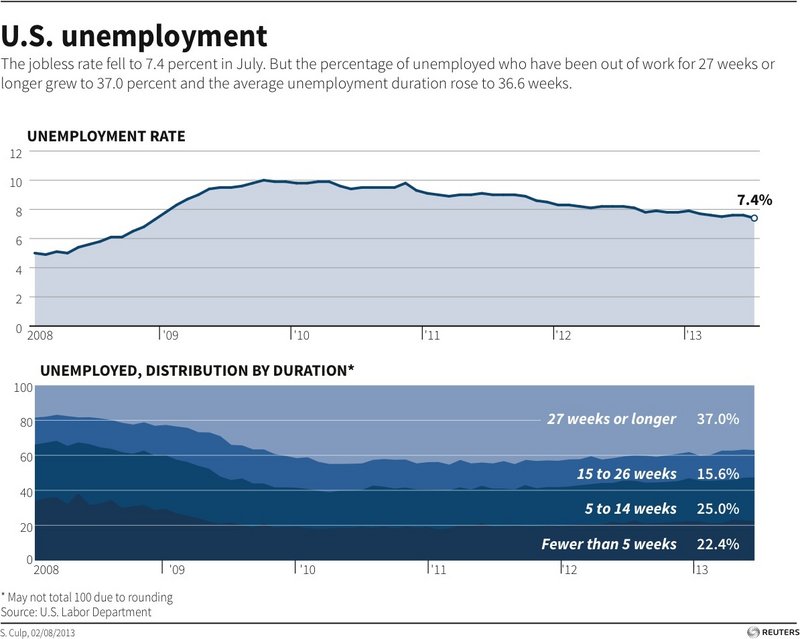

U.S. employers added 162,000 jobs in July, a modest increase and the fewest jobs since March. The gain was still enough to help lower the unemployment rate to a 4½-year low of 7.4 percent, a hopeful sign in an otherwise lackluster report.

The Labor Department said Friday that unemployment declined from 7.6 percent in June as more Americans found jobs and others stopped looking and were no longer counted as jobless.

Still, the government said employers created a combined 26,000 fewer jobs in May and June than previously estimated. Americans worked fewer hours in July, and their average pay dipped. The figures suggest that weak economic growth might be making businesses cautious about hiring.

Maine’s unemployment rate held steady at 6.8 percent in June, the latest month available, after falling in May to the lowest rate since November 2008, according to a Department of Labor report issued in mid-July.

The preliminary, estimated jobless rate was below 7 percent for the third month in a row, after more than four years in which it was at or above 7 percent. In April, Maine’s estimated unemployment rate was 6.9 percent.

Mac McKeever, spokesman for Freeport-based retailer L.L. Bean, said the company is always in hiring mode, but that efforts have been ramped up for the upcoming holiday shopping season.

“Right now, we are in the process of hiring 4,000 to 5,000 seasonal employees for our busy fall and holiday seasons, nearly half of which will be rehires from last year,” McKeever said.

Because L.L. Bean has a reputation as an employee-friendly company, he said, it typically gets an abundance of quality applicants for each of its job postings.

In addition to seasonal sales associates, the company is hiring for positions in its information-technology and marketing departments, as well as for analysts in its finance department, McKeever said.

Employee-benefits provider Unum in Portland also has been hiring, spokeswoman MC Guenther said, particularly in the areas of products and marketing, customer service, information technology and finance.

“We’re seeing a good rate of response to these openings, but it remains a challenge to find good candidates for IT and actuarial positions,” Guenther said.

TD Bank also is seeking to fill about 75 positions in Maine, a spokeswoman for the Portland- and New Jersey-based bank said.

The bank also plans to hire about 16 customer service and sales representatives each month between now and December to staff its call center in Auburn, spokeswoman Lauren Moyer said.

“While the market for talent is becoming very competitive, TD Bank has a great story as a Top 10 U.S. bank, and our strong brand awareness has meant that we have not seen a decline in applications for open positions,” Moyer said.

The U.S. Department of Labor’s Bureau of Labor Statistics estimated that 48,500 job seekers in Maine were unemployed in June, a decrease of 3,300 from June 2012, when the state’s jobless rate was 7.3 percent.

June’s estimate of 601,000 nonfarm payroll jobs in Maine was up 1,300 from the revised May estimate.

The job growth occurred primarily in the hospitality, professional services, health care and education sectors. Other sectors generally have stabilized since the nation’s economic downturn.

Nationally, job growth remains solid for the year. The economy has created an average 200,000 jobs a month since January. But the pace has slowed in the past three months to 175,000.

The Federal Reserve will review the July employment data in September to decide whether to slow its $85 billion a month in bond purchases, as many economists have predicted it will do.

Weaker hiring could make the Fed hold off on pulling back on any bond buying, which has helped keep long-term borrowing costs down. Yet it’s possible that the lower unemployment rate, along with the steady job gains the past year, will convince the Fed that the job market is strengthening consistently.

“While July itself was a bit disappointing, the Fed will be looking at the cumulative improvement,” said Paul Ashworth, chief U.S. economist at Capital Economics. “On that score, the unemployment rate has fallen from 8.1 percent last August, to 7.4 percent this July, which is a significant improvement.”

But Beth Ann Bovino, senior economist at Standard & Poor’s, said she thinks Friday’s job report will make the Fed delay any slowing in its bond purchases.

“September seems very unlikely now,” she says. “I’m wondering if December is still in the cards.”

The government’s revised totals show that May’s job growth was downgraded to 176,000, below the 195,000 previously estimated. June’s was lowered to 188,000, from the 195,000 reported last month.

The job gains in July were mostly in lower-paying industries, such as retail, hotels and restaurants. But manufacturing added 6,000 jobs, driven by strong gains at auto plants. Those were the first job gains at U.S. factories since February. Professional services such as finance, accounting and information technology also increased.

Governments added jobs for the first time since April, driven by the fifth straight month of local government hiring.

Recent data suggest that the economy could strengthen in the second half of the year.

A survey Thursday showed that factories increased production and received a surge of new orders in July, propelling the fastest expansion in more than two years.

The survey, by the Institute for Supply Management, also showed that the housing recovery is spurring more output by lumber companies, furniture makers and appliance manufacturers.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.