A Long Beach hospital charged Jo Ann Snyder $6,707 for a CT scan of her abdomen and pelvis following colon surgery. But because she had health insurance with Blue Shield of California, her share was much less: $2,336.

Then Snyder tripped across a secret of health care: If she hadn’t used her insurance, her bill would have been even lower, just $1,054.

“I couldn’t believe it,” said Snyder, a 57-year-old hair salon manager. “I was really upset that I got charged so much and Blue Shield allowed that. You expect them to work harder for you and negotiate a better deal.”

Unknown to most consumers, many hospitals and physicians offer steep discounts for cash-paying patients regardless of income. But there’s a catch: Typically you can get the lowest price only if you don’t use your health insurance.

That disparity in pricing is coming under fire from people like Snyder, who say it’s unfair for patients who pay hefty insurance premiums and deductibles to be penalized with higher rates for treatment.

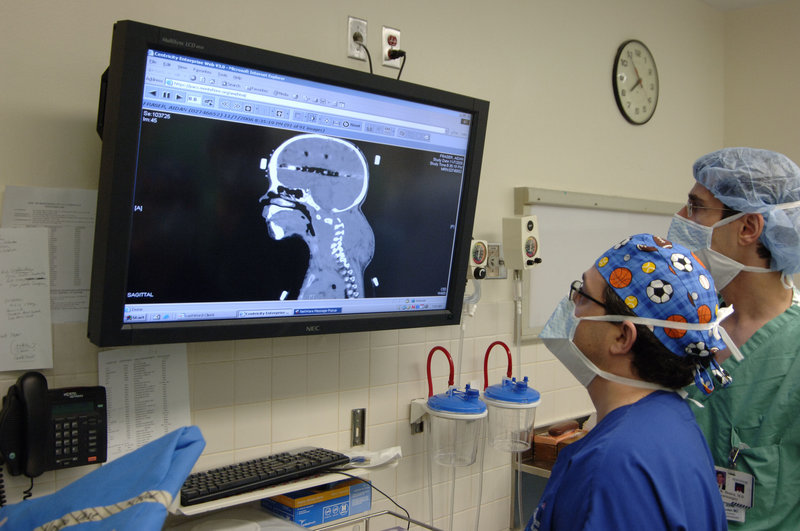

The difference in price can be stunning. Los Alamitos Medical Center, for instance, lists a CT scan of the abdomen on a state website for $4,423. Blue Shield says its negotiated rate at the hospital is about $2,400.

When the Los Angeles Times called for a cash price, the hospital said it was $250.

“It frustrates people because there’s no correlation between what things cost and what is charged,” said Paul Keckley, executive director of the Deloitte Center for Health Solutions, a research arm of the accounting firm. “It changes the game when health care’s secrets aren’t so secret.”

Snyder’s experience is hardly unique. In addition to Los Alamitos, the Times contacted seven other hospitals across Southern California, and nearly all had similar disparities between what a patient would pay through an insurer and the cash price offered for a common CT (computed tomography) scan, which provides a more detailed image than an X-ray.

Health insurance still offers substantial value for consumers by providing preventive care at no cost and offering protection from major medical bills that could bankrupt most families.

But cash prices – typically available for hundreds of common outpatient services and tests – have a real appeal to millions of consumers who are on the hook for a growing share of their medical costs as employers and insurers cut back on coverage and push more high-deductible plans.

Some doctors are trying to spread the word about cash prices and they’re urging patients to pressure hospitals and insurers to offer a better deal.

David Belk, an internist in Alameda, launched a website about medical costs and speaks to community groups about the huge markups compared with the prevailing cash price.

Belk recently told a group gathered at a seniors center about the vast price difference when he requested routine blood work for a patient last year. A local hospital charged her $782. Her insurer said that with its discount, she owed only $415.

“She could have gotten it for $95 in cash. How does that make sense?” Belk said. “The last thing the insurance companies want you to know is how inexpensive this stuff really is.”

For those patients who have insurance, getting the lower price would typically mean withholding that information from the hospital or clinic. Experts warn that doing so, however, means any payments don’t apply to customers’ annual insurance limits for out-of-pocket spending.

The decision on whether to pay cash or apply the fee toward the deductible will depend on a variety of factors, including the amount of the deductible and whether the person expects to incur more medical bills that year.

The cash discounts have evolved over time after hospitals were criticized in recent years for charging the uninsured their highest rates and then hounding them at times with overzealous collection efforts.

New government rules ensued that limited in many cases what hospitals could charge lower-income patients who were footing their own bills. Meantime, hospitals have been trying to boost revenue by encouraging more patients to pay upfront so they can avoid a lengthy and uncertain collections process.

The California Hospital Association says discounted cash prices are intended for the uninsured, not those who have coverage. Jan Emerson-Shea, a vice president at the industry group, said most hospitals offer a separate discount to insured patients who are willing to pay their portion upfront.

“If you have insurance, you are under that insurance plan’s negotiated rate with the hospital,” she said.

In the view of Robert Berenson, a senior fellow at the Urban Institute and vice chairman of the Medicare Payment Advisory Commission, big hospitals are exerting their market power to charge ever-increasing rates, and major insurers go along with it because they can pass along the costs to employers and consumers.

Insurance industry officials say health plans negotiate the lowest prices they can, but that they also need to include prominent hospitals favored by customers in the network, and those institutions can command higher prices.

Hospital executives say they don’t like to charge insured patients more, but say that’s a result of the country’s broken health care system.

At Long Beach Memorial Medical Center, where Snyder got her CT scan, the hospital’s chief financial officer said insured patients like her pay more to subsidize the uncompensated care given to the uninsured and low reimbursements for Medicaid patients.

“We end up being forced to charge a premium to health plans to make the books balance,” said John Bishop, the hospital’s finance chief. “It’s a backdoor tax on employers and consumers.”

Those higher prices charged by hospitals and other medical providers drove up health care spending at double the rate of inflation during the recession, even as patients used less medical care, according to a new study by the Health Care Cost Institute.

Snyder stumbled across the two-tier system accidentally. She has filed suit against her insurer, saying she hopes her case will lead to more disclosure of the price options, and ultimately lower treatment costs for patients.

In her suit, Snyder accused Blue Shield of unfair business practices, breach of good faith and misrepresentation over her medical bills. The suit seeks class-action status on behalf of other Blue Shield customers.

A spokesman for Blue Shield said the case has no merit and the nonprofit insurer negotiates the most favorable rates it can.

In a court filing, Blue Shield said it “cannot promise or represent that there could not be providers who will charge someone less out-of-pocket cost for a service than she would pay if the Blue Shield contract rate applies.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.