WASHINGTON – Goldman Sachs reaped “billions and billions of dollars” in profits by secretly betting in 2006 and 2007 that the U.S. housing market would crash, a strategy that conflicted with the interests of its clients who were still buying the firm’s risky mortgage securities, Senate investigators said Monday.

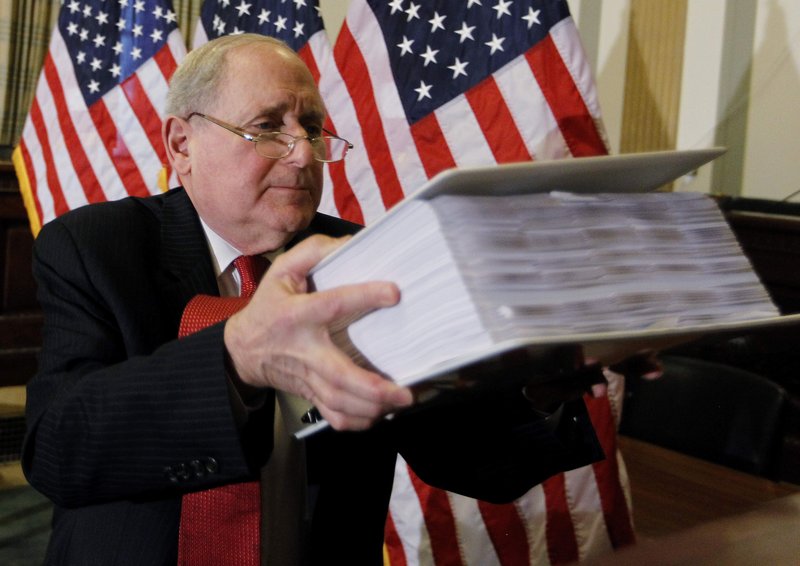

“The evidence shows that Goldman repeatedly put its own interests and profits ahead of the interests of its clients,” Sen. Carl Levin, D-Mich., the chairman of the Permanent Investigations Subcommittee, told a news briefing. “I think they’ve been misleading to the country.”

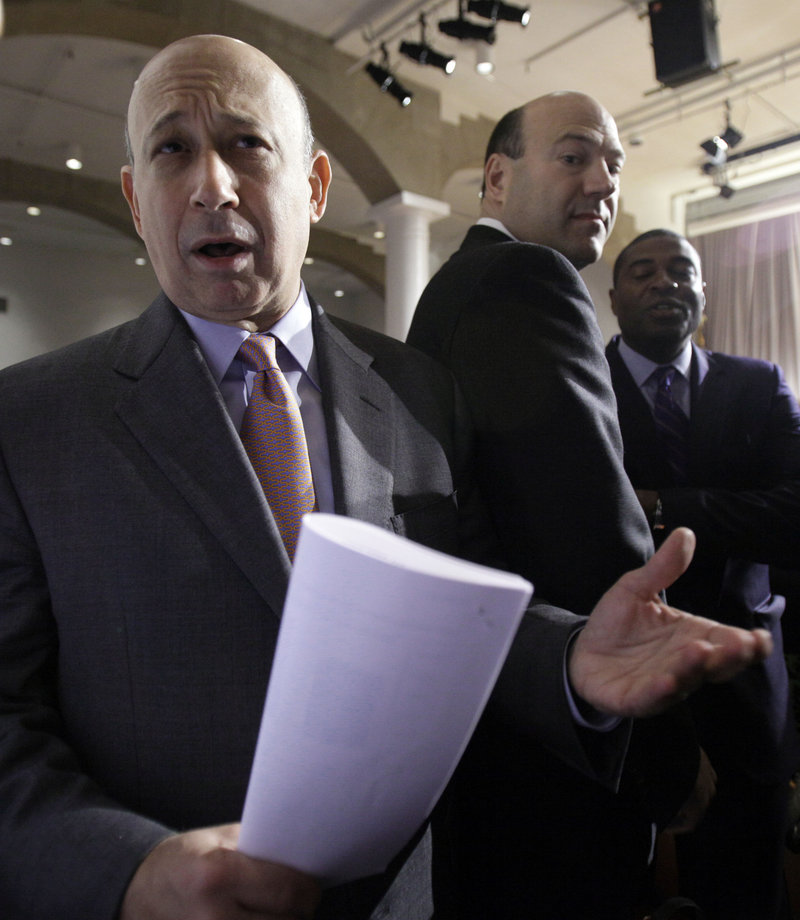

The panel provided the first detailed glimpse of its findings from an 18-month investigation into the world’s most prestigious investment bank, setting the stage for a hearing today at which Goldman’s chief executive, Lloyd Blankfein, and six other company executives will give sworn testimony.

Blankfein, in testimony prepared for delivery today, denied that Goldman orchestrated a “massive short,” or a series of negative bets that enabled it to ring up huge profits when the housing bubble burst and sank the nation’s economy.

“And we certainly did not bet against our clients,” he said.

The subcommittee’s findings bolstered reports in November and December by McClatchy Newspapers that Goldman had marketed $57 billion in risky mortgage securities, including $39 billion backed by mortgages that it bought from lenders, in 2006 and 2007, without telling investors it was secretly making bets on a housing downturn.

Goldman also sold billions of dollars in offshore securities that included subprime mortgages. Securities experts told McClatchy at the time that the practice might have constituted fraud because investors might have opted not to buy the securities if they knew Goldman was betting on their collapse.

The subcommittee and Goldman, which turned over 2 million documents to the panel in response to subpoenas in June 2009 and on March 12 of this year, have been publicly sparring since Saturday in the buildup to the hearing, releasing dueling sets of company e-mails.

On Monday, the subcommittee released dozens of additional excerpts from internal documents that staffers said show that Goldman mortgage traders, with the knowledge of senior company executives, shifted sharply from positive bets on the housing market to negative ones after a high-level meeting on Dec. 14, 2006. The shift followed 10 straight days of mortgage losses, Goldman has said.

In his 2007 performance review, senior Goldman trader Michael Swenson said he knew by the summer of 2006 from the “market fundamentals in subprime” that the home mortgage market and related exotic securities were headed for “a very unhappy ending.” He said he directed the firm to take a big bet that the market would go down.

As another top trader, Joshua Birnbaum, wrote in his performance review: “Much of the plan began working by February as the market dropped 25 points and our very profitable year was under way.”

About that same time — in February 2007 — Blankfein asked in an internal e-mail related to mortgage securities if the firm was “doing enough right now to sell off cats and dogs in other books throughout the division.”

Later that year, Blankfein wrote that, “Of course we didn’t dodge the mortgage mess. We lost money, then made more than we lost because of shorts.”

Goldman has said repeatedly that it made bets against the housing market, via insurance-like contracts known as credit-default swaps, largely in its role as an intermediary for clients and that it didn’t profit massively when loan defaults soared and home prices nose-dived beginning in the summer of 2007.

Levin said that Goldman has “a lot to answer for.”

He and his aides pointed to company documents that repeatedly showed the firm was making proprietary “short” bets, meaning it used its own money.

For example, they pointed to offshore deals assembled by Goldman, in which it bet against risky mortgages from the likes of Long Beach Mortgage, Fremont General and New Century Financial, among the most notorious lenders to marginally qualified homebuyers. In three of the deals, Goldman bet more than $2 billion that the securities would fail, and they were later downgraded to junk status.

Today’s Senate hearing comes 10 days after the Securities and Exchange Commission accused Goldman and one of its vice presidents of civil fraud for allowing a longtime client to stack an offshore deal with dicey home mortgage securities without telling investors that the client planned to bet they would fail.

The client, the hedge fund Paulson & Co., made $1 billion in profits on the deal, while two European banks lost that much.

The Goldman vice president, Fabrice Tourre, said in an e-mail to his girlfriend in January 2007 that he wasn’t “feeling too guilty” about the highly leveraged offshore deals he was structuring because he was making capital markets more efficient. So, Tourre wrote, “there is a humble, noble and ethical reason for my job 😉 amazing how good I am in convincing myself!!!”

Tourre, Swenson and Birnbaum are among the executives scheduled to testify Tuesday.

Levin said his subcommittee focused on whether Goldman’s separate contrary bets were improper, but he deferred judgment on whether they broke securities laws. His staff said that, while Goldman’s conduct may not meet definitions of fraud under civil and criminal statutes, Levin has proposed legislation to tighten limits on companies’ use of exotic new financial instruments to bet against the securities they sell.

In his testimony, Blankfein addresses the “supposedly massive short Goldman Sachs had on the U.S. housing market.” He said that during the two years of the financial crisis, while profitable overall, Goldman Sachs lost about $1.2 billion in the residential housing market.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.