WASHINGTON – Federal Reserve Chairman Ben Bernanke said Thursday that Congress could do more to help the U.S. economy this year but instead has focused on reducing the federal deficit.

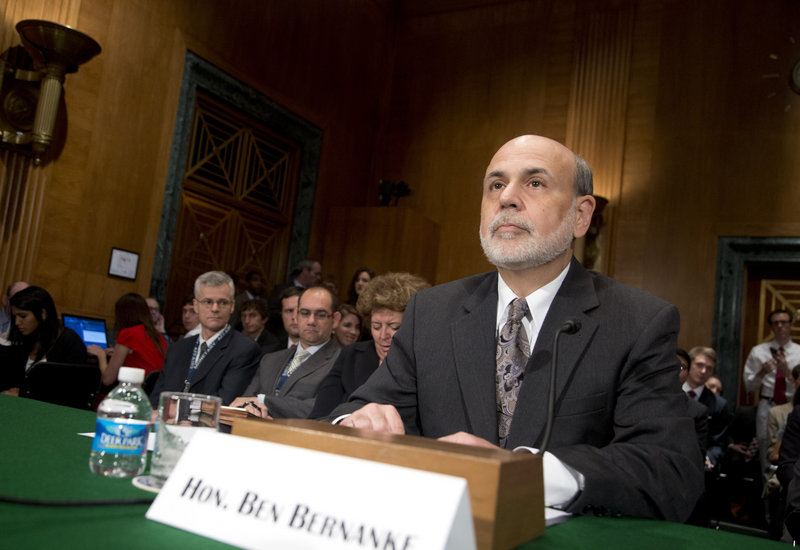

During his second appearance before lawmakers this week, Bernanke told the Senate Banking Committee that the Fed’s low interest rate policies have carried “an awful lot of the burden” to drive economic growth. Fed officials would have been very happy to “share that burden” with Congress, he said.

The Fed chairman made the comments only after Sen. Bob Corker, R-Tenn., prodded him to evaluate Congress’ role in supporting the economy after the recession.

Bernanke said lawmakers have spent too much energy on implementing tax increases and spending cuts when the economy was growing only modestly. Those actions could end up reducing economic growth by 1.5 percentage points this year, he has said.

But Bernanke said it was not the Fed’s role to threaten to raise interest rates or take other actions if Congress did not follow more appropriate policies.

“I don’t think it’s my place or the Federal Reserve’s place to try to force Congress to come to any particular outcome,” Bernanke said.

Corker said Congress has grown too dependent on the Fed’s efforts to drive growth, instead of taking action to help. Sen. Tom Coburn, R-Okla., was even blunter.

“We have let you down,” he told Bernanke. “The kindergarten of Congress has let you down by not doing the things to create confidence in the business community.”

Most of Bernanke’s comments about Fed policy were in line with testimony he gave Wednesday to the House Financial Services Committee. Bernanke said the Fed’s efforts to boost the economy remained tied to the job market’s health and inflation.

There is no “preset course” for the Fed’s $85 billion-a-month bond-buying program, he said. Any change will depend on the economy’s performance.

He also said the Fed could hold its benchmark short-term interest rate near zero even after unemployment falls below 6.5 percent. One reason the Fed might consider keeping the rate near zero longer is if inflation fails to move closer to the Fed’s 2 percent target rate.

The Fed’s low interest rate policies have spurred a stock market rally and encouraged more borrowing and spending.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.