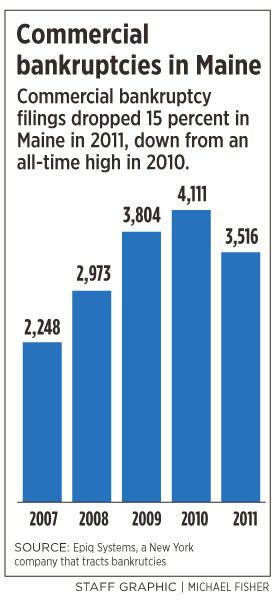

PORTLAND — Commercial bankruptcy filings in Maine declined by about 15 percent in 2011.

That’s short of the 20 percent decline in filings nationally, but still a sign that the state’s economy is improving, several Maine bankruptcy experts said.

Filings will likely keep falling in Maine this year, most predicted.

“I think in particular, Chapter 7 business numbers will continue to fall,” said bankruptcy attorney Richard Olson, a partner at Perkins Olson on Pleasant Street.

About 3,500 commercial entities in Maine filed for Chapter 7, Chapter 11 or Chapter 13 bankruptcy in 2011, according to Epiq Systems, a New York company that tracks bankruptcies. That’s down from 4,111 bankruptcies in 2010, the state’s all-time high.

Chapter 7 accounts for more than 85 percent of Maine’s commercial bankruptcies. A Chapter 7 filing requires the liquidation of a business’s assets to pay off creditors. Chapter 11 allows a business to keep creditors at bay while it reorganizes its debt and implements a plan to return to profitability. Chapter 13, which allows a business to set up a repayment plan to gradually eliminate its debt, accounted for a small percentage of Maine’s filings last year.

Chapter 7s should continue to decrease, and Chapter 11s might “slightly increase” in 2012, Olson said, “but that could be one of those good hidden signs.”

“Chapter 7 usually means the business is no longer viable. Chapter 11 means the business still has income coming in and can be saved if it’s debt is restructured,” he said. “So more Chapter 11s might actually be a slightly positive sign, since those businesses aren’t closing.”

Although filings fell in 2011, the 3,500 figure is still much higher than the 2,248 filings in 2007, before the economy collapsed.

“The fact that the numbers have declined year over year, it’s an indication that the economy didn’t just stabilize, but we’ve seen a gradual improvement of the economic climate,” said Larry Wold, president of TD Bank’s Maine market. “Still, that’s more (filings) than we want.”

In addition to the improving economy, experts pointed to other factors that might have helped bring the number of filings down.

Businesses that survived the initial economic downturn in 2008 have learned to survive with less income, said Yellow Light Breen, executive vice president of Bangor Savings Bank.

“They’ve changed their business plan and stuck it out,” Breen said.

Wold said the stigma of bankruptcy lessened during the worst of the economic collapse. “People became almost a little cavalier about filing for bankruptcy,” he said.

But as people became aware of the repercussions of having bad credit, they may have become less willing to file, he said.

Not everyone believes the bankruptcy decline is a sign the economy has improved. Mike Fagone, an attorney and shareholder at Bernstein Shur, a Portland firm that handles commercial bankruptcy cases, said banks have become more willing to work with clients who are having financial difficulties rather than foreclose on them. Wold, of TD Bank, said that’s true.

Fagone said there are signs the economy is still in trouble.

“Based solely on the number of calls we’re getting, I do not expect the (foreclosure) numbers to drop,” Fagone said. “Bernstein Shur continues to be very busy.”

In general, however, most experts contacted felt the economy is on the upswing, and that bankruptcies will continue to fall.

Len Gulino, another attorney and shareholder at Bernstein Shur, said the Maine real-estate market has picked up. Olson said some clients who couldn’t get credit a year ago now can. He and Wold also said Mainers seem more willing to invest than they were during the recession.

“Broadway Collision (in South Portland) filed for bankruptcy, and in August and September nobody thought it was worth anything, they couldn’t find a bidder,” Olson said. “It went for auction in December, went back and forth, and someone bought the stock for $80,000.

“It’s a small thing, but economic recoveries are made up of small things.”

Wold and Gulino said the European debt crisis could still derail the recovery, but they said the decline in bankruptcies and improvement in other indicators make them optimistic.

“Little by little, people are gaining some confidence back,” Wold said. “There’s reason to be cautiously optimistic in 2012.”

Jason Singer can be contacted at 791-6437 or at:

jsinger@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.