AUGUSTA — Gov. Paul LePage opened a day-long legislative hearing Monday with testimony backing his plan to use Maine’s next wholesale liquor contract to pay off the state’s debt to its hospitals.

“I have a plan to pay back the hospitals and make the liquor business more competitive with New Hampshire,” LePage told the Veterans and Legal Affairs Committee. “We must make the right decisions and we must pay our bills.”

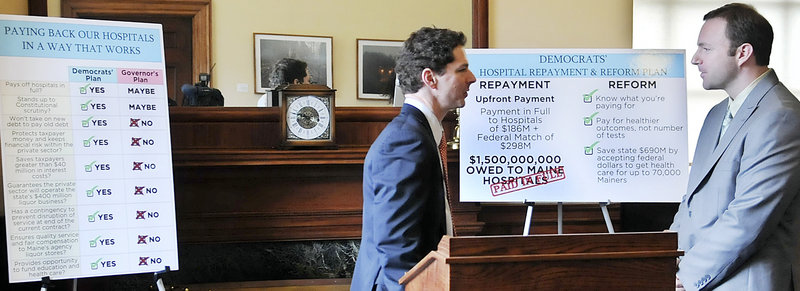

The governor spoke moments after Democratic leaders held a news conference to introduce an alternative plan to repay the hospitals.

The Democrats, who have majorities in the House and Senate, suggested combining the debt settlement with an expansion of Medicaid and other health-care-related measures in what party leaders called a more comprehensive approach.

LePage has proposed legislation that would use income from future liquor sales to pay off Maine’s debt to its hospitals. The state would issue bonds that would be repaid with future liquor revenue.

LePage has vowed to veto every bill that comes to him until his proposal passes. Once it does, he says, he will authorize $105 million in voter-approved bonds supporting infrastructure needs such as transportation and clean water.

A competing bill from Senate Majority Leader Seth Goodall, D-Richmond, includes criteria that bidders for the liquor contract must meet, such as a down payment of as much as $200 million.

“We may disagree on our approaches, but we agree with the governor – we need to pay back the hospitals. We must get the liquor contract right,” Goodall said in his testimony.

The Maine Hospital Association testified in support of LePage’s proposal and said it did not favor or oppose Goodall’s bill.

“We’re very happy to see there’s no controversy over using liquor revenue to pay the debt. We shouldn’t have to beg over an overdue bill,” said Jeff Austin, spokesman for the Maine Hospital Association.

Monday’s testimony, from about 45 people, lasted about seven hours. The hearing room was packed, and so many people waited to testify that numbers were handed out, while some people waited in overflow rooms.

In 2004, Maine awarded a 10-year contract to operate wholesale liquor operations in exchange for a $125 million upfront payment that helped close a budget gap. The state also got a portion of the revenue, which last year came to $8.5 million.

Gerry Reid, head of the state’s liquor and lottery operations, estimated that the state could get as much as $500 million over 10 years in a new contract.

LePage’s proposal would outsource the management, inventory, warehousing and distribution of liquor. The state also wants to lower retail prices to make Maine more competitive with New Hampshire, and pay higher commissions to agency liquor stores.

Reid said prices wouldn’t be cut for bottles smaller than 750 milliliters, to protect against over-consumption. Reid said small bottles can be tucked into pockets, which encourages consumption.

From mid-2004 through 2011, liquor sales totaled $864.7 million under the contract awarded to Maine Beverage Co., according to financial documents filed with the state.

Maine Beverage Co. has said that it likely would not bid on the next contract under LePage’s scenario. Two potential bidders have emerged, Dirigo Spirit and All Maine Spirits. Reid said there may be two other bidders, but they haven’t been publicly named.

“Nobody at Maine Beverage Co. believes a future contract would look like it did 10 years ago,” said Jim Mitchell, speaking for the company. “The business is in a very strong position today. We can’t know how the business will do, going forward.”

John Menario, vice president of All Maine Spirits, spoke against Goodall’s bill.

“Anyone who proposes legislation that delivers less than $450 million to the state is sticking it to the state of Maine,” Menario said. “If it were left to me, I’d let the governor get along with the (request for proposals) process.”

He objected to the non-refundable application fee of $25,000 in Goodall’s bill, and the requirement for an upfront payment of as much as $200 million.

Menario said his company could come up with that much money, if needed, but there would be interest costs.

He said that 10 years ago, Maine Beverage Co. delivered to the state “a pill that was sugar-coated cyanide that bought them control of the state liquor business. More than $330 million in profits left the state of Maine.”

Sixty percent of Maine Beverage Co. is owned by a New York private equity company; the remaining 40 percent is owned by Massachusetts-based Martignetti Cos.

All Maine Spirits was formed last year by six Maine residents for the purpose of bidding on the liquor contract.

Ford Reiche, president of Dirigo Spirit, said Goodall’s requirement of an upfront payment would repeat the mistakes of the past by selling off liquor revenue to a company that writes a big check.

When asked whether the $200 million upfront payment would squeeze out smaller bidders for the liquor contract, Goodall said every publicly known bidder has the financial wherewithal to raise that much money.

If a company can’t, it may not have adequate financial resources, he said.

“Cash is king in many negotiations,” he said.

Jessica Hall can be contacted at 791-6316 or at:

jhall@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.