NEW YORK — General Motors Co. CEO Dan Akerson said he doesn’t regret the company’s decision to increase spending on rebates and other deals earlier this year even though it has contributed to the company’s tumbling stock price.

GM surprised the industry — and Wall Street — when it raised discounts by $400 per vehicle in January and February. Most automakers didn’t raise them because demand for new vehicles has been rising in line with supply.

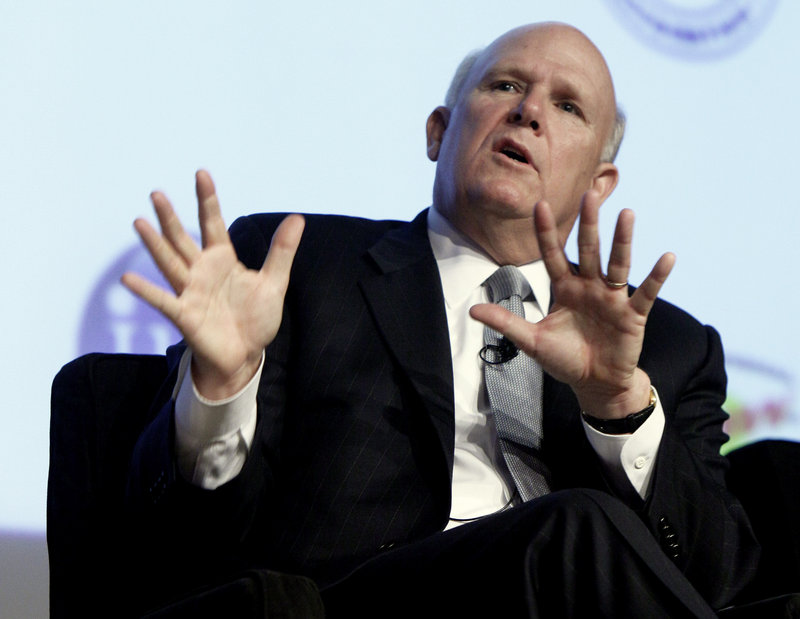

“I feel pretty good about that. I think we’re in pretty good shape,” Akerson said at an automotive conference Tuesday in New York.

Akerson said the increased incentives helped GM sell 100,000 more cars in the first quarter than it did in the same period last year. It also caught GM’s competition off-guard.

“I don’t want to be a predictable competitor,” Akerson said. “I don’t want the other guy to know exactly what I’m doing.”

GM pulled back on its incentives in March, spending $600 to $800 per vehicle less on the deals. But it was too late for some investors, who shied away from the company’s stock because higher rebates lower car companies’ profits.

GM’s stock was trading at $29.56 Tuesday afternoon, 10 percent below the company’s $33-per-share initial public offering in November. The stock opened the year Jan. 3 at $37.32, but has fallen 21 percent since.

That could hurt the government’s effort to recoup the $50 billion it gave GM to survive. The U.S. government got back $13.5 billion from the sale of some of its shares in November’s IPO. But to break even, it needs to sell its remaining shares for $53 each.

Akerson said he hasn’t had discussions with the U.S. Treasury on when it might sell its remaining stake. “They will tell us when they’re getting out,” he said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.