WASHINGTON — The job market is showing signs of the consistent gains the nation has awaited in the 4 1/2 years since the Great Recession.

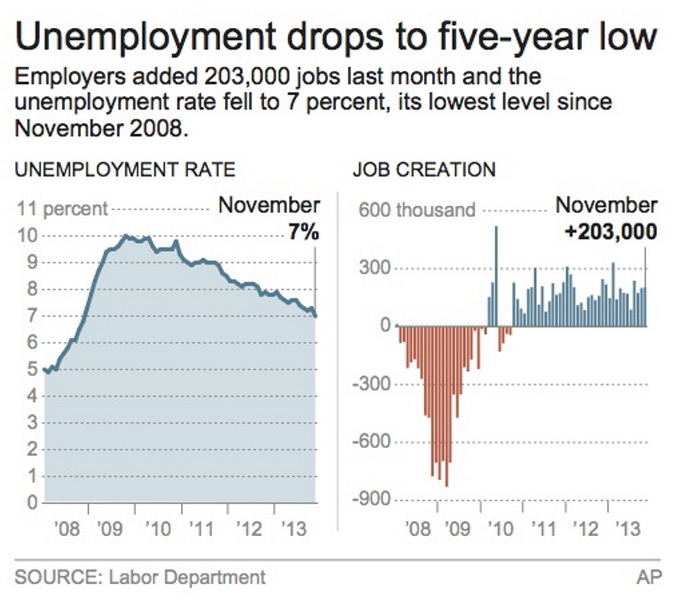

Employers added 203,000 jobs in November, and the unemployment rate fell to 7 percent, a five-year low, the Labor Department reported Friday. Four straight months of robust hiring have raised hopes that 2014 will be the year the economy returns to normal.

In Maine, the unemployement rate stood at 6.7 percent in October, the latest month for which data are available.

The steady job growth could also hasten a move by the Federal Reserve to reduce its stimulus efforts.

Stock investors were heartened by the report. The Dow Jones industrial average jumped 198 points.

A steadily improving job market could give consumers and business executives the confidence to keep spending and investing, even if a pullback by the Fed leads to higher interest rates. The Fed has been buying bonds each month to try to keep long-term borrowing rates low to spur spending and growth.

The celebration on Wall Street suggested that investors think a healthier job market, if it fuels more spending, would outweigh higher borrowing rates caused by a Fed pullback.

“It’s hinting very, very strongly that the economy is starting to ramp up, that growth is getting better, that businesses are hiring,” said Joel Naroff, president of Naroff Economic Advisors.

The economy has added a four-month average of 204,000 jobs from August through November, up sharply from 159,000 a month from April through July.

“The consistency (in hiring) is actually reassuring,” said Doug Handler, chief U.S. economist at IHS Global Insight. “Slow and steady is something you can plan and build on.”

The Fed could start slowing its bond purchases as soon as its Dec. 17-18 meeting. Some economists think the Fed may only telegraph a move at that meeting and wait until early next year to cut back.

Even if the Fed does start reining in its stimulus, most economists think growth will accelerate next year. Drew Matus, an economist at UBS, forecasts that growth will top 3 percent in 2014, from roughly 2 percent this year. That would be the first time growth had topped 3 percent for a full calendar year since 2005.

In addition to the solid job gains and the drop in unemployment, Friday’s report offered other encouraging signs:

• Higher-paying industries are adding jobs. Manufacturers added 27,000, the most since March 2012. Construction companies added 17,000. The two industries have created a combined 113,000 jobs over the past four months.

• Hourly wages are up. The average rose 4 cents in November to $24.15. It’s risen just 2 percent in the past year. But that’s ahead of inflation. Consumer prices are up only 0.9 percent in that time.

• Employers are giving their workers more hours. The average workweek rose to 34.5 hours from 34.4. A rule of thumb among economists is that a one-tenth of an hour increase in the workweek is equivalent to adding 300,000 jobs.

• Hiring was broad-based. In addition to higher-paying industries, retailers added 22,300 jobs, and restaurants, bars and hotels added 20,800. Education and health care added 40,000. And after years of cutbacks, state and local governments are hiring again. In November, governments at all levels combined added 7,000 jobs.

The report did contain some sour notes: Many Americans are still avoiding the job market, neither working nor looking for work. And America’s long-term unemployed are still struggling. More than 4 million people have been out of work for six months or longer.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.