AUGUSTA – State revenue from the gas tax is on the decline, as it is in other states that are struggling to fund transportation improvement projects.

Maine officials have so far been able to absorb the losses, an achievement that Gov. Paul LePage has attributed to the dollar-stretching ability of his transportation commissioner, David Bernhardt.

But some lawmakers and transportation advocates say Maine must find new ways to draw revenue to support upkeep of the state’s highways.

The issue is facing other states and the federal government, which are balancing the unpopularity of raising gas taxes with the reality that increasingly fuel-efficient vehicles are allowing their owners to buy less gas – and pay less gas tax.

John Melrose, a lobbyist for the Maine Better Transportation Association, which advocated for transportation funding, told lawmakers on the Transportation Committee on Friday that the state must come up with more revenue or risk further deterioration of its infrastructure.

Gas taxes support roughly two-thirds of the state’s $318.6 million highway budget. Even a slight dip in collections can force the Legislature to adopt supplemental spending or reduction plans to ensure that the budget stays balanced.

That happened Friday, when the Transportation Committee unanimously endorsed a supplemental highway budget designed to fill a $3.5 million shortfall for the fiscal year ending June 30.

The gap was driven largely by a $2.5 million downward projection of gas tax collections by the Maine Revenue Forecasting Committee.

Karen Doyle, the finance director for the Maine Department of Transportation, told lawmakers that the shortfall would be plugged primarily with 366 unfilled positions and a $1 million cut in the highway and bridge budget.

Ted Talbot, a spokesman for the Department of Transportation, said earlier this week that the $1 million had not been earmarked for any particular project, so there wouldn’t be any delays in infrastructure upgrades.

Sen. Linda Valentino, D-Saco, questioned whether the state could continue on that path without revenue, potentially by raising the gas tax. She also recognized the political reality.

“I know that if we send anything (to the governor’s office), even if it’s one penny, it will be vetoed,” she said. “What’s the point?”

LePage has taken a hard line against raising taxes, including gas taxes. In 2011, he signed the Republican-controlled Legislature’s proposal that halted the state’s indexing of the gas tax to adjust for inflation.

Republicans reasoned that Maine’s gas tax was already too high. It’s now 30 cents per gallon, the 16th-highest rate in the country and No. 3 in New England. Opponents of eliminating indexing said Maine’s tax is high because it has many roads and bridges to maintain.

New York’s rate tops the list at 50.6 cents per gallon.

The inflation indexing was eliminated in 2012. According to Maine Revenue Services, that cost the state $5.9 million in this fiscal year. It’s projected to cost $10.8 million in fiscal year 2013-14 and $15.7 million in the next fiscal year.

About a dozen states index their gas taxes to inflation, according to the National Conference of State Legislatures.

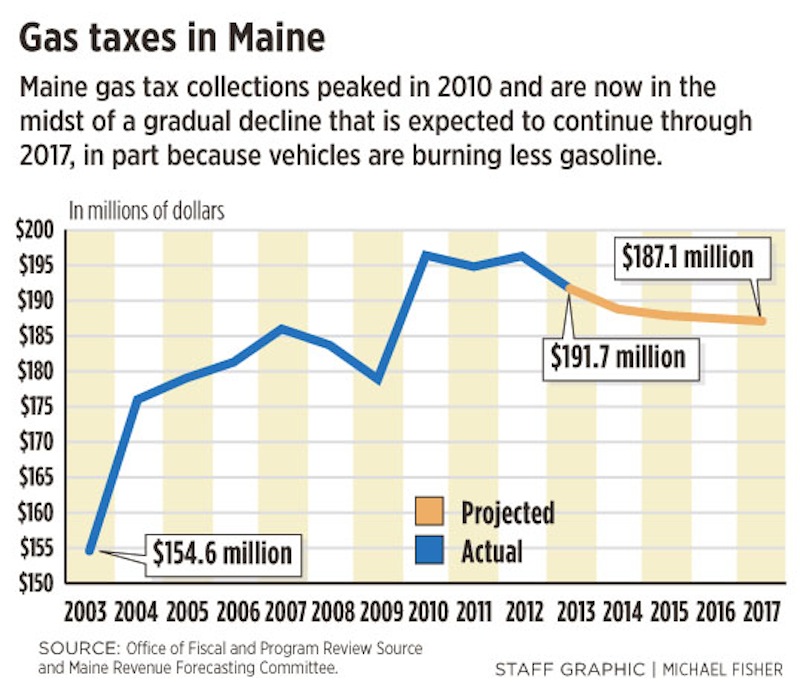

The Legislature’s Revenue Forecasting Committee is also projecting a downward trend in gas tax collections, from $191.7 million this year to $188.8 million in 2013-14.

There also are questions about whether the revenue modeling is keeping pace with the factors contributing to decreased collections.

That’s why highway fund fuel tax estimates have been manually adjusted downward by $3.6 million each fiscal year.

The revenue loss presents a challenge for policymakers. National polls show that people generally oppose raising gas taxes when pump prices already average $3.61 per gallon.

In Maine, the average price is now $3.58 per gallon, 10 cents higher than in New Hampshire.

Popular opposition may explain why seven states have not raised their gas taxes in at least 20 years, while six have raised them since 2008, according to the National Conference of State Legislatures.

The federal gas tax has not been raised since 1997. It stands at 18.4 cents per gallon.

The reluctance to raise the gas tax had led some state policymakers to explore alternatives, such as additional transportation borrowing or charging motorists based on the number of miles they drive.

Virginia’s Republican Gov. Bob McDonnell has a bolder proposal: eliminate the gas tax and raise the state’s sales tax to pay for it. McDonnell’s plan has drawn broad opposition.

The issue has led the conservative U.S. Chamber of Commerce to propose the unthinkable: raising the federal gas tax. Thomas J. Donohue, head of the chamber, told Congress in February that “the money is running out.”

He proposed an increase in the gas tax and indexing to inflation.

It’s not yet clear what awaits Maine. On Friday, the Transportation Committee simply recognized that it will have to do something soon.

Steve Mistler can be contacted at 620-7016 or at:

smistler@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.