WASHINGTON – The Federal Reserve said Thursday it will expand its holdings of long-term securities through open-ended purchases of $40 billion of mortgage debt a month, its third round of quantitative easing as it seeks to boost growth and reduce unemployment.

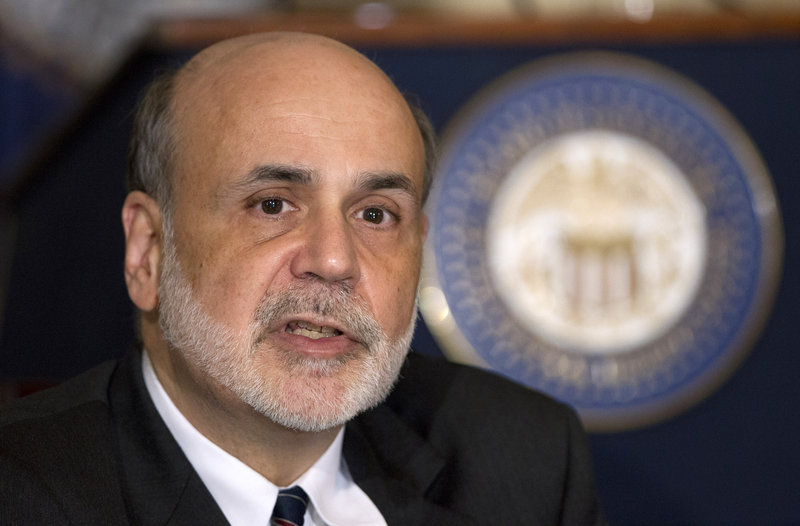

“We’re looking for ongoing, sustained improvement in the labor market,” Chairman Ben Bernanke said at his news conference Thursday in Washington after the conclusion of a two-day meeting of the Federal Open Market Committee. “There’s not a specific number we have in mind. What we’ve seen in the last six months isn’t it.”

Stocks jumped, sending benchmark indexes to the highest levels since 2007, as the Fed said it will continue buying assets, undertake additional purchases and employ other policy tools as appropriate “if the outlook for the labor market does not improve substantially.”

Bernanke is enlarging his supply of unconventional tools to attack unemployment that has been stuck above 8 percent since February 2009, a situation he called a “grave concern.” The decision immediately provoked a renewed backlash from Republicans, including Sen. Bob Corker of Tennessee, who said Bernanke’s policies damage the Fed’s credibility while doing little to spur the economy.

The open market committee also said it would probably hold the federal funds rate near zero “at least through mid-2015.” Since January, the Fed had said the rate was likely to stay low at least through late 2014. The Fed said “a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.”

The Standard & Poor’s 500 Index jumped 1.6 percent to 1,459.99 at the close of trading in New York. The yield on the 10-year Treasury note rose to 1.74 percent from as low as 1.71 percent.

“This is definitely a significant shift in (committee) policy,” said Julia Coronado, chief economist for North America at BNP Paribas in New York and a former Fed economist. “This is a very aggressive commitment to success on its mandates.”

Bernanke said the open-ended purchases would continue until the labor market improved significantly.

The central bank also released its economic forecasts for growth, inflation, unemployment and interest rates over the next three years. Twelve of the Fed’s 19 policy makers said interest rates should rise for the first time in 2015.

The Fed now expects the job-market outlook to improve more swiftly by 2014, with unemployment forecast to fall to 6.7 percent to 7.3 percent, compared with 7 percent to 7.7 percent in their June projections. In 2015, unemployment is forecast at 6 percent to 6.8 percent.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.