In Maine, the 5 percent sales tax applies when you buy hammers or hats, shoes, shirts or shovels. Does taxing everyone’s retail purchases at the 5 percent rate make the tax fair? Nope. Tax rates don’t tell us much about fairness. Tax fairness depends on the answer to this question: “What chunk of a household’s income goes to pay the tax?”

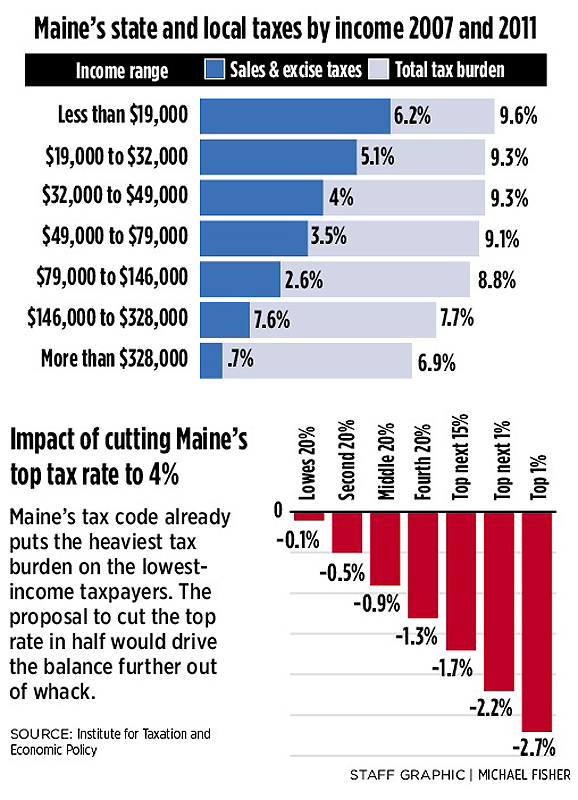

The news isn’t good. Maine’s tax system socks it to the 60 percent of the non-elderly population least able to pay. To see why take a look at the accompanying bar chart.

Oh yuck. Taxes. Percents. Numbers. Graphs. Mind numbing. If you’ll hang on for a few more lines, you’ll find out how Maine taxes affect you.

The first column lists (non-elderly) household incomes ranked from the poorest 20 percent up to the top 1 percent. See where your household falls? See the bite Maine’s sales and excise, property, and income taxes take out of your household’s income?

This chart divides Maine’s (non-elderly) households into 5 equal sized groups, each group contains 20 percent of Maine’s (non-elderly) households. The bars (quintiles) are arranged from the poorest 20 percent to the top 1 percent. (With so much variation at the high end, it’s helpful to look at three sub-groups: non-elderly households with incomes greater than the incomes of 80 percent of Mainers, but less than the top 5 percent; those households with incomes greater than 95 percent of Mainers, but less than the top 1 percent, and the top 1 percent of households.)

This tells us a lot about how hard state and local taxes hit households, depending on their income.

Sales taxes hit Mainers in the second, middle (third) and fourth quintiles (that’s 60 percent of the non-elderly population) hard. The poorest 20 percent of non-elderly Maine households (those with average incomes of less than a measly $19,000 per year and averaging a pitiful $11,800 annually), face a sales tax burden that eats up 6.2 percent of their income. The average weekly income in this group is only $223. The $14 per week sales tax bite really hurts. Fans of the Sheriff of Nottingham are cool with this.

But Robin Hood’s fans are not happy that Maine relies on such a backward tax. Sales taxes are terribly regressive. At high levels of incomes, less of a household’s budget is devoted to items subject to the sales tax. Contrast the families struggling to live on $933 per month (the average monthly income of families in the bottom 20 percent) with the families living on $58,600 per month (the average monthly income of families in the top 1 percent). Families at the top save — no sales tax applies. Families at the top hire tax attorneys, estate planners, and financial advisers — no sales tax applies. Families at the bottom don’t. So virtually all their income goes to meet basic monthly expenses, and too many of these expenses are subject to the sales tax.

If your family is struggling to meet basic monthly expenses, sales taxes pose a significant hardship. “What,” you wonder, “are ‘basic’ monthly expenses for a family?” Massachusetts Institute of Technology researchers make it easy for us to find that out, at http://livingwage.mit.edu/places/2300560545.

For a Portland family with two adults and two school-age children, basic monthly expenses include food ($713), medical ($421), housing ($1,109), transportation ($629) and other ($206). This family would have to have a pre-tax income of $44,636 to cover this bare-bones budget. Uh-oh. This means that 60 percent of Mainers earn less than a living wage! Now that’s a bitter pill.

Look again at the top 1 percent of Maine’s non-elderly households where the average income is $703,200 per year. For these families the sales tax burden is barely noticeable. Their average monthly income — $58,600 — more than most Mainers earn in a year! The sales tax bite? About $500 per month. Boo hoo.

State property taxes are regressive too. In fact, the only progressive tax in the state is the income tax, but that’s been undermined by recently enacted changes that reduced tax rates and lowered taxes. Aside from the nearly $400 million these cuts will cost in income taxes not collected (Gee, think this has anything to do with why the governor’s proposing to balance the budget by eliminating revenue sharing?) this tilts the economic playing field even more in favor of those already occupying the most advantageous positions.

Why are we doing this? There are plenty of ways to make state taxes fairer. If, for example, we broadened the sales tax base to include financial services, the share paid by the state’s highest earners would go up. If the Legislature cut property-tax giveaways to businesses by half (you know, the ones enjoyed by global, multinational corporations like Nestle and General Dynamics) there would be $200 million more in the state treasury.

But here’s the real kicker. Making our tax system fairer would be better for everyone, including those at the top who’d see their taxes rise. Why?

Maine is the 12th most equal state in the nation. In more equal societies people live longer and they have better mental health. Income equality leads to stronger communities where children do better at school and are less likely to become teenage parents. When inequality is reduced, people trust each other more, and there is less violence. Everyone, as a result, enjoys a higher quality of life. More and more rapid economic growth is an added benefit of greater equality.

Out with the Sheriff of Nottingham. In with Robin Hood.

Susan Feiner is a professor of economics and women and gender studies at the University of Southern Maine.

A chart showing the relative impact of tax cuts based on income level was corrected at 8:55 p.m. Sunday, Feb. 10, 2013.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.