PORTLAND – A recovering economy brought some stability to Maine’s largest retail market in 2010, a commercial real estate expert said Thursday, but declining vacancy rates for stores, restaurants and other retail space in Greater Portland were driven by a few large deals that mask an ongoing struggle.

Much of last year’s activity came from discounters, such as Marden’s and Goodwill, community banks including Bangor Savings and Gorham Savings, and casual restaurants such as Cracker Barrel and Chipotle Mexican Grill. The biggest retail news was the long-anticipated arrival of Trader Joe’s, which took over 24,000 square feet in Portland for its largest U.S. location.

But after breakneck growth through 2007, followed by the economic collapse of 2008 and 2009, last year’s “normal” market was welcome, said Mark Malone of Malone Commercial Brokers.

“After 2009, an ordinary market was pretty comforting,” Malone said.

Malone made his comments Thursday to more than 500 brokers, bankers and other professionals at the annual Maine Real Estate & Development Association forecast conference. Taken together, the presentations provided an overview of Maine’s economy through the lens of development, and a glimpse at how 2011 is shaping up.

With consumer spending driving the national economy, the health of the retail sector is a key barometer.

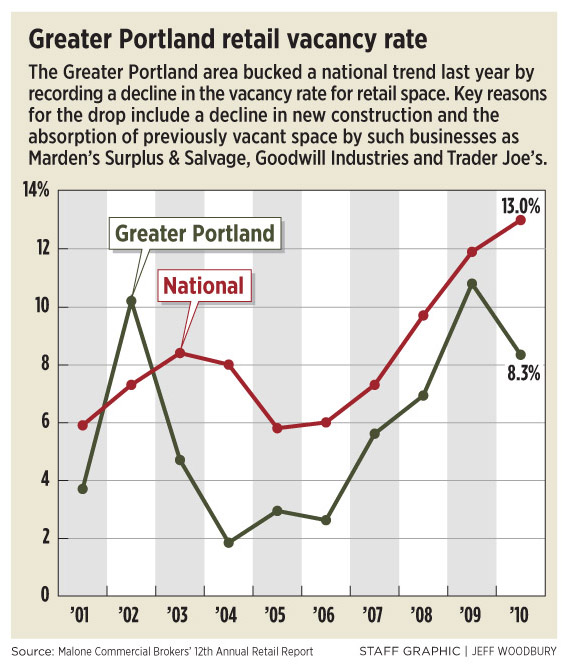

Greater Portland’s retail vacancy rate fell from 10.8 percent in 2009 to 8.3 percent last year, while the national rate climbed from 11.9 percent to 13 percent. But most of the improvement here came in the best spaces, with stronger tenants and better locations, Malone said. Vacancies in lower-tier properties actually rose.

To retain and attract tenants, landlords continued to offer discounts and free rent, although lease rates are beginning to firm up.

Retail construction was down, with only seven projects started. Half of the activity was a 34,350-square-foot shopping center, Western Avenue Crossing, that’s under construction in South Portland.

Looking ahead, Malone expects vacancy rates for prime properties to keep improving, and secondary properties to struggle. Lease rates will stay flat. New construction will be rare; there’s not much building demand with 500,000 square feet of vacant retail space.

Other real estate sectors have similar challenges. For instance:

Home sales: Overall volume fell to 2002 levels. Median prices rose to $175,000 in June, but slid back to $172,500 by December, said Mike LePage, a broker for Re/Max Heritage. The market won’t stabilize until foreclosures and defaults ease up, financing improves and consumer spending increases. This year will bring modest growth in sales, prices and interest rates, LePage predicted.

Multifamily properties: More units came on the market, but well below pre-recession levels, said Brit Vitalius of Vitalius Real Estate Group. One-quarter of the sales were bank-owned or short sales, and the median price for those transactions was roughly 66 percent of the market value. Vacancy rates are healthy in Portland, below 5 percent, but are as high as 15 percent in Biddeford.

Hospitality and vacation properties: Buyers are focused on vibrant coastal markets such as Kennebunkport, Portland, Camden and Bar Harbor, said Daren Hebold of Daigle Commercial Group. Sale prices were led by the 46-room Sea Chambers Motel in Ogunquit, for $6 million.

Last summer’s great weather boosted visits, but a slow recovery in group business travel and leisure travel will continue to challenge owners this year.

Real estate’s fragile condition was underlined by Charles Lawton, chief economist for Planning Decisions, Inc.

Home prices fell during the 1990-91 recession, Lawton noted, but sales picked up in the recovery. In this recession, sales rose last year but have begun falling again.

Lawton, a columnist for the Maine Sunday Telegram, also noted that commercial construction continues to be very weak and the labor force has not rebounded.

Those and other factors raise questions in 2011, he said, about whether the bursting of the housing bubble fundamentally changed how Americans view housing.

Staff Writer Tux Turkel can be contacted at 791-6462 or at:

tturkel@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.