NEW YORK — One of Wall Street’s biggest and most successful hedge fund companies was a hotbed of insider trading and its embattled billionaire owner wanted to hear no evil, prosecutors said in an indictment unsealed Thursday that claimed the firm earned hundreds of millions of dollars illegally.

The criminal indictment and civil lawsuits brought against SAC Capital Advisors and related companies did not name billionaire Steven A. Cohen as a defendant, referencing him only as the “SAC owner” who “enabled and promoted” insider trading practices.

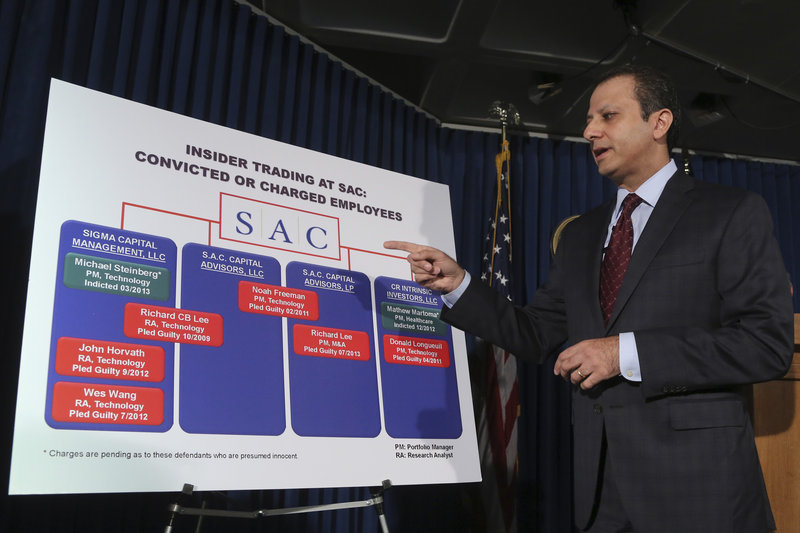

At a news conference, U.S. Attorney Preet Bharara said SAC “trafficked in inside information on a scale without any known precedent in the history of hedge funds.” He declined to comment on whether Cohen would be charged.

For more than a decade, the company earned hundreds of millions of dollars illegally as its portfolio managers and analysts traded on inside information from at least 20 public companies, Bharara said, announcing charges of wire fraud and four counts of securities fraud spanning 1999 to 2010. A court appearance for the firm’s lawyers was scheduled for Friday.

The possibility that the criminal case could topple the Stamford, Conn., firm, which once managed $15 billion in assets, led the prosecutor to note that the government was not seeking to freeze SAC’s assets. Bharara added that prosecutors were “mindful to minimize risk to third-party investors.”

In a statement, SAC Capital welcomed the prosecutor’s assurances and said it had been advised by prosecutors that “their action is not intended to affect the ongoing operations of SAC’s business, prevent investor redemptions or impact the interests of any of SAC’s counterparties.”

The company said it expected to agree with the government on a protective order that would “permit SAC to continue its operations in the ordinary course.”

Still, the government in one lawsuit sought SAC’s forfeiture of “any and all” assets.

The charges came less than a week after federal regulators accused Cohen in a related civil case of failing to prevent insider trading at the firm. While the Justice Department’s action targets SAC but not Cohen directly, the civil case brought by the Securities and Exchange Commission seeks to effectively shut him down by barring him from managing investor funds.

In its statement, SAC Capital said Thursday it “has never encouraged, promoted or tolerated insider trading and takes its compliance and management obligations seriously.”

It added: “The handful of men who admit they broke the law does not reflect the honesty, integrity and character of the thousands of men and women who have worked at SAC over the past 21 years. SAC will continue to operate as we work through these matters.”

A lawyer for Cohen did not immediately respond to a message for comment. Last week, an SAC Capital spokesman said “Steve Cohen acted appropriately at all times.”

In a statement, FBI Assistant Director George Venizelos said: “SAC Capital and its management fostered a culture of permissiveness. SAC not only tolerated cheating, it encouraged it.”

Bharara also announced that Richard Lee, a former SAC portfolio manager responsible for a $1.25 billion “special situations” fund, pleaded guilty Tuesday to conspiracy and securities fraud charges. Lee had worked for SAC in Manhattan from April 2009 through June 2011 and later at its Chicago office.

In court papers, the government was critical of Cohen, saying he purposely hired portfolio managers and analysts who knew employees of public companies likely to possess inside information and “enabled and promoted the insider trading scheme by ignoring indications that trading recommendations were based on inside information.”

It said Cohen fostered “a culture that focused on not discussing inside information too openly, rather than not seeking or trading on such information in the first place.”

SAC’s “relentless pursuit of an information ‘edge’ fostered a business culture within SAC in which there was no meaningful commitment to ensure that such ‘edge’ came from legitimate research and not inside information,” the criminal charges said.

The government also faulted the company’s compliance department, saying its investigations were weak, with a focus on “confirming” that any employee’s email implying access to inside information was merely poorly drafted.

The government said the department had identified only a single instance of suspected insider trading by its employees in its history even though former employees had pleaded guilty to insider trading.

Venizelos, head of the FBI’s New York office, called the company’s compliance department “the embodiment of the phrase, ‘See no evil. Hear no evil. Speak no evil.'”

Barry Boss, a criminal defense lawyer in Washington, said the government’s frequent references to Cohen in court papers were a way for prosecutors to cast aspersions of guilt without providing due process.

“Given a choice between being besmirched in the indictment and being named in the indictment, I think somebody would take besmirched every day,” he said.

SAC Capital has been at the center of one of the biggest insider-trading fraud cases in history. Four employees have already been criminally charged with insider trading, and two of them have pleaded guilty. And an SAC affiliate has agreed to pay $615 million to settle SEC charges.

Cohen, who lives in Greenwich, Conn., is one of the highest profile figures in American finance and one of the richest men in America. He is among the handful of upper-tier hedge fund managers on Wall Street who pull in about $1 billion a year in compensation.

An SAC portfolio manager, Mathew Martoma, has pleaded not guilty to insider-trading charges accusing him of earning $9 million in bonuses after persuading a medical professor to leak secret data from an Alzheimer’s disease trial between 2006 and 2008.

Even in the high-flying hedge fund world, SAC Capital stands out for its mammoth returns. Meanwhile, Cohen became one of the highest-profile figures in U.S. finance and the 40th-richest American, with a net worth of $8.8 billion, according to Forbes. Of the roughly $15 billion in assets that SAC Capital managed as of earlier this year, about half belonged to Cohen and his employees and half was client money.

In the past, the Justice Department has been wary of bringing criminal prosecutions against entire organizations out of fear of the collateral damage — that going further than fining a company could kill a business. The accounting firm Arthur Andersen went under after it was convicted in 2002 of destroying Enron-related documents before the energy giant’s collapse — an outcome that cost tens of thousands of jobs.

There are already reports that SAC’s clients are pulling their money from the firm. It’s not always an easy process: Clients usually have to give notice of at least 30 days. Hedge funds also can write into their contracts that they’ll deny withdrawal requests if too many clients want to pull out money at the same time.

Hedge funds typically consist of wealthy individuals and institutional investors attracted to the ability to both bet against and for different markets and stocks, giving themselves a “hedge” to do well in both good economies and bad. Most people never directly invest in a hedge fund, though the directors who manage their mutual fund, pension or college’s endowment might.

In the face of mounting legal woes, Cohen has kept up his philanthropic efforts. The Steven and Alexandra Cohen Foundation, named for Cohen and his wife, recently helped sponsor a $10,000-per-table poker tournament in Manhattan that raised money for an education advocacy group.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.