PORTLAND -The $94.9 million budget proposed by the school board for the 2012-13 school year would increase the tax rate by 3.4 percent, and most city councilors say that’s too much.

But school officials say the tax rate doesn’t tell the whole story.

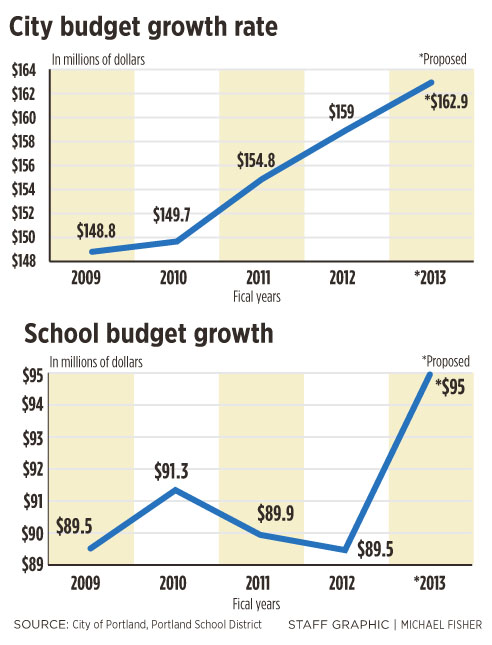

While the property taxes needed to fund Maine’s largest school district have increased every year for the past three years, the actual spending has declined 2 percent, from $91.3 million in the 2009-10 budget to $89.5 million in 2011-12.

How can the tax rate for schools rise when spending goes down?

During that period, the district has lost nearly $12 million in state and federal funds, and Portland taxpayers have spent almost $7 million to make up the difference.

The trend is continuing. In its proposed 2012-13 budget, which begins July 1, the school district will be without the $2.1 million that was provided by the federal American Jobs Act for retaining employees during the recession.

The school board proposes allocating $1 million from its fund balance to help cushion the loss. It is asking taxpayers to make up the rest.

Board Chair Kathleen Snyder, who will present the school budget to the City Council tonight, said the school board has been working hard in recent years to manage a fiscal crisis.

With the district’s finances now in order and internal reforms made, she said, it’s time to invest in the quality of education received by the district’s 7,000 students.

“We are as a district and a board finally talking about student achievement,” she said.

Superintendent Jim Morse said the proposed budget would enable the district to make modest improvements, such as $100,000 for two new early-education classrooms as part of a partnership with the Catherine Morrill Day Nursery and the federal Head Start program. The classes would be at the Longfellow and Riverton schools.

The proposal also includes $524,000 as the first expenditure in a four-year plan to spend $2 million upgrading the district’s outdated computers and technology infrastructure.

Unlike in recent years, the budget calls for no net reductions in the staff. The district has eliminated more than 100 positions since 2009

“We haven’t asked for the moon,” Morse said. “We haven’t asked for anything extravagant. We are asking not to lay off people. We think that is a reasonable place to go.”

For a home valued at $200,000, the proposed school budget would add $64 to the tax bill. The school board approved the budget on April 10. The budget is subject to approval by the City Council.

The council’s Finance Committee will discuss the school budget Wednesday, and may make recommendations to the council or ask the school board to make cuts.

Councilor John Coyne, who serves on the Finance Committee, said he has heard little support from the public for a tax increase this year.

“People are feeling the pinch still,” he said. “They tell us the economy is turning around, but not fast enough to absorb a 3.4 percent tax increase.” City Manager Mark Rees has proposed a $162.9 million budget, which would increase the tax rate for municipal services by 2.9 percent.

Combined, the proposed city and school budgets would increase the tax rate by 3.2 percent, from $18.28 per $1,000 valuation to $18.87. For a home assessed at $200,000, taxes would go up $118.

Mayor Michael Brennan said he doesn’t disagree with any of the initiatives in the school budget, but the council must work on the city and school budgets to limit the tax increase. He said the cuts will be relatively modest.

“We are trying to get to a point where we can meld together the city and school budgets to create a budget that works,” he said. “We are talking about hundreds of thousands of dollars, not millions.”

Councilor Cheryl Leeman said she believes cuts can be made that don’t sacrifice the quality of education. She said the public is demanding cuts because taxpayers are making the same kinds of decisions in their own family budgets.

“The reality is that none of us — whether we are in the private sector or public — have the same kind of income we had in the last two or three years,” she said. “We have to make choices. That doesn’t mean we have to minimize quality. It means we have to be more efficient.”

Staff Writer Tom Bell can be contacted at 791-6369 or at:

tbell@pressherald.com

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.