A report this week by USA Today that lists Portland among the 10 U.S. cities with the biggest tax burdens has become the flash point for a debate on Gov. Paul LePage’s tax policy.

It also led LePage to call Portland “the liberals’ flagship city.”

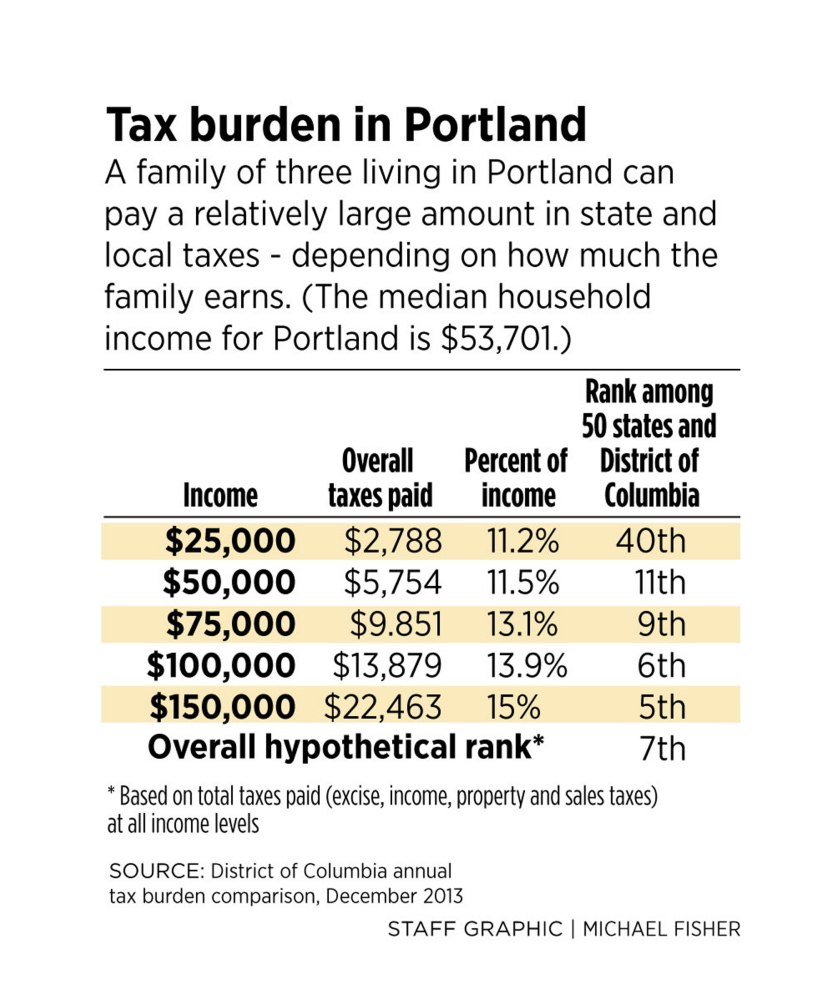

The report, based on a study by the District of Columbia, ranked Portland seventh in the nation for its state and local tax burden. The city’s tax burden is relatively small for low-income residents but especially big for wealthier residents, USA Today reported.

The ranking is based on the combined cost of three state taxes – income, sales and auto excise – and the municipal tax on property. USA Today cited LePage’s efforts to reduce state income taxes but said other taxes, including the property tax, still add to Portland’s high burden.

LePage used the report late Wednesday to tout his efforts to cut income taxes for low-income families and to rebut claims by Democrats that his tax reform has benefited only the wealthy. He took a shot at Portland in the process.

“Maine liberals falsely label this historic tax relief as ‘tax cuts for the rich,’ ” LePage said in a written statement. “But, as this report points out, the rich in Portland – the liberals’ flagship city – pay more than their fair share, while low-income Mainers have enjoyed tax relief because of our income tax cut.”

WHO BENEFITED MOST FROM TAX CUTS?

Democrats responded quickly.

They pointed to a report by Maine Revenue Services that shows nearly 43 percent of the tax cuts adopted under LePage have gone to the top 10 percent of Maine earners. Taxes for the top 1 percent, who earned about $354,000 last year, were reduced by $2,810 while the 200,000 households that earned less than $20,000 received an average reduction of $17, the report says.

“Let’s not get distracted by the newest shiny object coming from the LePage administration,” Senate President Justin Alfond, D-Portland, said in a prepared statement.

House Speaker Mark Eves, D-North Berwick, noted LePage’s proposal to eliminate revenue-sharing with municipalities, a program that returns a portion of sales and income taxes to communities to reduce their reliance on property taxes.

“Last year, (LePage) tried to pay for (the tax cuts) by proposing one of the largest property tax increases in Maine’s history,” Eves said in a prepared statement.

LePage’s press secretary, Adrienne Bennett, did not return phone calls or an email seeking comment.

LePage never called for municipalities to increase property taxes to make up for reduced revenue from the state, although municipal officials said that would likely happen. Instead, LePage called on cities and towns to “tighten their belts” when he introduced his plan last year.

David Sorensen, communications director for the Maine House Republicans, issued a news release Thursday citing data from Maine Revenue Services showing that LePage’s tax cuts reduced income taxes by an average of $337 for about 460,000 households, and kept 70,000 Mainers from having to pay income taxes.

“The Republican-led tax cut package of 2011 is not slanted toward the rich, but does benefit all Mainers by providing real tax relief that puts more money into the pockets of hardworking Mainers and more money into the private sector economy,” Sorensen said.

A SLAP AT PORTLAND, AND A RESPONSE

The USA Today ranking is based on a report in December by the municipal staff in Washington, D.C., that was intended to help the district compare its tax burden to the largest city in each state.

The report looked at income, sales, excise and property taxes paid in 2012 by a hypothetical family of three, at five income levels. In Maine, all of those taxes are set by the Legislature with the exception of property taxes, which are set by municipalities.

Portland ranked 40th in its tax burden for a family earning $25,000 a year, and fifth for a family earning $150,000. The low-income family pays about $2,788 in taxes, 11.2 percent of its income, the report says. The high-income family pays $22,463 in taxes, 15 percent of its income.

When the tax burdens for hypothetical families at five income levels were added up, Portland ranked seventh-highest in the nation overall.

LePage blamed city leaders for the high-ranking tax burden. His news release described Portland as “a city where local budgets are controlled by liberals.”

Portland Mayor Michael Brennan responded by saying LePage “cherry-picked” portions of the report to make a “less than subtle jab at Portland.”

“It’s just totally untrue,” Brennan said of the suggestion that Portland has liberal spending habits. “We have been very careful to be as prudent and cost-effective as we can.”

Brennan said LePage’s budget policy – which reduced revenue sharing to communities, shifted half of teachers’ retirement costs to municipalities and “virtually eliminated” the state’s circuit breaker property-tax relief program – has forced the city to raise an additional $1 million in tax revenue.

Portland City Manager Mark Rees said low-income residents who may have benefited from lower income taxes are paying more for housing. “It is a bit disingenuous of the governor to criticize the city’s reliance on property taxes to provide necessary municipal services when his administration supports policies that require municipalities to raise property taxes or cut services,” Rees said in an email.

RATES IN 59 COMMUNITIES TOP PORTLAND’S

A comparison of property tax rates shows that Portland residents pay less than residents of 59 other Maine communities.

Maine Revenue Services compiles a statewide list of property tax rates, adjusted to equalize valuations, which vary from community to community. That means the tax rates on the list may differ from the actual rates in those 511 municipalities.

According to the most recent data available, from 2011, the 59 municipalities with higher property tax rates than Portland’s included Lewiston, Bangor and Waterville, where LePage was mayor from 2003 until he became governor in 2011.

The adjusted rate for Portland was $17.90 per $1,000 of assessed value. Waterville’s adjusted rate was $19.49 per $1,000, Lewiston’s was $21.27 and Bangor’s was $19.01.

A spokeswoman for U.S. Rep. Mike Michaud, a Democratic gubernatorial candidate, said LePage’s tax cuts are “unfunded and are fiscally irresponsible.”

“Because of his failed economic policies, more Mainers are homeless, more children are living in poverty and Maine ranks last among states for private-sector job growth since he took office,” Michaud spokeswoman Lizzy Reinholt said in an email. “If he really wanted to support Maine’s families and working poor he’d stop slashing important programs that get Mainers back on their feet and focus on real solutions to our problems.”

Independent candidate Eliot Cutler’s spokeswoman, Crystal Canney, said property taxes are putting too much burden on Maine families.

“While it is all well and good that the governor has reduced the income tax by half a percent, in too many cases his approach has simply shifted the tax burden to local communities,” Canney said in an email. “What Maine needs is comprehensive tax reform focused on reducing the property tax burden.

Randy Billings can be contacted at 791-6346 or at:

rbillings@pressherald.com

Twitter: @randybillings

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.