If anyone is harboring doubts about the proposed tax-sharing plan that would turn a Portland eyesore into a $100 million development called The Forefront at Thompson’s Point, it’s time to put the doubts aside and get on board with a plan that is clearly a great deal for the city and its taxpayers.

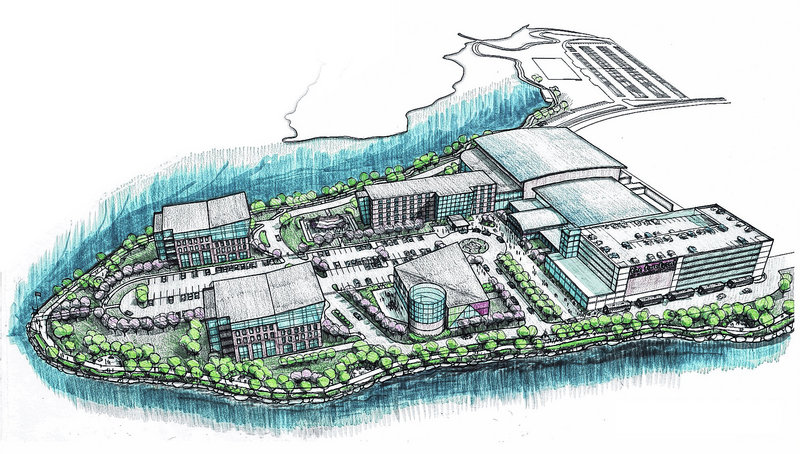

The plan involves nearly 30 acres of undeveloped property just off Interstate 295 and not far from the Portland International Jetport where developers led by owners of the Maine Red Claws basketball team plan to build a commercial, sports and entertainment complex.

A study commissioned by developers estimates that the complex will generate $169 million in one-time economic impact during construction and annual economic impact of $31.3 million once the complex is up and running.

City government’s role in this is simple and unassailable: create a tax increment financing (TIF) mechanism that allows the taxpayers to capture a substantial portion of property tax revenue generated by the development while returning a portion of the revenue to the developers. It is a system employed routinely by municipal governments around the country and in this case is about as good a deal as a city can get.

The Forefront developers are not seeking a penny of upfront financial assistance from the city to launch the project.

The city will not have to issue bonds to help pay for construction, as cities often do when such projects are undertaken, even if the impetus for the development comes from the private sector. It’s called a “public-private partnership” and, in this partnership, any risk associated with the plan will be assumed by the private partner.

Without the development, the Thompson’s Point site would generate about $2.9 million in property taxes over the next 30 years. The Forefront project, which will feature a hotel, a restaurant, offices, a performance hall and an “event center” that will accommodate conventions and serve as home to the Red Claws, is expected to increase that number to $57.8 million over the three-decade life of the tax increment plan.

The city would return $31.4 million of that revenue to the developers to help defray their costs while capturing $26.4 million for the taxpayers.

That’s $26.4 million that the city would never collect without this development. And none of the $2.9 million that the city would collect without the project goes to the developers. Portland taxpayers retain all of that money, with or without The Forefront.

At a time when private development is stagnant because of the challenging economy in Maine and elsewhere, a project of this magnitude — especially on property that has no other significant prospects for development — is a godsend.

The development is expected to generate 1,230 desperately needed jobs during construction and will support 455 jobs in operation.

The City Council appears to be on track to approve the plan — a workshop and a special council meeting to advance the authorizing ordinances toward eventual passage will be held this evening. Councilors undoubtedly will hear from folks who oppose the plan for one reason or another, so Portland residents who support it — and it is well worth supporting — would be wise to contact their representatives at City Hall and urge them to expedite approval (a final vote is scheduled for June 20).

A deal like this doesn’t come along very often, and the sooner it’s approved, the sooner the money will start rolling in.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.