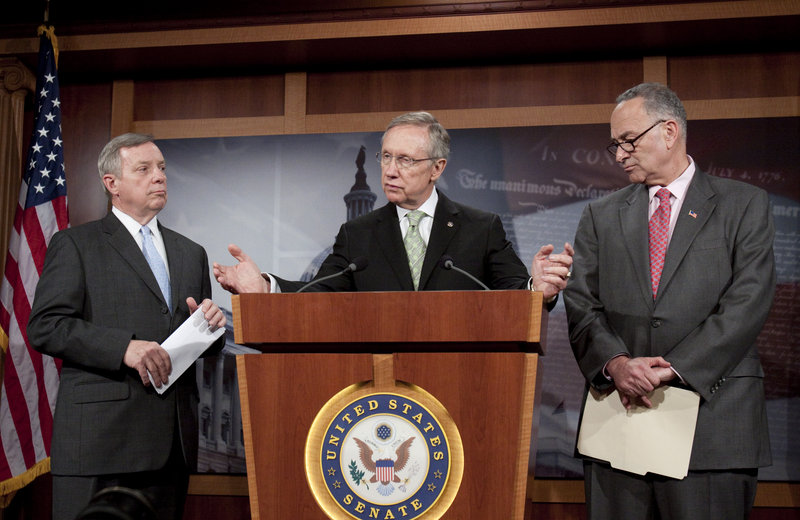

WASHINGTON – Senate Majority Leader Harry Reid, D-Nev., plans to move forward Monday with an expansive bill to overhaul the nation’s financial regulatory system, setting up a possible showdown between Republicans and Democrats if efforts at a compromise fall short.

As President Obama spoke Thursday in New York about the “essential” need for the landmark legislation, Reid set in motion the Senate procedures necessary to hold a crucial test vote late Monday afternoon.

“The games of stalling are over,” Reid said.

Opinion polls show the public is receptive to new federal curbs on Wall Street after twin catastrophes — the recession that has driven unemployment to double digits and a banking crisis that has led to huge losses in Americans’ retirement accounts.

Democrats will need support from at least one Republican to reach the 60 votes required to overcome a filibuster and proceed with formal debate on the bill put forth by Sen. Christopher Dodd, D-Conn. It would create an agency to protect consumers against abuses in mortgages and other loans, set up a council of regulators to monitor for risks to the financial system and give the government power to wind down large, troubled financial firms.

Senate Republicans continued to oppose the pending test vote, known as cloture. They used the threat of a filibuster as a bargaining chip, saying Dodd’s bill contains flaws that could harm the economy.

Maine’s senators both discussed the regulatory reform bill with Treasury Secretary Timothy Geithner earlier this week.

Sen. Susan Collins, R-Maine, whom Democrats have been courting in recent days, said she sees great promise in the negotiations aimed at producing a bipartisan bill.

“The current financial regulatory system is deeply flawed, and we must put an end to taxpayer-funded bailouts of huge financial firms,” she said in a statement. But Collins said she opposes what she called a “divisive” vote Monday, arguing for more time to reach consensus.

“I hope that Senator Reid abandons his plan to force a premature cloture vote on Monday,” she said.

Collins proposed elements of financial regulatory reform last year, some of which are included in the current bill.

Sen. Olympia Snowe said it is essential to have the framework of a bipartisan agreement before debate begins on the Senate floor.

She favors forcing the investment device known as derivatives — which played a key role in the economic collapse — to be traded on an open exchange. The bill also must take steps to preclude the need for another taxpayer-funded bailout, she said.

“My primary objective is to ensure that this 1,300-page bill helps create jobs and not stifle small business lending,” Snowe said.

The lead Republican negotiator on the far-ranging legislation, Sen. Richard Shelby of Alabama, also cautioned Democrats against trying to force the bill.

“I wouldn’t want to rush it and make a lot of mistakes,” he said. “We’re making progress, but we’re dealing in something very complex.”

Republicans have focused most of their recent criticism, at least publicly, on a proposed $50 billion “resolution fund” to cover the cost of a major financial firm’s failure. GOP lawmakers say the fund, although financed by the financial industry, allows regulators to treat creditors of failing firms differently, essentially permitting the government to pick winners and losers.

Democrats and Obama administration officials have signaled they would be willing to drop the provision from the bill. Such a move is unlikely to cause waves among Democrats, and it could allow GOP lawmakers voting for the bill to claim a legislative victory.

Still, although the $50 billion fund and concerns over how the legislation would affect community banks and small businesses have drawn the bulk of public focus, other critical issues remain.

The two sides still must find common ground over the “Volcker Rule,” which would ban Wall Street banks from engaging in certain investment activities, such as owning hedge funds.

Some Republicans also object to language that would roll back a doctrine called preemption, which for years has allowed big banks to answer solely to federal regulators. Dodd and the Obama administration want to give states authority to go beyond federal laws, arguing that preemption prevented state regulators from quashing obvious abuses.

In addition, both the Senate banking and agricultural committees have passed legislation that would impose new rules on derivatives, which are contracts that allow financial traders to bet on the direction of stocks, commodities and other assets. Those measures must be reconciled in coming days and have drawn intense interest from lawmakers and the financial industry alike.

The derivatives bill that emerged out of the agriculture committee Wednesday bans big Wall Street banks from trading derivatives. That provision is likely to face opposition from Treasury officials, major banks and lawmakers on both sides of the aisle.

While the legislative formalities followed a rocky, partisan script Thursday on the Senate floor, noteworthy maneuverings were taking place in private huddles with lawmakers, including Shelby, Dodd and a collection of House Democrats.

Reid took to the floor about 2:30 p.m. and moved to begin debate on the financial overhaul bill, which requires consent from all 100 senators. Senate Minority Leader Mitch McConnell, R-Ky., quickly objected.

“The majority leader is once again moving to a bill, even while bipartisan discussions on the content of the bill are still under way,” McConnell said. “It has important consequences for the taxpayers if done incorrectly. … My impression was that serious discussions were going on; I think they should continue.”

Senate aides expressed optimism that Dodd and Shelby will reach a deal before the Monday vote, in which the first move would be to strip out the existing bill, replace it with new language from them and move forward with debate.

In the absence of a deal, all 59 senators in the Democratic caucus are expected to vote to move the bill, forcing Republicans to decide whether to block the effort.

Such a move would set up a political showdown in which the two sides would probably blame each other for blowing up the regulatory reform effort. Once debate begins on the legislation, dozens of amendments could arise in coming weeks before a final vote.

Staff Writer David Hench contributed to this report.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.