WASHINGTON — Lawmakers are engaged in a playground game of “who goes first,” daring each political party to let the year end without resolving a Jan. 1 confluence of higher taxes and deep spending cuts that could rattle a recovering, but-still-fragile economy.

President Barack Obama returns from Hawaii Thursday to this increasingly familiar deadline showdown in the nation’s capital, with even a stopgap solution now in doubt.

Adding to the mix of developments pushing toward a “fiscal cliff,” Treasury Secretary Timothy Geithner informed Congress on Wednesday that the government was on track to hit its borrowing limit on Monday and that he would take “extraordinary measures as authorized by law” to postpone a government default.

Still, he added, uncertainty over the outcome of negotiations over taxes and spending made it difficult to determine how much time those measures would buy.

In recent days, Obama’s aides have been consulting with Senate Democratic Leader Harry Reid’s office, but Republicans have not been part of the discussions, suggesting much still needs to be done if a deal, even a small one, were to be struck and passed through Congress by Monday.

At stake are current tax rates that expire on Dec. 31 and revert to the higher rates in place during the administration of President Bill Clinton. All in all, that means $536 billion in tax increases that would touching nearly all Americans. Moreover, the military and other federal departments would have to cut $110 billion in spending.

But while economists have warned about the economic impact of tax hikes and spending cuts of that magnitude, both sides appear to be proceeding as if they have more than just four days left. Indeed, Congress could still act in January in time to retroactively counter the effect on most taxpayers and government agencies, but chances for a large deficit reduction package would likely be put off.

House Republican leaders on Wednesday said they remain ready to negotiate, but urged the Senate to consider or amend a House-passed bill that extends all existing tax rates. In a statement, the leaders said the House would consider whatever the Senate passed. “But the Senate first must act,” they said.

Aides said any decision to bring House members back to Washington would be driven by what the Senate does.

Reid’s office responded shortly after, insisting that the House act on Senate legislation passed in July that would raise tax rates only on incomes above $200,000 for individuals and $250,000 for couples.

Meanwhile, Obama has been pushing for a variant of that Senate bill that would include an extension of jobless aid and some surgical spending reductions to prevent the steeper and broader spending cuts from kicking in.

For the Senate to act, it would require a commitment from Senate Republican Leader Mitch McConnell not to demand a 60-vote margin to consider the legislation on the Senate floor. McConnell’s office says it’s too early to make such an assessment because Obama’s plan is unclear on whether extended benefits for the unemployed would be paid for with cuts in other programs or on how it would deal with an expiring estate tax, among other issues.

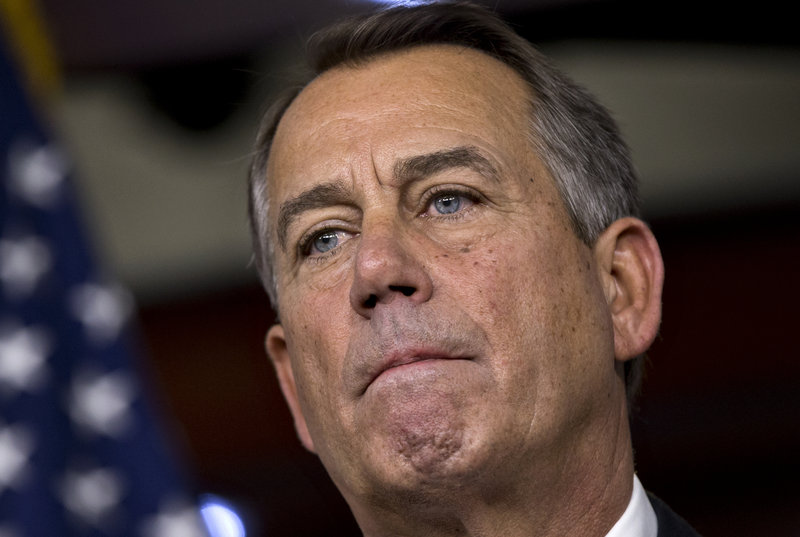

What’s more, House Speaker John Boehner would have to let the bill get to the House floor for a vote. Given the calendar, chances of accomplishing that by Dec. 31 were becoming a long shot.

Amid the standoff, Geithner advised Congress on Wednesday that the administration will begin taking action to prevent the government from hitting its borrowing limit. In a letter to congressional leaders, Geithner said accounting measures could save approximately $200 billion.

That could keep the government from reaching the debt limit for about two months. But if Congress and the White House don’t agree on how to avoid the “fiscal cliff,” he said, the amount of time before the government hits its borrowing limit is more uncertain.

“If left unresolved, the expiring tax provisions and automatic spending cuts, as well as the attendant delays in filing of tax returns, would have the effect of adding some additional time to the duration of the extraordinary measures,” he wrote.

Whenever the debt ceiling hits, however, it is likely to set up yet another deadline for one more budget fight between the White House and congressional Republicans.

Initially, clearing the way for a higher debt ceiling was supposed to be part of a large deal aimed at reducing deficits by more than $2 trillion over 10 years with a mix of tax increases and spending cuts, including reductions in health programs like Medicare. But chances for that bargain fizzled last week when conservatives sank Boehner’s legislation to only let tax increases affect taxpayers with earnings of $1 million or more.

Obama and his aides have said they would refuse to let Republicans leverage spending cuts in return for raising the debt ceiling. But Republicans say the threat of voting against an increase in the limit is one of the best ways to win deficit reduction measures.

Another potential showdown is pending. A renewed clash over spending could come in late March; spending authority for much of the government expires on March 27.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.