Maine homebuilders are growing more confident about the market for new single-family homes, a sentiment that mirrors the findings of a national survey issued Monday.

The National Association of Home Builders/Wells Fargo Housing Market Index, a leading economic indicator for the housing industry, showed that builders are more optimistic about demand for new homes than they have been since before the housing-market crash began in 2006.

The index hit a milestone in June, jumping 8 points from 44 to 52, the National Association of Home Builders said Monday. It’s the first time the index has been above 50 since April 2006.

Any score above 50 indicates that a majority of builders surveyed said they perceive sales conditions as positive.

“Surpassing this important benchmark reflects the fact that builders are seeing better market conditions as demand for new homes increases,” said association Chairman Rick Judson, a homebuilder and developer from Charlotte, N.C. “With the low inventory of existing homes, an increasing number of buyers are gravitating toward new homes.”

In Maine, market conditions are improving mainly in coastal areas. The trend has yet to spread west to inland markets, said Larry Duell, president of the Home Builders and Remodelers Association of Maine.

Duell, who owns Lebanon-based Father and Son Builders Inc., said his customers are primarily vacation-home buyers from New York, Massachusetts and Connecticut.

Inland areas, where homebuilders rely mostly on local buyers, have yet to recover from Maine’s housing crash, which hit full force in 2008, he said.

“Once you get west of that (Interstate) 95 corridor, there’s absolutely nothing going on,” Duell said.

But overall, signs throughout the state are positive, he said.

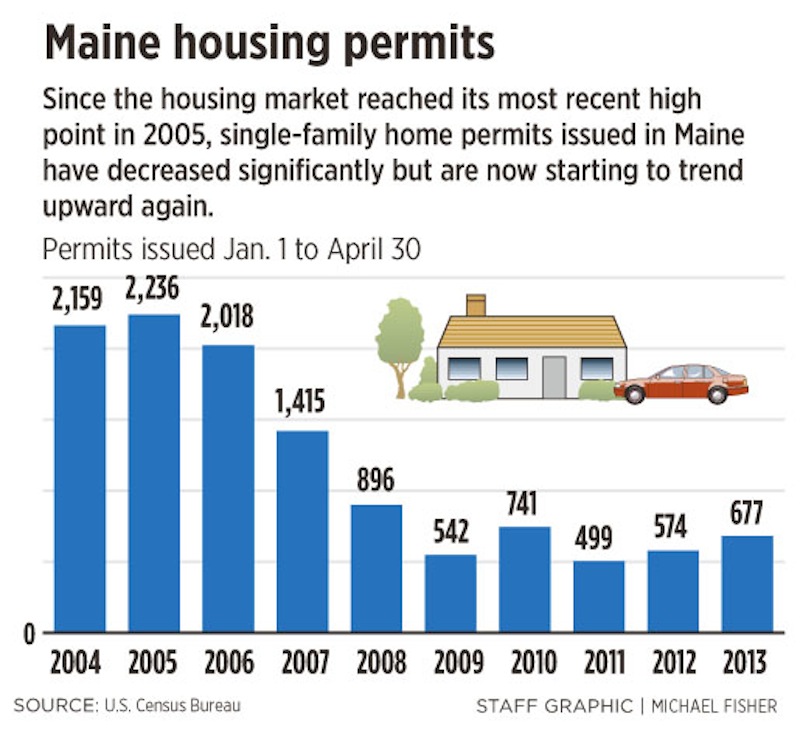

Permits for construction of single-family housing were up 18 percent statewide through April of this year — the most recent month for which data is available — compared with the first four months of 2012. As of April 30, 677 new-home permits had been issued this year, compared with 574 a year ago.

The Portland area had an even bigger jump. As of April 30, 336 permits had been issued in 2013, up nearly 24 percent from the 272 issued a year ago.

Economic indicators that bode well for future home sales include the recent drop in Maine’s estimated unemployment rate to below 7 percent, and a 7-point boost in the national Consumer Confidence Index in May, Duell said.

“Everything’s encouraging,” he said. “If we could just get some building inland, we’d be golden statewide.”

Jerry DeHart, owner of Ogunquit-based Coastal General Construction Inc., said his company’s target market of second-home buyers never went away completely, but his business had to rely increasingly on home-renovation jobs after the housing market imploded.

That’s no longer the case, he said. Coastal General Construction’s homebuilding side is up 30 to 40 percent from a year ago.

“We’ve noticed a significant increase,” DeHart said.

Mark Patterson, who owns Sanford-based Patco Construction Inc., said his company has yet to see an increase in new-building contracts over 2012, but he has received an encouraging number of calls recently.

“I’m definitely optimistic about the next six months because of the number of inquiries we’re getting,” said Patterson, who participates in the National Association of Home Builders’ monthly survey.

Nationally, the 8-point jump in June’s Housing Market Index was the biggest one-month gain since September 2002, David Crowe, chief economist for the National Association of Home Builders, said in a news release.

“Builders are experiencing some relief in the headwinds that are holding back a more robust recovery,” Crowe said. “Today’s report is consistent with our forecast for a 29 percent increase in total housing starts this year, which would mark the first time since 2007 that starts have topped the 1 million mark.”

Derived from a monthly survey that the association has been conducting for 25 years, the Housing Market Index gauges builders’ perceptions of current single-family home sales — and expectations for the next six months — as good, fair or poor.

The survey also asks builders to rate traffic of prospective buyers as high, average or low. Scores from each component are used to calculate a seasonally adjusted index. Any number above 50 indicates that more builders view conditions as good than poor.

Improvements in the market for existing single-family homes boost new-home sales. When the number of existing homes for sale decreases, the prices and demand for new homes increase.

Maine Association of Realtors data for April, the most recent numbers available, indicate the median price for an existing home increased 4.4 percent statewide from April 2012.

The number of home sales statewide increased by 13.7 percent, from 824 in April 2012 to 937 in April 2013, according to the association.

One possible driver of the growth in home sales is the low but rising average interest rate for a 30-year, fixed-rate mortgage, said industry analysts.

As of Monday, the average interest rate had risen to 3.98 percent, a 14-month high but still lower than interest rates in previous decades, according to Freddie Mac.

Analysts suggest another reason for the rebound in home sales is likely the entrance of large, institutional investors into the rental-home business since the national home foreclosure epidemic sparked by the widespread issuance of risky, sub-prime loans.

In April, the U.S. home ownership rate reached an 18-year low of 65 percent, according to the U.S. Census Bureau. Investors continued to buy up rental homes to capitalize on the unprecedented number of families that cannot qualify for a mortgage.

Duell said many of today’s would-be home buyers are struggling to get financing in the aftermath of that crisis, and that hurdle must be overcome before the homebuilding industry can reach sales levels comparable to those before the housing crash.

“Financing is an issue that we’re battling,” he said.

J. Craig Anderson can be contacted at 791-6390 or at:

canderson@pressherald.com

Twitter: @jcraiganderson

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.