WASHINGTON – New signs emerged Wednesday that the economic rebound is sputtering. Sales of new homes hit a record low last month. And mortgage giant Freddie Mac signaled it will need more federal aid — and might never repay it.

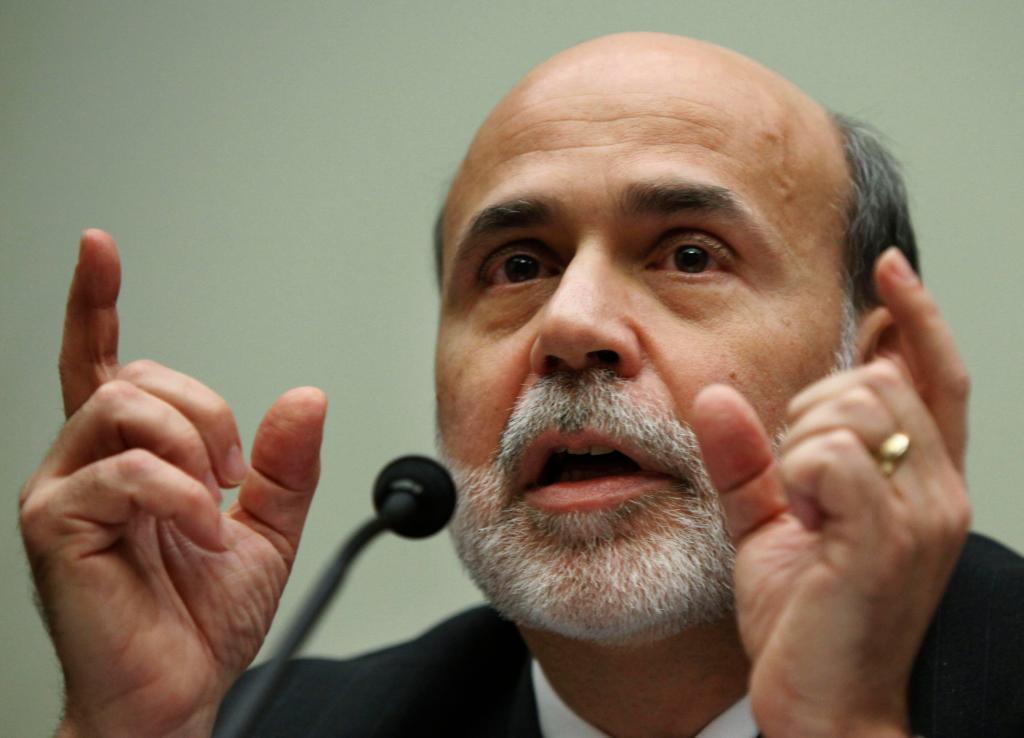

Against that backdrop, the government is trying to prop up the housing and job markets. Federal Reserve Chairman Ben Bernanke reiterated the need to continue record-low interest rates for ”an extended period.” And the Senate passed a bill to give tax breaks to companies that hire the jobless.

Bernanke told Congress that low rates will help ensure that the recovery lasts and help ease the sting of high unemployment. Asked what else Congress could do to stimulate job creation, he hesitated to say.

”I’m sure you know the menu of things that you could do which could create jobs,” he said. ”Unfortunately there’s no — there’s no silver bullet here.”

Investors seemed buoyed by Bernanke’s commitment to low rates, despite the news on home sales and Freddie Mac. The Dow Jones industrial average gained about 91 points, roughly 0.9 percent.

Yet economists cautioned that the government’s ability to help is limited.

”Our view is that it will be a long, tough slog for U.S. consumers in particular and for the economy overall,” said Sal Guatieri, senior economist at BMO Capital Markets.

Bernanke, in his twice-a-year report to the House Financial Services Committee, said the rebound would endure. But he also sought to restrain hopes. He said the Fed sees moderate growth that will cause only a slow decline in the nearly double-digit jobless rate.

He offered no new clues about when the Fed would eventually raise interest rates. Most economists think it’s months away.

Bernanke faces more pressure than usual from lawmakers in an election year. Their constituents are struggling, while bailed-out Wall Street banks are profitable again. Unemployment stands at 9.7 percent, home foreclosures are at record highs and people and businesses are having trouble getting loans.

Freddie Mac’s earnings report was grim news for taxpayers, who have had to rescue the company and Fannie Mae. Freddie lost nearly $26 billion last year and has lost nearly $80 billion since 2007. A record proportion of its borrowers — 4 percent — face foreclosure. And its chief executive warned of many more foreclosures still to come.

And Freddie Mac said it will likely need more federal aid beyond the $51 billion it has already received, and that it may not be able to repay it.

Fannie and Freddie are vital players in the industry. They buy loans from lenders and sell them to investors. Combined, they own or guarantee about half of all residential mortgages. Had they gone broke in 2008, millions of people would have been unable to get mortgages.

Freddie and Fannie have already soaked up $111 billion from the government, which seized control of them in September 2008. That number is expected to hit $188 billion by the fall of 2011.

”We now have unlimited taxpayer exposure to the bailout of Fannie and Freddie, a bailout nation where the big get bigger, the small get smaller and the taxpayer gets poorer,” Rep. Jeb Hensarling, R-Texas, said at a House hearing.

The Obama administration had been expected to announce plans to overhaul Freddie Mac and Fannie Mae this month when it submitted its 2011 budget request. But Treasury Secretary Timothy Geithner said Wednesday that won’t happen until next year.

”We want to make sure that we are proposing changes at a time when we have a little bit more distance from the worst housing crisis in generations,” he told the House Budget Committee.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.