of self-insured small businesses, those with fewer than 100 workers, increased from 11.9 percent to 14.2 percent during the same five-year period, the institute found. Maine-specific figures were not available.

ACA HELPS DRIVE SELF-INSURANCE

The biggest jump in self-insured midsize companies occurred from 2014 to 2015, the year the ACA’s employer mandate took effect for all businesses with at least 100 employees. The mandate does not apply to businesses with fewer than 50 employees, and it did not take effect until 2016 for businesses with 50 to 99 employees.

The ACA “absolutely” has influenced many midsize businesses to self-insure, said Dan O’Halloran, an employee benefits consultant based in Yarmouth. He said companies that self-insure can reduce the overall cost of their employee health benefits by at least 5 percent just by avoiding ACA-related taxes and fees.

Self-insurance is not the right fit for every business, O’Halloran said. It involves a certain amount of financial risk and requires employers to be more involved in the day-to-day health of their workforce. Still, he said the advantages are significant.

O’Halloran said his company, The O’Halloran Group, works with about 400 self-insured companies nationwide, including eight in Maine. Among those companies, most saw only a slight increase in the cost of their employee health benefits this year, he said.

“The largest increase was less than 3 percent, and we have some where the cost has actually gone down,” O’Halloran said.

Two factors are driving the increase in self-insured businesses: rising health care costs and insurance market instability, said Mike Ferguson, president and CEO of the South Carolina-based Self-Insurance Institute of America.

“By setting up your own plan, you sort of park yourself in a safe harbor,” he said.

POOLING USED TO EASE HIGH COSTS

Average annual increases in employee health care costs have decreased slightly since the ACA’s passage, according to a study by the New York-based Commonwealth Fund. On average, employer health insurance premiums nationwide for single policies grew by an average of 4.7 percent per year during the five years leading up to the ACA’s passage, and by 3.8 percent per year during the five years that followed it, the study found. However, the controversial health care law and ongoing efforts to repeal it have created a great deal of employer anxiety about the stability of the insurance market.

Overall, most employers’ reactions to the law have been negative, and it has prompted many businesses to seek alternatives, self-insurance industry representatives said.

“They’re asking for help and saying, ‘Is there anything else we can do?’ ” O’Halloran said.

His firm works with Philadelphia-based Pareto Captive Services LLC, which helps make self-insurance more affordable for smaller businesses by pooling them together in large employee-benefit groups called captives. Being part of a captive helps reduce the impact of unexpectedly high medical costs.

St. Albans-based nonprofit Skills Inc. joined the captive in July 2015, according to its executive director, Stephanie Johnson. Since then, the nonprofit has seen its health care costs go down, she said.

The savings have made it possible to do things for the roughly 135 employees enrolled in Skills Inc.’s health insurance program, such as offering them individual health savings account plans at no cost to the employees, Johnson said.

“It’s been one of the best decisions we’ve made,” she said.

TAILORING HEALTH BENEFITS TO NEEDS

Skills Inc., which provides support services to adults with mental disabilities, opted to self-insure as a way to save money, Johnson said. But there have been other advantages, such as the ability to tailor health benefits to the specific needs of its workers, she said.

For example, a number of Skills Inc. employees suffer from diabetes, so the nonprofit adjusted its benefits plan to cover 100 percent of the costs of their supplies and medication, Johnson said.

“The plan that we offer to our employees is completely customizable,” she said.

Most self-insured businesses use a third-party administrator such as Gray-based Patient Advocates to manage their health plans, pay claims and oversee employee wellness programs.

Patient Advocates President James Ward said another benefit of self-insured plans is that there are fewer restrictions on where employees can go to get medical treatment. For example, if a surgical procedure can be done less expensively in another state, there is no financial penalty for going there. That’s not the way it works with most major health insurance plans, he said.

Ward said many of the clients his company works with in Maine have sent employees to the Boston area for major medical procedures because the hospitals there are priced more competitively.

“We’ve got clients who’ve literally seen their costs go from $1.1 million down to $500,000,” he said. “And the care is top-notch.”

According to 2016 data from the Kaiser Family Foundation’s annual survey of employer-offered insurance, the average annual premium was $6,435 for single coverage and $18,142 for family coverage. On average, employees contributed 18 percent of the premium for single coverage and 30 percent for family coverage.

DRAWBACKS: RISKS, RESPONSIBILITY

If being self-insured has so many benefits, then why doesn’t every company do it?

The No. 1 answer is risk.

With third-party insurance, the annual cost of employee health benefits is negotiated up front. That’s not how it works for a self-insured business.

Self-insured companies pay the actual medical claims incurred by their workers as they arise. So if the staff has a particularly bad health year filled with unusually expensive claims, the employer’s costs go up for that year. The risk is particularly high for smaller businesses that don’t have the cash flow to cover unexpected costs, O’Halloran said.

“The volatility scares some of the midsize businesses away from doing it,” he said.

One company with a large Maine presence sees opportunity in helping self-insured businesses offset that risk. Unum Group, an insurance provider based in Tennessee with about 3,000 employees at its Maine headquarters, recently began selling a type of insurance that protects self-insured businesses from having to pay extremely high employee medical claims.

Unum President and CEO Mike Simonds said nationwide sales of the insurance product, known as stop-loss insurance, have been increasing rapidly.

“It has been growing at about a 15 percent clip for the past three or four years,” he said.

But stop-loss insurance only covers claims over a certain dollar amount, and there are still other risks for self-insured employers, said Ferguson, the self-insurance industry group president. One of them is legal liability, he said.

Every self-insured business must have designated personnel who are responsible for making sure health care benefits are administered properly. If a dispute arises over what the plan covers, and an employee believes that a medical claim has been unfairly denied, that employee may sue the employer over the loss.

“Companies sometimes would rather not have that responsibility,” Ferguson said.

SELF-INSURANCE NOT FOR EVERYONE

Johnson noted there is no guarantee that a self-insured organization will save money. She said Skills Inc. had an experience with a previous self-insurance plan that did not turn out as well as the current one. Choosing the right plan administrator makes a big difference, she said.

Companies that self-insure take on a greater responsibility overall in managing their employees’ health benefits, so it’s not a good option for businesses that don’t want that level of involvement, Ferguson said. But those companies that take up the challenge are finding that it lowers their costs and improves the overall health of their workforce, he said.

“What we’re seeing is a gradual trend toward self-insurance,” he said. “It’s not a stampede.”

J. Craig Anderson can be contacted at 791-6390 or at:

Twitter: jcraiganderson

This story was updated at 11:45 a.m. on Aug. 8 to correct the spelling and title of Unum President and CEO Mike Simonds.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.