Mark Stitham was born and raised in Dover-Foxcroft, so Maine was the obvious choice when he decided to buy a vacation home.

Stitham, a psychiatrist whose primary home is in Kailua, Hawaii, bought a second home in Cape Elizabeth in 1993. It serves as a home base for visiting relatives, seafood feasts and forays into Portland.

He could not have afforded it, he said, if he couldn’t deduct mortgage interest from his income taxes. Probable Republican presidential nominee Mitt Romney said over the weekend that he would consider eliminating or reducing mortgage interest deductions on second homes as part of a larger tax-reform plan.

“I definitely could not have afforded the home without a tax deduction,” said Stitham, who has since paid off his Cape Elizabeth mortgage.

Eliminating the mortgage-interest deduction for second homes would likely have a big impact on Maine.

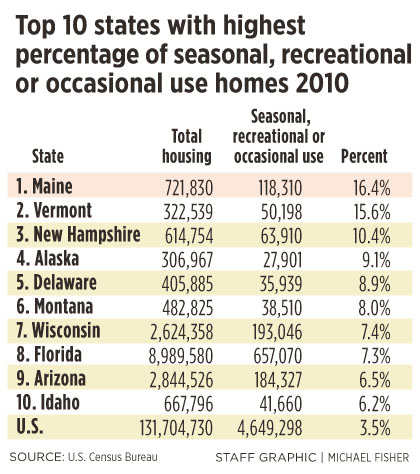

Maine has a higher percentage of housing dedicated to seasonal, recreational or occasional use than any other state – 16.4 percent, or 118,310 out of 721,830 units, according to data from the 2010 census. The other northern New England states follow closely behind: Vermont is second at 15.6 percent, and New Hampshire is third with 10.4 percent. Nationally, the figure is 3.5 percent.

Over the weekend, reporters overheard Romney make the remarks about ending the second-mortgage tax break “for high-income people” during a fundraiser in Florida, news sources reported. He did not say whether the proposal would be limited to certain income brackets.

Since then, the former Massachusetts governor has passed on chances to clarify his remarks, and an aide said he was merely discussing an idea, The Associated Press reported.

But some members of Maine’s real estate industry said they were concerned.

“Real estate in Maine is not that great. Any attack on any of the incentives for people to buy homes – even secondary homes – would be a detriment to our real estate industry,” said Michael Baribeau, owner of Brunswick-based Century 21 Baribeau Agency.

Baribeau also worried that doing away with the mortgage-interest deduction on second homes might open the door to eliminating them on primary residences.

“I think the biggest thing we as Realtors would be concerned about is setting a precedent,” he said.

Last year, President Obama proposed limiting mortgage-interest deductions at 28 percent for taxpayers in the 33 percent and 35 percent tax brackets, according to CNNMoney.

In February, 624 existing single-family homes were sold in Maine – an increase of nearly 30 percent from the year before, according to the Maine Real Estate Information System Inc. The median sale price fell almost 6 percent to $149,900.

Currently, interest of $1 million or less can be deducted for mortgages taken out after Oct. 13, 1987. The cap applies to both primary and secondary homes.

Exactly how much of an impact eliminating the second-home mortgage deduction would have is complicated because it isn’t clear which income brackets it would apply to and because many homebuyers do not take out a mortgage.

Nationally, four of 10 vacation homes are purchased with cash, said Walter Molony, a spokesman for the National Association of Realtors. Also complicating the question is that many second homes in Maine are modest, relatively inexpensive camps that may have been in a family for generations and are owned free and clear.

But eliminating any incentive to buying a home in the current economic climate could hurt the real estate industry, Molony said.

“It’s a bad idea. We oppose any changes in the mortgage interest deduction. It really is a bad signal, just as the housing market is trying to get on its feet,” he said.

In 2011, the industry saw national sales of vacation homes rise 7 percent to 502,000. But Molony noted that in 2006, the figure was 1,670,000.

Joyce Barter, a broker with Krainin Real Estate in Raymond and Naples, said that the higher priced the home, the less likely the buyer will take out a mortgage. About 75 percent of the agency’s sales are waterfront or water-related properties, and Barter estimates that up to 80 percent of those are second homes.

But in some cases, it makes financial sense for buyers to take out mortgages even if they don’t need to, Barter said.

“The million-dollar properties and up rarely have a mortgage, and if they do, they are only getting a mortgage because it is a financially sound idea rather than they have to get a mortgage. They can borrow the money from somebody – the bank – and keep their cash somewhere where it’s going to earn more,” she said. And they get the added benefit of being able to deduct the interest from their taxes, she said.

Maggie Krainin, the owner of the agency, said eliminating the second-home deduction could have an impact.

“If you remove the interest on a second home, you’re cutting out a lot of incentive,” she said. “I think it would make a difference to some people. Obviously, a deduction is a deduction.”

Scott Townsend of Keller Williams Realty, a Portland-based firm that specializes in Scarborough properties, believes that removing any incentives would make people think differently about their investment decisions. And that could have an effect on communities where a lot of second homes are located, he said.

“If you look at it, they are paying the same real estate taxes as the people next door, but they don’t have the impact on our school systems, roads and other aspects of where our taxes go – like year-round residents,” he said.

Stitham, the Hawaii psychiatrist, would support reducing – but not eliminating – mortgage-interest deductions for the wealthy. He thinks that the aim of increasing homeownership has gone too far, leading to the subprime crisis.

“I think if you eliminate it, you’ll really kill the market,” he said.

Staff Writer Ann S. Kim can be reached at 791-6383 or at: akim@pressherald.com

Twitter: AnnKimPPH

Correction: This story was revised at 1:25 p.m., April 18, 2012, to reflect the correct spelling of Krainin Real Estate in Raymond and Naples, and the name of its owner, Maggie Krainin.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.