WASHINGTON – Carl Calhoun makes mattresses for a living, but lately he’s been enduring more than his share of sleepless nights.

As the president and CEO of the Body Rest Mattress Co. in St. Petersburg, Fla., Calhoun and his wife, Emma, are struggling to keep their 28-year-old company from becoming another casualty of the Great Recession.

They’ve laid off half their employees. They’ve cut the hours and benefits of those who remained. They’ve even tapped their home equity to pump more money into the business.

Yet without a six-digit bank loan to see them through, the Calhouns and their 31 employees face a very uncertain future.

“We know what we’re doing,” Calhoun said. “We just ran out of capital. It’s only through the grace of God that we’re here right now. And I’m not the only one.”

He’s right. Across the country, thousands of small business owners are fighting for survival and hurting for cash after getting the cold shoulder from banks over loan requests.

The Troubled Asset Relief Program poured hundreds of billions of dollars into big banks to help spur business lending during the recession, but the cash infusion hasn’t prevented thousands of companies from closing their doors as banks have tightened their credit standards and purse strings.

The Obama administration is pushing a $30 billion Small Business Lending Fund to address the problem. The proposal, which passed the House of Representatives in June, would provide smaller community banks with government loans that become cheaper as the banks lend more money to small businesses.

Todd McCracken, president of the National Small Business Association, said the plan should help.

“But it’s not a silver bullet,” he said. “There isn’t a silver bullet.”

Credit is essential for small businesses to expand their work forces, purchase equipment and property and cover daily operating costs. For much of the past decade, the nation’s big banks were generous providers.

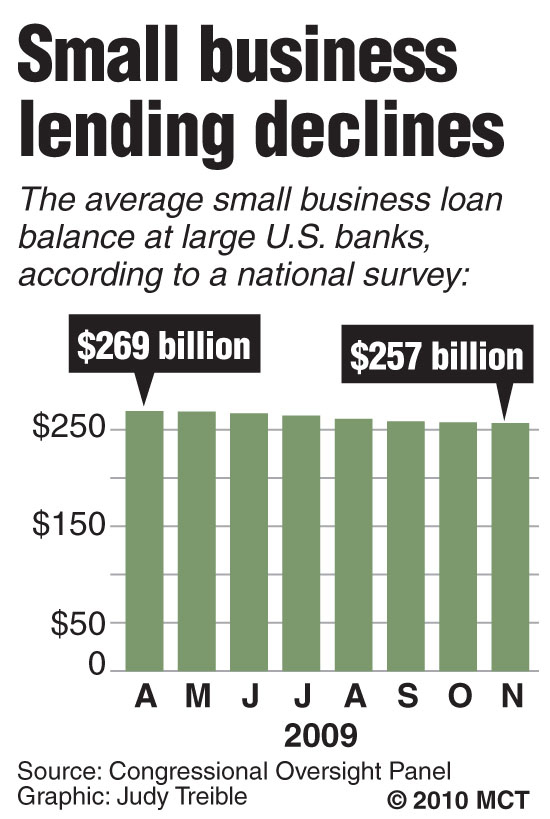

From June 2008 to June 2009, however, the “credit crunch” saw small business loan balances fall 9 percent at banks that have more than $100 billion in assets. But overall lending only fell 4 percent.

In the second quarter of this year, small business loans fell to less than $670 billion from more than $710 billion in the second quarter of 2008.

That’s bad news not only for business owners such as the Calhouns, but also for the economy. Small businesses — generally described as those that have 500 or fewer employees — account for half the nation’s private-sector employers and have created a majority of the new jobs since the mid-1990s.

AS SMALL BUSINESSES GO …

If the economic recovery is going to take off, most agree that small business hiring will provide the lift. Without credit for small businesses, however, that recovery appears grounded indefinitely.

Adam Lapsevich, the president of Digital Design Video Productions in Chagrin Falls, Ohio, wants to hire a video editor, two salespeople, a social media specialist and a comptroller/project manager, but he needs a $100,000 loan to make it happen, and the banks aren’t biting.

“We’ve got talented people here in northeast Ohio who are looking for jobs. I’m talking $100,000, not a quarter of a million,” Lapsevich lamented. “It’s not like I’m selling hot dogs at a gas station. We’ve got a very hot product.”

Digital Design creates online video-marketing campaigns for businesses. Eight months ago, at the height of the recession, Lapsevich was considering bankruptcy because business was down and the interest rates on the company’s credit cards had reached 20 percent after several late payments. The company is now ready to expand, but banks may be holding Digital Design’s recent struggles against it.

“I’ve weathered the storm, and things are picking up, but in order for things to pick up a little faster, I need to get a couple of salespeople out there,” Lapsevich said.

It’s not uncommon for small companies to have cash-flow and credit problems, because they typically use their credit to exploit opportunities, said McCracken of the small business group. With stricter lending standards, however, a maxed-out credit line or a few late payments can make a small business appear to be a bad loan risk.

“All these external forces have combined to make some businesses look worse than they really are, and we have to make sure that this whole situation doesn’t cause these otherwise successful businesspeople to fail. And it could,” McCracken said.

Carl Calhoun, 61, left a career in banking to purchase his mattress company in 1982. Emma Calhoun, the company’s vice president and chief financial officer, gave up a teaching career to help him run the business.

When he approached his bank of more than 20 years seeking a loan of $250,000 to $300,000, Calhoun said, he was told to put up some of his own money in order to increase sales. So he borrowed against his home equity, hired more salespeople and expanded his sales territory from the West Coast to the East Coast.

The plan worked, he said. Sales increased 30 percent. His customer base of hotels, universities, medical facilities and retail outlets increased 20 percent.

‘THEY DIDN’T KNOW OUR BUSINESS’

To maintain the new accounts, however, he needed the loan to pay his beefed-up sales staff and his suppliers. After waiting two months for a decision, Calhoun said, he was told that the local branch wouldn’t decide on his request; corporate bank officials from out of state would make the call.

“They didn’t know anything about our business,” Calhoun said. “The local people knew us. They’d been dealing with us for over 20 years.”

As more months went by without a decision, Calhoun lacked the cash to buy raw materials, which made it hard to fill orders.

In the absence of loan money, the Calhouns have used management skills and business savvy to maintain sales and keep their dream alive — stepping up sales to assisted living facilities, jails and cruise ships. They’re promoting a new line of nonallergenic, eco-friendly “green” mattresses.

But their bottom line still depends on one thing — the ability to borrow working capital.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.