CHICAGO – Robert Rhea logged on to his iPad in Cape Cod, Mass., one day in August to turn off the air conditioning in his Dallas home ahead of cooler Texas weather.

Rhea, who was attending a wedding and tracked his daily power usage on an iPhone app supplied by TXU Energy, estimates the remote tweaking saved him $175 on his electricity bill that month. He controls his home temperature through a wireless thermostat TXU gave him in exchange for allowing the utility to shut off his air conditioning during periods of high demand.

The 57-year-old owner of a tile refinishing business is among a new breed of conservationists that analysts say is curtailing sales of electricity and driving an unprecedented shift in the $374 billion U.S. power industry. After homes and businesses stocked up on energy-saving gadgets and appliances, power use per unit of economic growth fell to a record in 2011, according to the Energy Department.

“There is a quiet revolution in energy efficiency going on in our country,” said Howard Learner, executive director of the Environmental Law and Policy Center, Chicago-based advocates of clean energy.

The U.S. is a proving ground for nations such as Japan, Britain, Germany and Canada that also have started offering more efficient appliances to consumers and testing “smart” technology that powers down homes when prices surge.

The result: demand for electricity is shrinking even as economies grow, an effect that’s starting to erode sales and profit at utilities from New England to Oregon. They include OGE Energy Corp. and Teco Energy Inc., both of which have under-performed the 10 percent gain this year in the Russell 1000 Utilities index.

Electricity use in the U.S. declined 2 percent this year through Sept. 22, and was down 3 percent from a year earlier as consumers buy light bulbs that burn 25 percent fewer watts and install technology that turns off appliances when the delivery grid is strained. The industry produced $374 billion in revenue in 2011, the Edison Electric Institute said.

Power and coal consumption dropped last year to 2,790 British thermal units per real dollar of U.S. gross domestic product, a 32 percent drop from 1981 levels and a record low for data collected since 1973, the Energy Department said on its website.

Learner credits a 20-year push by the federal government to promote energy-saving appliances. Consumers bought 280 million such products in 2011, cutting their utility bills by $23 billion, the Environmental Protection Agency said on its website.

FirstEnergy Corp. Chief Executive Officer Anthony Alexander said the Midwestern markets where his power company operates have lost “about five years of growth” and that margins were being squeezed by poor demand and an oversupply of electricity generation.

“We would have thought that by now we would have seen a far more robust growth in the industrial, commercial and residential sectors than we’re seeing,” Alexander said at a Sept. 5 investor conference. “In fact, we are seeing flat to negative residential, flat to very sluggish commercial and spotty industrial.”

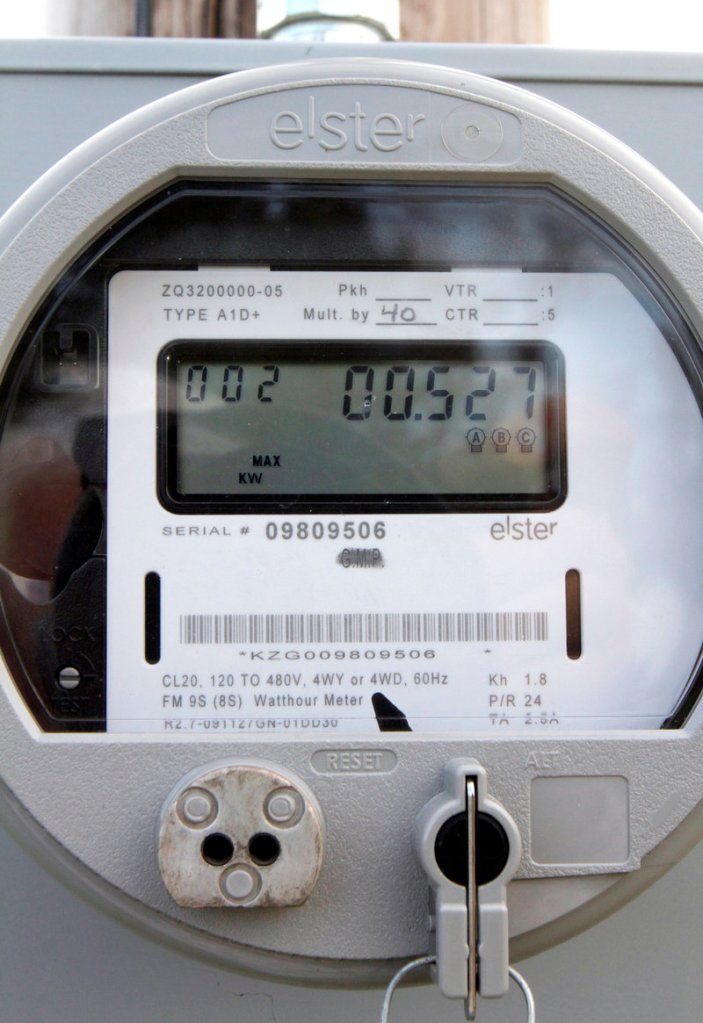

Utilities are expected to invest $12.4 billion in smart meters and updated electricity grids through 2015, amplifying the trend, Theodore Hesser, an analyst for Bloomberg New Energy Finance, said in a telephone interview.

U.S. demand for power is expected to grow by about 1.1 percent through 2030, well below the 1.7 percent annual growth rate that the industry saw from 1990 through 2011, consulting firm Wood Mackenzie said in a July 2012 report.

Angie Storozynski, a New York City-based analyst for Macquarie Capital USA Inc., predicted long-term load growth will be even lower, about 0.6 percent, in a Sept. 11 note to clients.

“Slow load growth should hurt near-term earnings,” Storozynski wrote. It may drive utilities to seek rate increases more frequently from regulators or postpone spending on power plants and transmission lines, she said.

Northeast Utilities, Scana Corp. and Teco Energy are among utility owners facing stagnant demand, Storozynski said. State incentives that compensate utilities for efficiency gains should help dull the blow for Hawaiian Electric Industries Inc., UIL Holdings Corp., Edison International, PG&E Corp. and Portland General Electric Co.

“A small change in the growth of power demand can completely change a utility business model,” Hesser said in a telephone interview.

Utilities are shifting focus from selling electrons to providing higher-profit services like installing programmable thermostats and retrofitting buildings with windows, insulation and roofing that use less energy, Hesser said. As those efforts boost conservation, “that would further sink demand, and a cycle is born,” he said.

To be sure, the advance of smart meters that allow utilities to track a consumer’s power use in real time could be deterred by privacy concerns or technical glitches such as a rash of house fires that caused Exelon Corp.’s PECO utility to suspend its meter rollout in August.

A surge in the economy might also prompt power use to rebound as it did after declining when the U.S. plunged into recession in 2008 and 2009.

The 4.4 percent uptick in U.S. power consumption in 2010 was followed by a 0.8 percent decline in 2011, the U.S. Department of Energy said in a Sept. 11 report.

“Was the economy worse in 2011 than in 2010? No, it was growing,” Paul Patterson, a New York-based utilities analyst with Glenrock Associates, said in a telephone interview. “Clearly you have conservation and appliance efficiency pushing a lot of this.”

The trend is causing regulators to question the need for building more transmission lines, a source of earnings for power companies since federal regulators allow returns on infrastructure investment that can top 12 percent.

PJM Interconnection, which manages the electric grid in 13 states and the District of Columbia, in recent months asked power companies to cancel a planned $2.1 billion transmission line and freeze another $1.2 billion project after determining the lines were no longer needed to import electricity to Maryland, Delaware and neighboring states.

Lower demand is also helping drive wholesale power prices to near-historical lows in PJM’s territory, the largest competitive U.S. power market, and “could be a very troubling trend” for independent generators that can’t rely on regulated rates, Patterson said.

Among the hardest hit: FirstEnergy and independents such as NRG Energy Inc. and Calpine Corp. that sell electricity in competitive markets. These companies have already been hurt by a plunge in the price of natural gas, which sets the price of electricity in most markets.

FirstEnergy, which owns 10 regulated utilities from Ohio to New Jersey, said in a Sept. 19 statement it would fire 200 workers due to “continued slow customer load growth and an abundance of electric generation supply resulting in lower power prices.”

Oklahoma Gas & Electric, OGE’s utility based in Oklahoma City, is among power companies shifting their business models to emphasize saving as well as selling power.

By encouraging consumers to cut back power-hogging air conditioning during sultry weather when demand is greatest, OG&E hopes to postpone building a new fossil-fuel plant this decade to meet growing demand.

“Power plants are expensive and those costs are ultimately borne by customers,” Brian Alford, a spokesman for the utility, said in a telephone interview. “Our goal is to defer the need for that investment.”

The company has shaved an estimated 64 megawatts off of its total daily summer peak demand through a variable pricing program.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.