WASHINGTON — President Obama’s proposed tax breaks for business sound like ideas that have enjoyed broad Republican backing in the past. But in today’s toxic political atmosphere, he’s unlikely to get much – if any – GOP help.

Still, his plans put Republicans on the spot, making it harder for them to say no to legislation they once embraced.

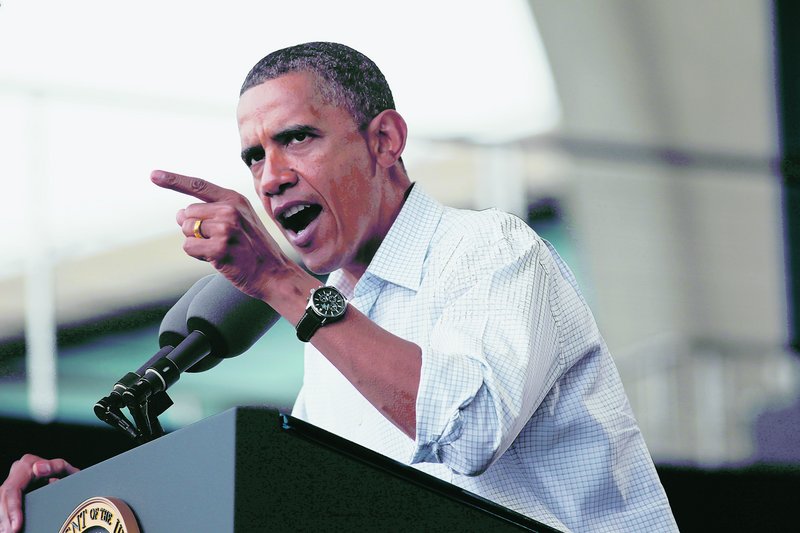

In a speech today in Cleveland, Obama will ask Congress to let businesses quickly write off 100 percent of their spending on new plants and equipment through 2011.

Its part of a raft of new Obama proposals to spur job creation and help businesses – and to try to give his party a much-needed boost ahead of November elections that will determine which party controls the House and Senate.

Clearly frustrated by the halting economic recovery and mindful of polls showing Republicans poised to make big midterm gains, Obama had his economic advisers come up with a fresh set of proposals with job-creating potential.

Among them: a $50 billion program to rebuild roads, railways and airports and to create a new infrastructure bank to oversee long-term projects. Legislation containing multiple public works projects has usually been popular in Congress across party lines.

The administration has not spelled out exactly how it would pay for all the new proposals, but suggested it would offset tax cuts by closing various corporate loopholes and levying targeted tax hikes on big business, particularly on the oil and gas industry and on multinational corporations.

Some of these tax proposals were included in the budget Obama submitted to Congress earlier this year but were never acted on by Congress.

Rep. Dave Camp of Michigan, the senior Republican on the tax-writing House Ways and Means Committee, called Obama’s business tax measures serious proposals worthy of consideration.

But he said that “raising taxes to cut taxes is at best a zero sum game.”

The proposed tax break for research and development has been around in one form or another since 1981 and in the past has drawn bipartisan support. However, Congress previously extended it just for short periods of time, usually just for one or two years, with frequent lapses that make it hard for businesses to plan.

The credit most recently lapsed in 2009.

Obama has long advocated making the credit permanent.

His proposal to let companies quickly write off 100 percent of their investments in new plants and equipment is similar to proposals advanced several times by President George W. Bush – with considerable GOP support at the time.

The idea is to give companies an incentive to spend and invest now, rather than later. The administration claims the change would put nearly $200 billion in the hands of businesses over the next two years.

Under the current law, a company gets to deduct 50 percent of the costs up front, and the remainder over three to 20 years, depending on the nature of the investment.

A senior administration official said the expensing provision would potentially benefit 1.5 million corporations and several million individuals. The tax break would be retroactive to today.

Republican leaders greeted Obama’s most recent proposals cautiously, given past GOP support for various components.

“The White House is missing the big picture,” said House Minority Leader John Boehner, R-Ohio.

“These aren’t necessarily bad proposals. …” he said. But he added that they don’t address the larger problems of “excessive government spending” and Democratic tax policies, including the impending expiration of Bush-era tax cuts.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.