MINNEAPOLIS – Ashley Cassidy has spent most of her career trying to find a way to support herself without her parents’ help.

So far, it hasn’t been easy.

Cassidy has returned home twice after earning college degrees. She moved back after graduating from St. Cloud State University in 2008, the year the financial crisis hit. In May, she re-entered the job market with a master’s degree in mass communication, only to find herself back in her old room in the Brooklyn Park suburb of Minneapolis.

“I just didn’t know how bad or stressful it would be to try and find a job in this market,” said Cassidy, 26.

For most young adults, the only jobs market they know is the one shaped by the Great Recession. Unemployment for 20- to 24-year-olds is about 14.9 percent, well above the national average of 9.1 percent. That doesn’t allow young workers to think much about the job they want, just the job they can get. And if they live on their own, it’s often with roommates.

The economic impact extends well beyond mom and dad’s wallet. With young adults struggling to live independently, household spending is diminished as fewer new households are being created. As a result, less need exists for furniture, appliances and a variety of services.

“Job formation helps determine household formation,” said Maury Harris, chief U.S. economist for UBS Securities.

From March 2009 to March 2010, the number of new households in the United States was the lowest on record. The plight of younger workers played a large part in the downturn of households, as families were forced to consolidate.

When the housing market collapsed and waves of job losses followed, many of today’s new job seekers were still in school. Since then, unemployment for workers 20 to 34 years old has roughly doubled.

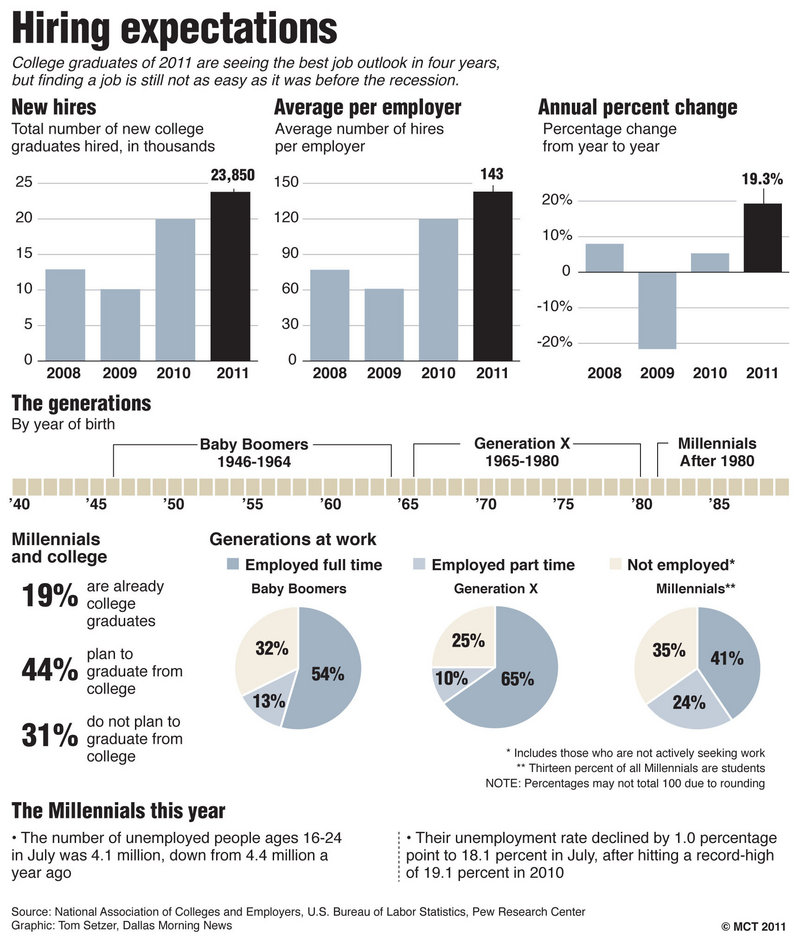

The reality check has been felt in a number of ways. Only two of five college graduates who applied for a job this year received an offer, according to the National Association of Colleges and Employers. In 2007, the figure was more than three in five.

For young adults with only high school diplomas, the situation is even more dire. Their jobless rate reached 18.8 percent in June. Even in a dour economy, the numbers clearly show that education improves your employment outlook, said Steve Hine, director of Minnesota’s Labor Market Information Office. But, he added, the data are likely to mask underemployment that may be occurring among people with college degrees.

“They may be employed but in jobs that are well under their skill level or might be part time,” he said.

Cassidy aptly fits the “underemployed” description. She works part time at Pier 1 to bring in some income and juggled two unpaid marketing internships to gain professional experience. She spends the rest of the time looking for a full-time job and the independence she hopes will follow eventually.

“When I do find a job, I know my plans are not to get a house right away,” she said. “I would like to start payments on my (college) loans and start saving as well to have a base.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.