WASHINGTON — U.S. consumers slowed their borrowing in August to an annual increase of 4.2 percent – a pullback from a pace of roughly 7 percent over each of the past three years.

The Federal Reserve said Friday that overall consumer credit rose $13.1 billion in August, down from the $17.7 billion increase in July.

Economists and financial markets monitor the consumer borrowing report for insights about consumer spending, a category that represents about 70 percent of U.S. economic activity. Consumer spending barely edged up in August in a sign that some Americans remain cautious despite a relatively solid job market.

Others signs suggest that consumers are being careful with the additional debt they’re taking on. A measure of delinquencies tracked by the American Bankers Association remained below its historic 15-year average, the trade association said Thursday.

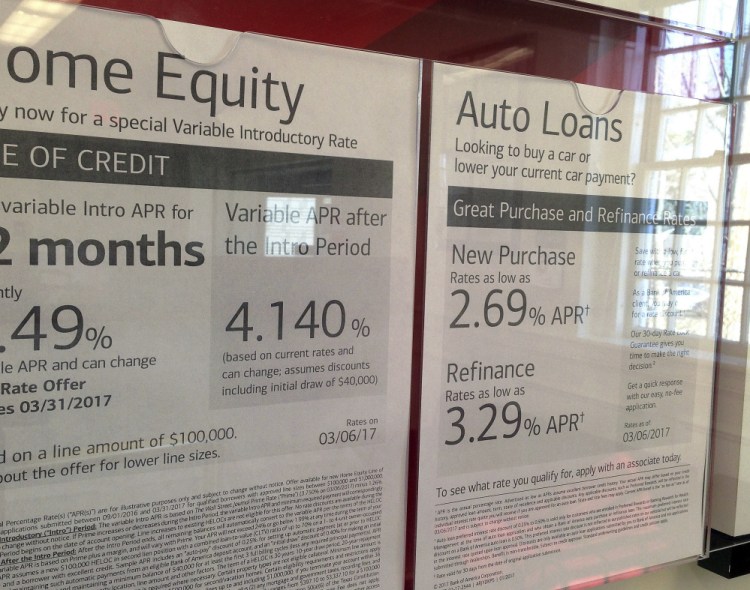

Non-revolving credit, which includes auto and student loans, increased $7.3 billion. The revolving credit category, which includes credit cards, increased $5.8 billion.

The August increase brought consumer credit to a total of $3.77 trillion. The Fed’s monthly credit report does not include mortgages or other debt secured by real estate, including home-equity loans.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.