TRENTON, N.J. – Janet and Mark Hartmann, a New Jersey couple with 68 years of government jobs between them, may retire ahead of plan because the state is $102 billion short of funds needed to pay all the benefits it owes.

New Jersey and 20 other states are urging early retirements, cutting benefits and demanding employees contribute more in the face of what the Pew Center on the States says is a $1 trillion gap between available assets and what’s owed workers.

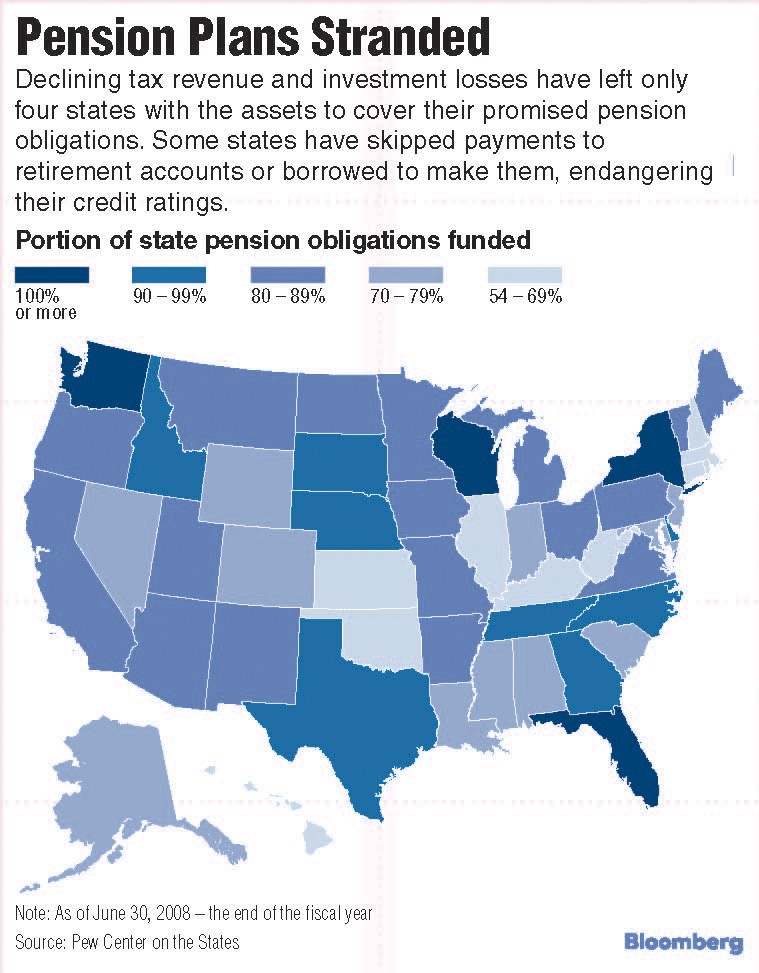

Declining tax revenue has left governments unable to make up the $724 billion of market losses suffered by the 100 largest state retirement plans in the two years that ended last June, according to the Census Bureau. Some states have skipped payments to retirement accounts or borrowed to make them, endangering their credit ratings.

“This, in my opinion, is the public issue of this decade,” New Jersey Gov. Chris Christie said at the Manhattan Institute for Policy Research last month. “Things that used to be sacred cows, that used to be the third rail, no longer are. They’ve been replaced by the unaffordability, absolute unaffordability.”

The deepest recession since the Great Depression cut state tax revenue by $67 billion during the fiscal year ending last June 30, the most on record, according to the Census Bureau.

That’s combined with rising costs to leave only four states with assets sufficient to cover promised benefits in the year that ended in June 2008, the last period with complete figures, the Pew Center said.

States had $2.35 trillion set aside to cover $3.35 trillion of pension, health-care and other retirement obligations in fiscal 2008, Pew said in February. Assets at 125 state plans surveyed by Wilshire Associates, a consultant in Santa Monica, Calif., covered only 65 percent of liabilities on June 30, 2009, down from 85 percent in 2008.

Private industry is doing little better. Pensions at companies in the Standard & Poor’s 1500 Index had median assets in 2009 to cover only 75 percent of what they owed, said a June 1 report from the consulting firm Mercer, a unit of Marsh & McLennan Cos.

“It’s primarily due to the effects of the 2008 market downturn,” said Keith Brainard, chief researcher for the National Association of State Retirement Administrators, based in Baton Rouge, La. The S&P 500 Index lost 38 percent in 2008.

In New Jersey, the pension system lost $15 billion in the year ended June 30, 2009, a period in which the S&P 500 dropped 28 percent. That left state funds, which cover about 800,000 teachers and government workers, with $89 billion of assets to pay $135 billion of benefits, according to the most-recent actuarial report. The state has set aside nothing to cover $56 billion in health-insurance benefits promised to retirees.

In response, Christie, a 47-year-old Republican who took office Jan. 19, proposed that employees still working after Aug. 1 contribute to health care and get lower benefits, encouraging those like the Hartmanns to retire now under current terms.

“The pension for our retirement was part of the reason we took these jobs,” said Mark Hartmann, 59, a business manager in the Treasury Department’s tax division in Trenton. His wife, Janet, 58, a reading teacher since 1976 in Hillsborough in central New Jersey, wants to keep working, he said at a retirement seminar last month. “But if it’s going to cost her in her retirement, how can she?”

The 3,294 teachers who began collecting benefits last year through New Jersey’s Teachers Pension and Annuity Fund, the largest of the state’s seven retirement systems, receive on average $49,378 a year, the fund’s latest report says. Christie’s plan to charge retirees 1.5 percent of their benefits to pay for health care would cost each about $741 a year.

Christie also has proposed rolling back a 9 percent benefit increase that was approved by state lawmakers in 2000.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.