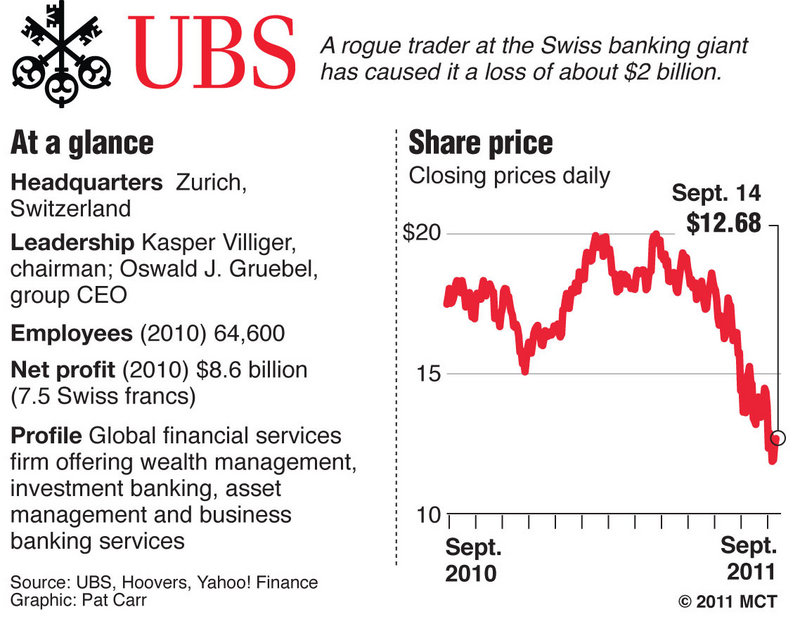

LONDON – One man armed with only a computer terminal humbled a venerable banking institution yet again. This time it was Swiss powerhouse UBS, which said Thursday that it had lost roughly $2 billion because of a renegade trader.

The arrest of 31-year-old equities trader Kweku Adoboli in London is one more headache for troubled international banks, and fresh proof they remain vulnerable to untracked trading that can produce mind-boggling losses.

UBS discovered irregularities in its trading records Wednesday night, and Adoboli was arrested early Thursday. Swiss banking regulators began looking into the scandal, which sent the bank’s stock sharply lower.

“From the scale of this case, you can be sure that it’s the biggest we’ve ever seen for a Swiss bank,” Tobias Lux, a spokesman for Swiss regulators, told The Associated Press.

Analysts said the bank’s image would be badly hurt. UBS was deemed to have recovered from the lending crisis that hammered banks in 2008 and to have improved its management of risk, said Fionna Swaffield, a bank analyst at RBC Capital Markets.

Details about the alleged fraud were scarce. In a terse statement shortly before markets opened, UBS informed investors that a large loss due to “unauthorized trading” had been discovered.

UBS estimated the loss at $2 billion, big enough that the bank said it might have to report a quarterly loss.

Adoboli was being held by London police.

According to his profile on LinkedIn, a social networking site for professionals, Adoboli served on an equities desk at UBS called Delta One and worked with exchange-traded funds, which track different types of stocks or commodities.

UBS added extra security at its offices in London’s financial district. Reporters were told that no additional information would be provided.

UBS is struggling to restore its reputation after heavy losses from subprime mortgages and an embarrassing U.S. tax evasion case that blew a hole in Switzerland’s storied tradition of banking secrecy. UBS took a $60 billion bailout from the Swiss government in 2008.Analysts said the bank’s image would be badly hurt. UBS was deemed to have recovered from the 2008 crisis.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.